LDG denies insolvency, continues negotiations with creditors

On July 22, the People’s Court of Dong Nai Province issued a decision to initiate bankruptcy proceedings against LDG Investment Joint Stock Company (HOSE: LDG), relating to a disputed debt with Phuc Thuan Phat Construction and Trading Joint Stock Company (Phuc Thuan Phat) based in District 12, Ho Chi Minh City.

According to the decision, within 30 days from the issuance of the decision, creditors must contact the People’s Court of Dong Nai Province to obtain information about the asset management and liquidation enterprise, and submit their debt claims.

In response to this development, LDG has issued a statement on its website. The company acknowledged the court’s decision but emphasized that they are not insolvent and have been negotiating in good faith with Phuc Thuan Phat to resolve the outstanding debt.

LDG explained that they had signed contracts with Phuc Thuan Phat for the construction of several components of the Tan Thinh Residential Area project. However, the project encountered legal hurdles, hindering its progress. Despite these challenges, LDG asserted that they have already paid Phuc Thuan Phat 95% of the contract value. Nevertheless, there are still some outstanding debts that need to be settled.

LDG further mentioned that they have been cooperative and have negotiated multiple times with Phuc Thuan Phat regarding the remaining debt and payment schedule. However, the two parties have not yet reached an agreement. As a result, Phuc Thuan Phat has requested the court to initiate bankruptcy proceedings.

LDG stated that they have submitted documents to the People’s Court of Dong Nai Province and the Ho Chi Minh City High People’s Court, requesting a review and revocation of the bankruptcy decision. Additionally, LDG is continuing negotiations with Phuc Thuan Phat to reach a consensus on the debt settlement.

The company reassured that it remains solvent and is committed to fulfilling its financial obligations. LDG is determined to continue negotiations and find a solution that protects the rights and interests of all involved parties.

Who are the creditors?

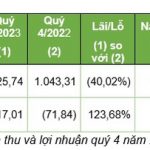

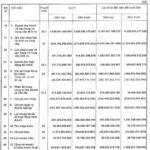

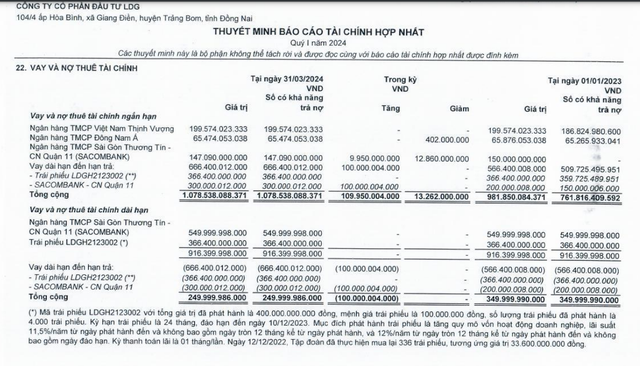

According to LDG’s latest financial report as of March 30, the company’s financial debt stood at nearly VND 1,328 billion. This includes short-term financial debt of over VND 1,078 billion and long-term debt of over VND 916 billion.

The company’s primary creditors include Sacombank, with a total debt of approximately VND 997 billion, and a bond debt of over VND 366 billion that has become due.

LDG’s Q1 2024 Financial Report.

Illegal construction of 680 villas in Trang Bom, Dong Nai

LDG, listed on the Ho Chi Minh City Stock Exchange with a chartered capital of nearly VND 2,500 billion and total assets of over VND 6,500 billion, has been in the spotlight recently due to controversies surrounding its real estate projects.

One notable incident involves the Tan Thinh Residential Area project in Doi 61, Trang Bom, Dong Nai, where LDG was found to have illegally constructed 680 houses, including 198 villas and 290 townhouses, between 2018 and 2020, even though they had not obtained the necessary land use rights and construction permits from the authorities.

LDG illegally constructed 680 villas in Trang Bom, Dong Nai.

Despite the lack of necessary approvals, LDG entered into sales contracts with 60 customers, receiving payments ranging from 25% to 95% of the contract value. Seven households have already moved into the illegally constructed houses. This project did not meet the conditions for trading future formed real estate assets as stipulated by law.

The violations at the Tan Thinh Residential Area project are among the three cases being monitored by the Central Steering Committee for Corruption Prevention and Control.

Tracodi (TCD) earns 163 billion VND profit in 2023

Throughout the year 2023, Tracodi achieved a consolidated net revenue of VND 1,784.5 billion and a post-tax profit of VND 163.3 billion.