With the rising standard of living, international travel and business trips have become more common for Vietnamese citizens. A journey to a foreign country requires preparation in many aspects, such as itinerary planning, cultural and language understanding, and financial readiness to create memorable experiences. The excitement of strolling through bustling streets in a Western country or relaxing on a beach can be enhanced and made more worry-free with a credit card in hand. You can conveniently spend and shop abroad without carrying large amounts of cash.

However, using a credit card overseas incurs foreign transaction fees. Therefore, understanding these international transaction fees is essential to avoid unexpected costs.

What are foreign transaction fees, and which transactions incur them?

Foreign transaction fees are charges levied by credit card issuers on purchases made in foreign currencies when traveling abroad or when making online payments in foreign currencies to overseas merchants, such as on Amazon. These fees typically range from 1% to 3.5% of the transaction amount and are applied on top of the purchase price converted to the local currency. Additionally, withdrawing foreign currency from ATMs located outside of Vietnam will also incur these fees.

For example, when paying for a dinner in Japan, if the cardholder swipes for 1 million VND (after conversion at the applicable exchange rate) and the bank charges a 3.5% transaction fee, the fee amounts to 35,000 VND. This means the cardholder will have to pay a total of 1,035,000 VND for that transaction.

Hence, for frequent travelers and business people, finding a credit card with low foreign transaction fees is crucial. A card with favorable foreign transaction terms will allow you to spend more comfortably, buy more items, or purchase more valuable gifts during your travels.

Which credit cards have favorable foreign transaction fees?

Currently, different banks offer varying foreign transaction fee rates, typically between 1% and 3.5% of the transaction amount. Additionally, there may be discrepancies in the foreign exchange rates applied by different financial institutions. Therefore, choosing an international credit card that suits your needs will help you maximize benefits and minimize costs, and you may even find options that waive these fees entirely.

For instance, ACB’s most premium card, the ACB Visa Infinite, offers a complete waiver of foreign transaction fees for cardholders’ spending in any country, whether at physical stores or for online international transactions. Many other ACB international credit cards also feature competitive foreign transaction fees compared to the market. For example, the ACB Privilege Visa Signature card offers foreign transaction fees as low as 0.9% based on the customer’s preferential ranking, while the ACB Visa Signature card charges only 1.9%.

Additionally, ACB international credit cardholders can convert their purchases into installment plans with zero interest and zero fees via the ACB ONE banking app. When paying for an item or service worth 3 million VND or more with an ACB credit card, you can opt for a 0% interest and 0% fee installment plan for three months on ACB ONE, regardless of the merchant’s policies. This feature allows you to break down large expenses into smaller, more manageable payments, alleviating financial pressure and enabling you to enjoy a more relaxed lifestyle.

Thao Anh, a 35-year-old from Ho Chi Minh City who has traveled to nearly 20 countries, shared her experience: “As someone who loves exploring new places, my credit card has become my trusted companion. I chose the ACB Privilege Visa Signature card because of its extremely low foreign transaction fee of only 0.9%. Additionally, when booking flights and hotels online with this card, I can enjoy a 20% discount. On many occasions, when I came across must-have items during my travels, I was able to make the purchase and then convert it into a 0% interest and 0% fee installment plan for three months.”

Another important consideration when using credit cards is safety and security. In the event of a lost or stolen card while abroad, ACB credit cardholders can easily lock their cards via the ACB ONE app or by calling the hotline with their internationally-roaming phone number.

In addition to competitive fees, ACB cardholders enjoy various benefits, including airport lounge access and discounts at ACB partner establishments. Moreover, card transactions earn unlimited ACB Rewards points, which can be redeemed for e-vouchers or gifts from popular brands such as Phuc Long, Aeon Mall, Traveloka, Shopee, and Starbucks.

Learn more about ACB’s credit card offerings at: Mở thẻ thanh toán ACB nhanh – an toàn, nhận ngàn ưu đãi

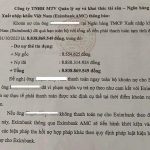

How to use credit cards without turning “borrow 8 million into debt of 8 billion”?

Knowing how to use and spend credit cards may seem straightforward, but not everyone grasps it fully. If you don’t understand it completely and use it correctly, you can end up with unnecessary expenses, fall into the “debt trap,” or even face legal consequences for intentionally maxing out your credit cards.