Foreign Direct Investment (FDI) into Vietnam in the first half of 2024 reached nearly $15.2 billion, an increase of over 13% compared to the same period last year. FDI disbursement was over $10.8 billion, an increase of more than 8%. Real estate business activities accounted for nearly $2 billion, 4.7 times higher than the same period last year, and made up nearly 20% of the total registered capital.

Nearly $2 billion of FDI registered in real estate in the first half of 2024

In the newly published report on the industrial real estate sector, ACBS Research revealed that industrial parks (IPs) and economic zones (EZs) account for 35-40% of total annual FDI registration or 70-80% of FDI in the manufacturing industry. In addition, the cost of industrial land rent for building factories accounts for about 10% of the total investment in an FDI project, so the industrial real estate segment is expected to continue benefiting directly from the stable growth of FDI capital.

Apart from geopolitical and trade cooperation factors, industrial real estate in Vietnam remains attractive to FDI due to its competitive costs compared to many other countries in the region, including labor, land rent, and electricity costs.

|

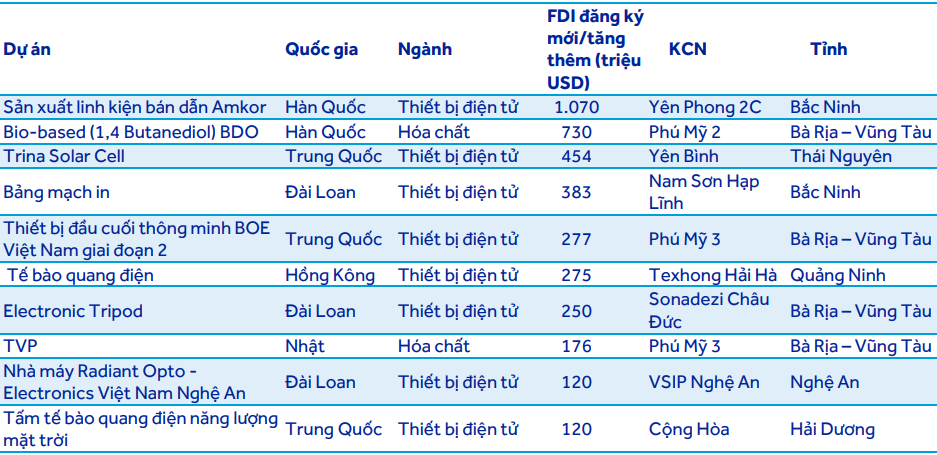

Major FDI projects in the first half of 2024

Source: ACBS

|

Bac Ninh province took the lead in attracting FDI registered capital in the first half of 2024 with nearly $2.6 billion, triple the amount in the same period last year, thanks to Amkor’s semiconductor manufacturing project, which increased its investment by over $1 billion.

Source: ACBS

|

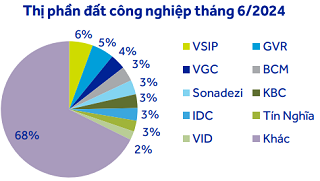

As of the end of June 2024, Vietnam had 429 established IPs with a total land area of over 134,500 hectares. Among them, VSIP continues to lead with over 7,500 hectares, accounting for a 5.6% market share, followed by the Vietnam Rubber Group (HOSE: GVR) with over 7,000 hectares, making up 5.2%.

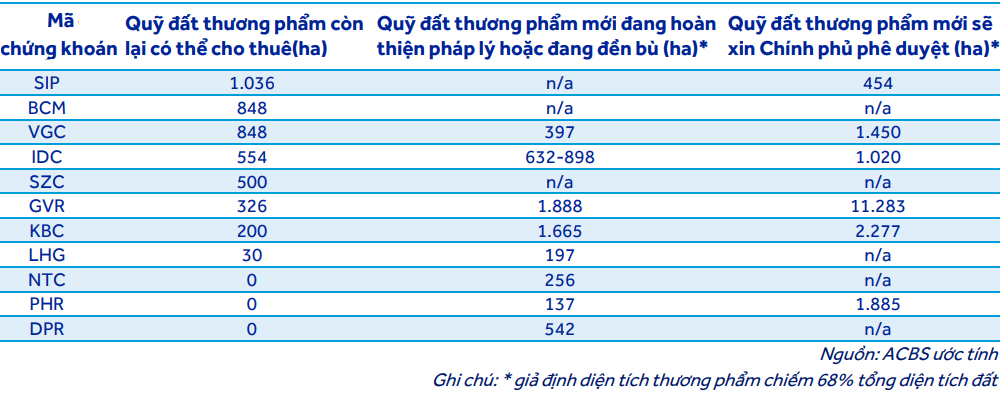

The remaining industrial land fund for lease is limited

According to ACBS Research, the remaining land fund available for lease is not abundant, especially in the southern region. Therefore, companies are actively expanding their search for new land funds, with an advantage given to companies that have rubber land allowed to be converted into industrial land, such as GVR, Phuoc Hoa Rubber (HOSE: PHR), or enterprises that have attracted large international corporations over the years, including Kinh Bac City Development Share Holding Corporation (HOSE: KBC), Viglacera (HOSE: VGC), and IDICO (HNX: IDC).

Which rubber companies will benefit from the wave of conversion to industrial land?

However, Saigon Investment VRG (HOSE: SIP) has the largest remaining commercial land fund available for lease among listed companies, with over 1,000 hectares concentrated in Tay Ninh (772 hectares), Dong Nai (133 hectares), and Ho Chi Minh City (130 hectares). This is followed by Becamex IDC (HOSE: BCM) with 848 hectares left for lease in Binh Duong, and VGC with 848 hectares.

