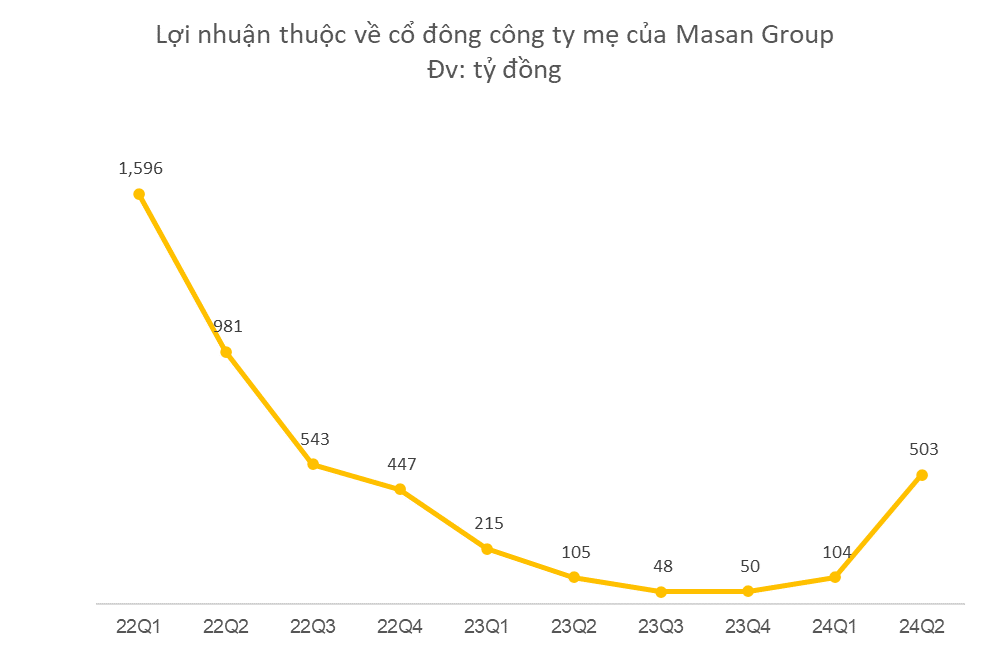

Masan Group, one of Vietnam’s leading consumer retail companies, has announced impressive financial results for the second quarter of 2024. With a revenue of VND 20,134 billion, the company witnessed an almost 8% increase compared to the same period last year. However, what stands out is their net profit, which soared to VND 946 billion, an astonishing 120% surge.

This remarkable performance can be attributed to the improvement in their consumer retail business, the recovery of non-core operations, and a reduction in net financial expenses of VND 138 billion.

As of June 30, 2024, Masan Group’s cash and cash equivalents stood at VND 21,977 billion, a significant increase of VND 5,000 billion from the beginning of the year. This boost in liquidity is a result of improved free cash flow and financial activities.

The company’s net debt-to-EBITDA ratio for the last 12 months decreased to 3.3x, down from 3.9x in the fourth quarter of 2023, successfully achieving their target of maintaining this ratio below 3.5x. Free cash flow for the last 12 months also increased by 71% year-over-year to VND 7,429 billion in the second quarter.

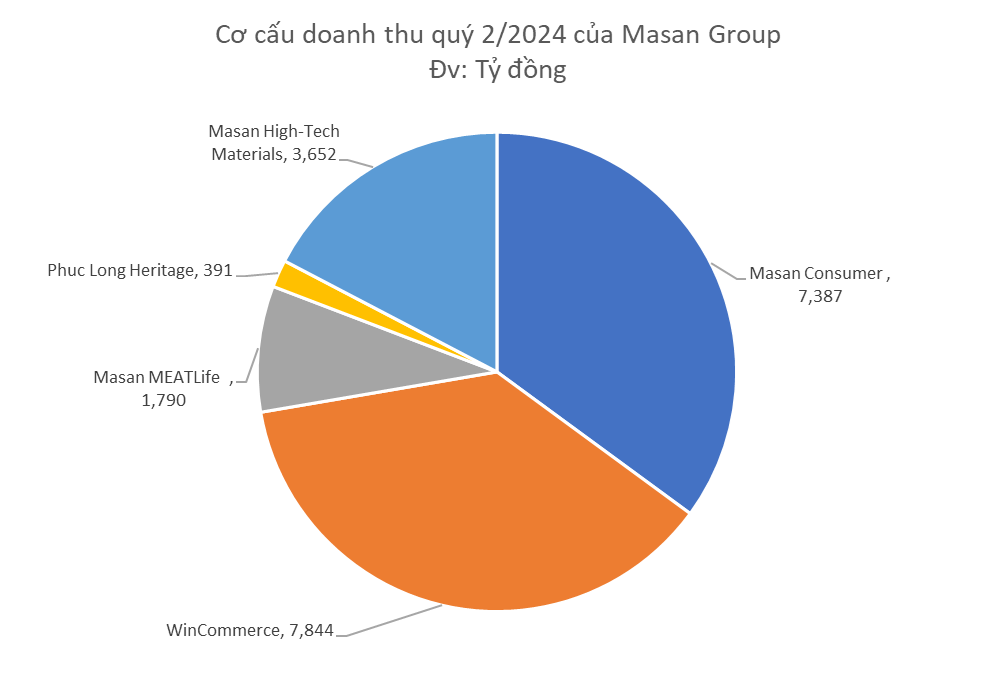

Masan Consumer, a key contributor, achieved a revenue of VND 7,387 billion, marking a 14% increase year-over-year. This growth was driven by the convenience food, beverage, and coffee segments, which saw respective increases of 20.7%, 17.6%, and 16% compared to the previous year. Masan Consumer also maintained a high gross profit margin of 46.3%.

WinCommerce, Masan’s retail arm, recorded a 9.2% year-over-year growth in revenue, reaching VND 7,844 billion across its network. This success is a testament to the effectiveness of their upgraded WinMart and WinMart+ Rural store concepts, which cater to urban and rural consumers respectively, and have proven to be highly efficient.

Masan Group also shared that WinCommerce turned a net profit in June 2024, a significant milestone.

Masan MEATLife (MML) saw a remarkable improvement, with EBIT increasing by VND 105 billion year-over-year. This is the second consecutive quarter of positive EBIT for MML, driven by increased revenue from their processed meat business, benefiting from higher pork and chicken prices, as well as lower feed costs.

Phúc Long Heritage (PLH), Masan’s restaurant business, experienced a 5.3% year-over-year growth in revenue, reaching VND 391 billion. This growth was fueled by the addition of 15 new stores opened in the second quarter of 2023. PLH now operates 163 stores nationwide, with the management team carefully integrating 4 stores outside of WCM into the system.

Masan High-Tech Materials (MHT) witnessed an improvement in EBIT of VND 193 billion, benefiting from higher APT and copper prices. The upcoming sale of H.C. Starck Holding GmbH to Mitsubishi Materials Corporation for USD 134.5 million, expected to be finalized by the end of 2024, will further boost MHT’s performance. This transaction is anticipated to result in a one-time gain of approximately USD 40 million in the second half of 2024 and an increase in long-term net profit of USD 20-30 million.

Techcombank, an associate company of Masan, contributed VND 1,236 billion to the group’s EBITDA in the second quarter of 2024, representing a remarkable 38.5% year-over-year growth.

For the first half of 2024, Masan Group achieved a revenue of VND 38,989 billion, a 4.5% increase compared to the same period last year. Their net profit reached VND 1,425 billion, a 64% increase, while net profit attributable to the company’s shareholders stood at VND 607 billion, a remarkable 90% jump.