International Payments Made Easy with Techcombank Business

In addition to competitive exchange rates, Techcombank Business offers a host of convenient features such as pre-transaction information checks, swift go money transfers, and fee promotions to boost your import-export business’s growth.

Post-Pandemic Recovery

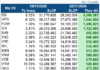

The import-export industry’s resilience is evident in 2024, presenting opportunities for businesses. International payment solutions are crucial to supporting businesses in seizing cross-border opportunities. According to Vietnam’s Ministry of Industry and Trade, the total import-export turnover in the first four months reached nearly $239 billion, a 15.1% increase compared to the same period last year.

Notably, the import structure in the first quarter of 2024 remained positive, with production inputs accounting for 94% and consumer goods making up 6%. This indicates businesses’ tendency to increase imports for export production. These positive signs suggest expanding opportunities for import-export businesses in the remaining months of the year.

Overcoming Barriers with Techcombank’s Advantages

International payments and foreign exchange rates have long been challenging for import-export businesses, especially small and medium-sized enterprises recovering from the pandemic. Techcombank, with its investment in technology and financial expertise, strives to provide efficient cross-border payment solutions. Techcombank Business is highly regarded by the business community for its safe, convenient, and promotional international payment solutions.

Techcombank Business: Your Trusted Partner for International Payments

Techcombank Business simplifies international payments, offering a fully online process that completes transactions within just 2 hours. The platform also includes features like pre-transaction information checks and the swift go money transfer service, providing peace of mind and faster transactions. Additionally, businesses can easily pay port fees, export taxes, and more directly through Techcombank Business.

Techcombank’s competitive exchange rates and fee promotions make it a compelling choice for foreign currency transactions and international payments. “My company regularly sources products from international partners. However, our input costs, including procurement, storage, and transportation, have increased by 8%. To stay afloat, we’ve had to cut operational, management, and personnel expenses and optimize our production processes. International payment fees are no exception,” shared Minh, owner of a seafood import-export company in Nha Trang.

Statistics show that over 80% of businesses with regular international payment transactions seek fee reductions, especially for money transfers. Understanding businesses’ concerns, Techcombank has launched initiatives like “Free International Online Transfers for the First Year” and “Free Incoming International Transfers.” Techcombank Business also offers lifetime domestic online transfer fee waivers, free account management, and attractive number-coded accounts worth up to 100 million VND.

Businesses can also easily access credit lines of up to 70 billion VND directly through the platform to support their production and trading activities. Additionally, Techcombank provides timely market updates and recommendations to help businesses navigate exchange rate fluctuations and make informed decisions to optimize their operations.

“We believe that with Techcombank Business, import-export businesses can leverage the bank’s advantages to enhance their competitive edge, optimize operational costs, and gain more autonomy in international transactions with their partners,” shared Techcombank’s leadership. “We aim to understand the unique needs of the import-export industry and create value for businesses.”

From a business perspective, practical benefits are essential for survival and growth. Techcombank Business’s “Foreign Currency Transactions and International Payments” solution is expected to become a vital tool for import-export businesses to conquer the international market.

Explore more about Techcombank’s foreign currency and international payment solutions: Here

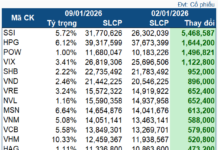

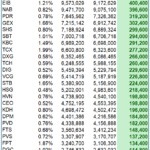

Positive Signs in Exports and Imports: Early 2024

Vietnam’s total import-export turnover in January 2024 reached nearly $64.22 billion, representing an increase of 37.7% compared to the same period last year. This positive signal in the trade of goods shows a promising start to the year 2024.