In the first half of 2024, three companies were approved for investment registration for new industrial parks: VGC in Song Cong 2 in Thai Nguyen (296 hectares) and Doc Da Trang in Khanh Hoa (288 hectares), GVR with the approved project of Hiep Thanh IP in Tay Ninh (495 hectares), and IDC with Tan Phuoc 1 IP in Tien Giang (470 hectares).

|

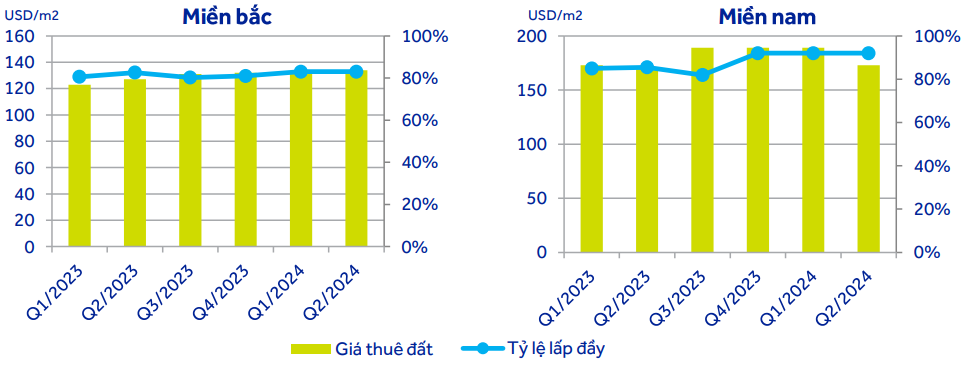

Rental prices continue to increase

As of the second quarter of 2024, the northern region’s industrial land rent was $134/m2/remaining lease term, up 4.5% from the same period last year, while the southern region’s rent was $173/m2/remaining lease term, a slight increase of 1%. Rental prices are expected to continue growing by 3-7% per year in the period of 2024-2026.

The occupancy rate in the northern region was about 83%, with no significant change compared to the same period last year, while the southern region achieved 92%, an increase of 6.5%.

Source: CBRE/ACBS

|

Factory rental prices in the second quarter of 2024 were nearly $4.9/m2/month, an increase of almost 2% compared to the same period last year in the north and 1% in the south.

Warehouse rental prices ranged from $4.5 to $4.6/m2/month, a decrease of 1% in the north and an increase of 2% in the south. Rental prices are expected to increase slightly by 0-3.5% per year in the period of 2024-2026.

Warehouse rental prices in the second quarter of 2024 ranged from $4.6 to $4.9/m2/month

ACBS Research predicts that flexible products that can be converted between warehouses and factories, as well as multi-story warehouses/factories, will become more popular in cities with limited land funds.

Enhancing public investment to attract more investment

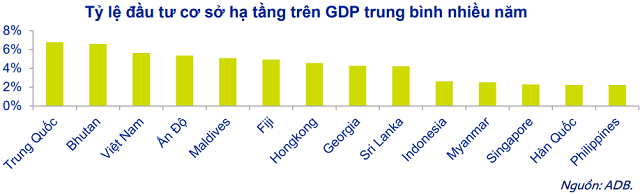

Vietnam has made significant efforts to improve its infrastructure, reducing logistics time and costs for businesses and attracting more investors. According to the ADB, Vietnam’s infrastructure investment ratio to GDP in recent years has been among the highest in Asia, averaging 5.7%.

Source: ACBS

|

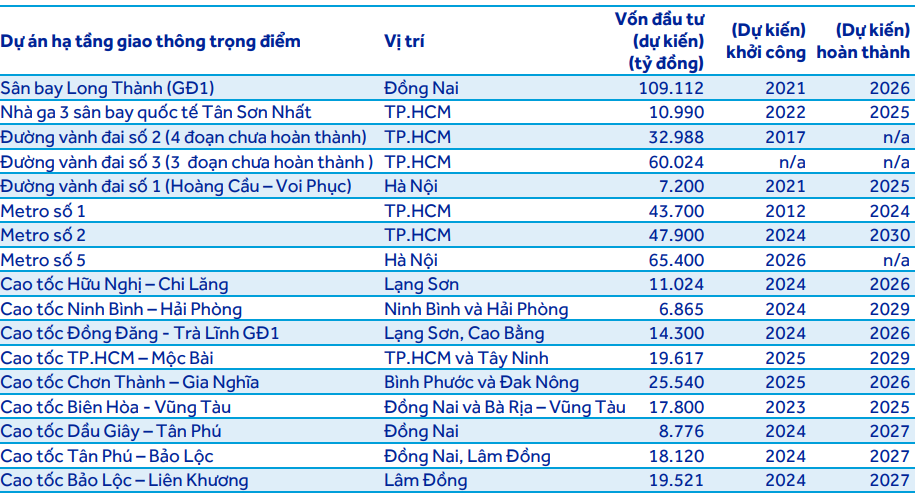

As of June 2024, the country had over 2,100 kilometers of expressways, and the government aims to reach 3,000 kilometers by the end of 2025. This is a rather ambitious goal but clearly demonstrates the government’s determination to accelerate infrastructure development.

In addition, the most important key project, Long Thanh International Airport (phase 1), is ahead of schedule on many items and is expected to be completed by 2026.

Source: ACBS

|

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

Mobile World achieves revenue of VND118,000 trillion: TVs, tablets, and phones all decrease by 10% – 50%, while one product grows in both quantity and revenue.

Mobile World Investment Corporation (MWG) has recently announced its 2023 business results. According to the report, the company’s consolidated revenue reached over 118 trillion Vietnamese dong, equivalent to 89% of the revenue in 2022.