|

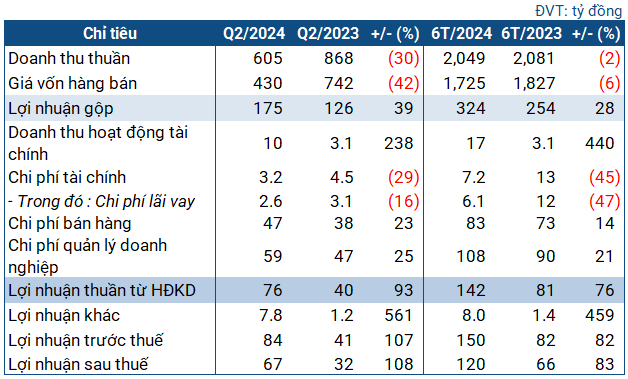

Q2 Business Targets of LAS

Source: VietstockFinance

|

In Q2, LAS witnessed a 30% year-on-year decline in revenue to VND 605 billion. However, cost of goods sold decreased even further by 42% to VND 430 billion. As a result, LAS achieved a gross profit of VND 175 billion, a 39% increase. Gross profit margin also improved from 14.5% to nearly 29%.

Financial income for the period reached over VND 10 billion, 3.4 times higher than the same period last year. Although various expenses increased significantly (financial expenses up 23%, and management expenses up 25%), they did not have a significant impact on the final outcome. Together with other income, which surged to VND 7.8 billion, nearly seven times higher than the previous year, the company posted a post-tax profit of VND 67 billion, up 108% year-on-year. This was also the highest quarterly profit for LAS in the past eight years since Q1/2016.

| LAS’s quarterly net income from 2016 to 2023 |

LAS stated that product consumption in Q2 decreased due to fluctuations in the domestic and global fertilizer market. However, by anticipating raw material price movements and purchasing reasonable lots of products such as sulfur and potassium, the company was able to reduce the proportion of cost of goods sold to revenue, resulting in a significant increase in gross profit.

In addition, the successful auction and disposal of the acid production line brought in an additional VND 6.5 billion in other income. As a result, Q2 performance showed exceptional growth.

Source: VietstockFinance

|

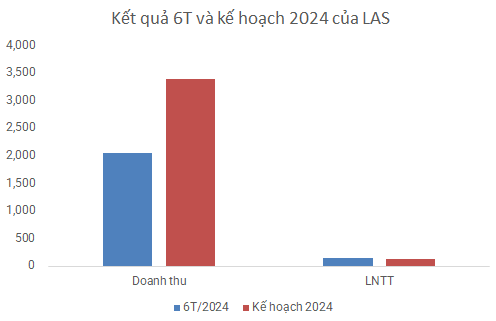

On a cumulative basis, LAS achieved half-year revenue of over VND 2 trillion, slightly lower than the same period last year, and a post-tax profit of VND 120 billion, an increase of 83%. Referring to the results approved at the 2024 Annual General Meeting of Shareholders, the company has achieved 60.3% of its revenue target and exceeded the full-year net profit plan by more than 10% in just six months.

As of the end of Q2, LAS‘s total assets were recorded at over VND 2.3 trillion, unchanged from the beginning of the year, with over VND 2 trillion in short-term assets. Cash and cash equivalents increased by 14% to VND 838 billion. Inventories decreased by 16% to nearly VND 874 billion.

On the other side of the balance sheet, short-term debt decreased slightly to over VND 921 billion, representing the company’s total liabilities. The current and quick ratios were 2.2 and 1.26, respectively, indicating LAS‘s ability to meet its short-term debt obligations. Short-term borrowings decreased by 34% to VND 264 billion, comprising loans from commercial banks.

Tracodi (TCD) earns 163 billion VND profit in 2023

Throughout the year 2023, Tracodi achieved a consolidated net revenue of VND 1,784.5 billion and a post-tax profit of VND 163.3 billion.