Illustrative Image

Vietnam Prosperity Joint Stock Commercial Bank (VPBank) has announced new deposit interest rates effective from July 16th. The bank has increased interest rates by 0.1% p.a. for terms ranging from 2 to 18 months while keeping the rates unchanged for 1-month, 24-month, and 36-month terms.

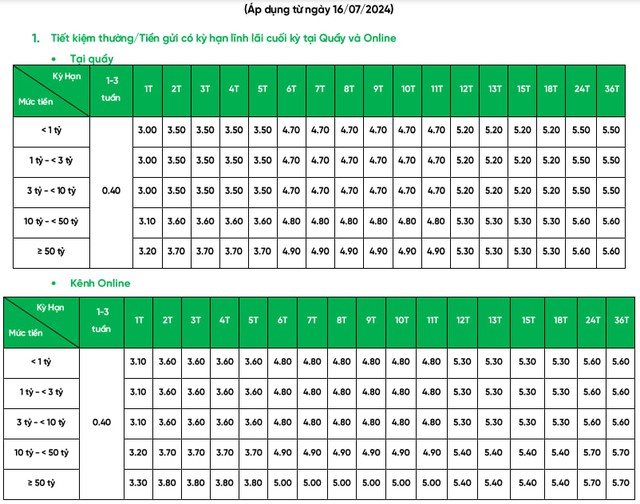

Specifically, VPBank offers five tiers of deposit amounts: below VND 1 billion; from VND 1 billion to below VND 3 billion; from VND 3 billion to below VND 10 billion; from VND 10 billion to below VND 50 billion; and VND 50 billion and above.

For over-the-counter deposits, the interest rate for a 1-month term ranges from 3% to 3.2% p.a.; the rate for 2- to 5-month terms is 3.5% to 3.7% p.a.; 6- to 11-month terms earn 4.7% to 4.9% p.a.; 12- to 18-month terms offer 5.2% to 5.3% p.a.; and 24- to 36-month terms provide 5.5% to 5.6% p.a.

Source: VPBank

Online deposits offer slightly higher interest rates, 0.1% p.a. more than over-the-counter deposits. Specifically, the 1-month term offers 3.1% to 3.3% p.a.; 2- to 5-month terms range from 3.6% to 3.8% p.a.; 6- to 11-month terms are at 4.8% to 5.0% p.a.; 12- to 18-month terms offer 5.3% to 5.4% p.a.; and 24- to 36-month terms provide 5.6% to 5.7% p.a.

Additionally, VPBank offers a priority customer policy, where customers with a minimum deposit of VND 100 million and a minimum term of 1 month will receive an additional 0.1% p.a. on top of the published interest rates.

With these adjustments, VPBank is the 11th bank to raise deposit interest rates in July and the next major private bank to join the race. Previously, MB had also increased its deposit interest rates starting July 10th.

After reaching historic lows, deposit interest rates started to climb back up in late March and continued to rise in April, May, and June. In June alone, about 23 commercial banks increased their deposit interest rates, with many banks adjusting rates two to three times. At the beginning of July, a number of banks, including large banks like MB and VPBank, also raised their deposit interest rates.

Analysts attribute this trend to low deposit growth from individuals and businesses in the first months of the year, coupled with recovering credit growth, which has prompted banks to increase deposit interest rates to ensure a balanced capital source. Additionally, the State Bank of Vietnam’s (SBV) interventions through bond issuances and foreign currency sales have impacted the Vietnamese Dong liquidity of banks.

In a recently published strategy report, Rong Viet Securities (VDSC) stated that the increase in deposit interest rates is a suitable scenario based on expectations of exchange rate movements and interest rate policies.

Regarding exchange rates, the analysis team assessed that pressure on the exchange rate remains persistent. The strength of the US dollar is expected to continue due to: (1) the interest rate differential between the US and other countries remaining high as the Fed cuts interest rates at a slower pace and to a lesser extent than other central banks, (2) the prediction that a Trump victory in the upcoming US presidential election will lead to a return of inflation, influencing the Fed’s interest rate decisions, and (3) prolonged geopolitical risks increasing the demand for USD as a safe-haven asset. Additionally, due to seasonal factors, foreign currency demand (for imports) may surge again in the third quarter, before the FED officially reverses its interest rate policy, prolonging the pressure on exchange rates during this period.

Meanwhile, after 10 consecutive weeks of foreign currency sales to stabilize the exchange rate (from April 22nd), the SBV is estimated to have sold an amount equivalent to approximately 30% of the 2022 foreign exchange expenditure. For the upcoming period, in a scenario where the SBV aims to both protect foreign reserves and stabilize the exchange rate, VDSC does not rule out the possibility of an interest rate hike (by 0.2% to 0.5%) in the third quarter.

On the other hand, the recovery of credit growth in the second half of this year is also a notable factor. “This, combined with the net withdrawal of funds through foreign currency sales, could create liquidity pressure for the banking system and impact interest rates in the latter half of 2024,” the analysis team commented.

However, VDSC believes that the increase will not be as drastic as in 2022 due to different macroeconomic contexts. The year 2024 lacks the shock factors of 2022, such as sudden changes in credit demand and monetary policies, which caused a surge in interest rates. Additionally, the pressure on foreign currency outflows will ease significantly if there is an additional “convergence” effect on interest rates (with the FED reducing rates while the SBV increases them in the second half of the year). Therefore, VDSC forecasts that an increase of 0.5% to 1.0% in interest rates, returning to pre-pandemic levels, is a reasonable scenario.

Accelerating disbursement of the 120 trillion VND credit package for social housing

Deputy Prime Minister Trần Hồng Hà has recently issued directives regarding the implementation of the 120,000 billion VND credit package for investors and buyers of social housing, workers’ housing, and projects for the renovation and construction of apartment buildings.