Understanding Credit Cards

Credit cards have long been a familiar financial product to many people. Understanding, possessing and using credit cards correctly can be very convenient for expenses and consumption. However, according to Mr. Nguyen Thang (former head of credit department at a large bank and now a financial expert), in reality, due to the pursuit of credit card opening targets, many bank employees have invited customers to open cards in an innocent way without fully explaining the product. Some customers, due to their small credit limits, are careless, leading to many consequences. Many people don’t even bother to read the credit card agreement, they just sign and receive the card.

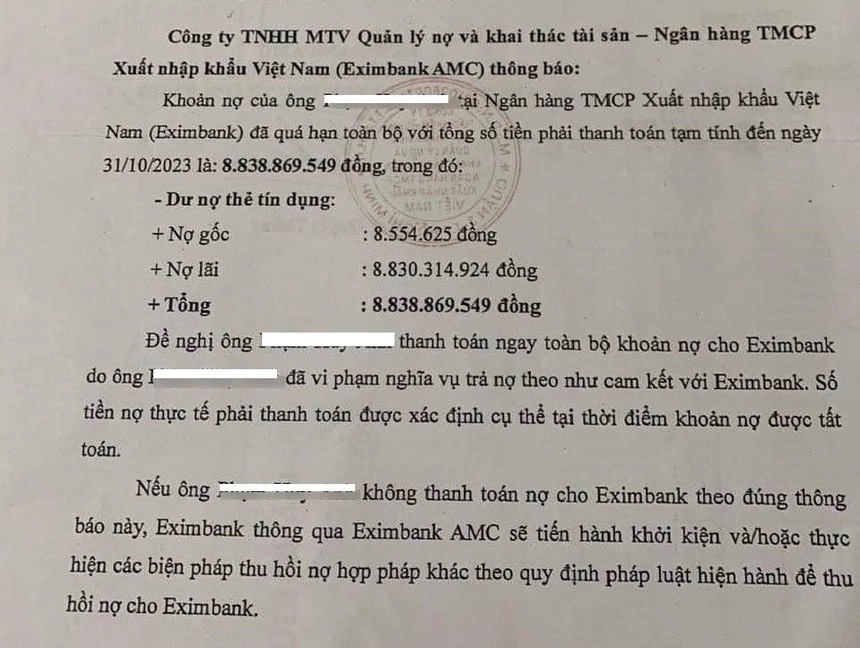

“After a highly publicized incident involving a customer with an initial debt of 8 million dong, which eventually turned into a total debt of 8 billion dong at a bank, I have seen a series of comments on social media. Many of them don’t understand, don’t have enough knowledge about credit cards, credit card debts, and the interest that has to be paid,” Thang commented.

“8 million to 8 billion” debt case attracts attention

Credit cards allow cardholders to conduct transactions within the credit limit agreed with the issuing organization, typically a bank. In simple terms, a credit card is a form of unsecured personal loan from a bank that is to be repaid before the payment due date. Unsecured loan is a loan without collateral, which is why each bank has different regulations, usually with a low credit limit but high interest rates.

With a credit card, you can make direct payments or online payments for products or services within a certain amount of money and incur a debt with the bank. Credit cards have different tiers with credit limits based on agreements with customers.

Credit cards are issued with the purpose of guiding customers towards payment and consumption of products and services, and customers will benefit the most from using them for this purpose. Credit cards can be used to withdraw cash, but they cannot be used for transfers, meaning you cannot use the money within your credit limit to transfer to another account or receive transfers from other accounts to “add” money to the card.

Simple but little-known notes leading to “credit card debts”

With a credit card, you are given a certain credit limit (say 8 million dong) for payment and expenses, which you then repay into your card. The bank will send you a statement on a specific day of the month listing the transactions, outstanding balance, payment due date, and minimum payment amount. You will have a grace period of a certain number of days (usually 30 to 45 days) during which you won’t be charged any interest for late payments.

After the interest-free period, the bank will calculate interest on the remaining balance. The interest rate is a term agreed upon when signing the card agreement. At the payment due date, the cardholder must repay at least the minimum payment amount, otherwise late payment fees will be charged.

Credit cards are modern, convenient financial products, but need attention to avoid falling into “debt traps”

In reality, many people use credit cards to withdraw cash. Credit cards are meant for payments, not cash withdrawals. If you withdraw cash with a credit card, you will have to pay a very high fee, which is deducted directly from your credit limit. When withdrawing cash, you will be charged interest, and the interest rate for credit cards is always higher than other loans.

Many people are careless, thinking that opening a credit card is simply using a bank’s service, “if you don’t use it, then just cancel the card, it’s no problem,” or thinking that opening a card is just a civil transaction, so they try to “inflate” credit card debts. When you don’t use or spend on your credit card, you may still be charged maintenance fees, annual fees. Therefore, if you don’t need the card, you should go directly to the bank or contact them to cancel the card, check your outstanding balance, and make sure there is no remaining debt before canceling the card.

Intentionally going into credit card debt and avoiding repayment will result in a bad debt status on the credit information system (CIC), making it difficult or impossible to obtain other loans throughout the banking system. The interest accruing from credit cards over a long period of time will be very high. According to lawyer Ngo The Hiep (JW Law Company), deliberately creating debt and fleeing from repayment can lead to a bank lawsuit and can be pursued criminally for the crime of misuse of trust to appropriate property under Article 174 of the 2017 Penal Code.

Credit cards have many benefits and are useful for payment purposes. Brands, products, and services are often associated with banks, and credit card users receive many benefits, cashback when paying for these products with their cards. Nguyen Ngan (Thanh Xuan, Hanoi) said: “I often use credit cards to make payments to receive benefits. When I fully repay the debt, on time, there are no issues. Using credit cards is basically simple, the only thing to note is the payment due date, so as not to exceed the due date, as if you can borrow money to spend in advance without interest.”