Vinh Hoan Joint Stock Company (VHC on HoSE) reported consolidated financial results for Q2 2024, with revenue reaching VND 3,196 billion, a 17% increase year-over-year.

Despite the significant revenue growth, a decline in profit margins led to a 20% decrease in gross profit, totaling VND 462 billion.

During this quarter, financial revenue increased by 18% to VND 117 billion, while financial expenses rose by 15% to VND 57 billion. Selling and administrative expenses also increased by 23%, totaling VND 141 billion.

As a result, Vinh Hoan reported a 26% decline in net profit for Q2 2024, amounting to VND 336 billion.

The company attributed the continued profit decline in Q2 2024, despite higher revenue, to a decrease in the selling price of the tra fish product group.

For the first half of 2024, Vinh Hoan recorded a 22% increase in revenue year-over-year, reaching VND 6,051 billion. However, net profit after tax attributable to the parent company was VND 484 billion, a 26% decrease compared to the previous year.

Notably, during the first six months of 2024, the company’s expenses for transportation, storage, and other costs increased by 56%, totaling VND 100 billion.

For the full year 2024, Vinh Hoan has set two business plans: a basic scenario and a high scenario. In the basic scenario, the company targets VND 10,700 billion in revenue, a 6.6% increase year-over-year, and expects a net profit after tax of VND 800 billion, representing a 12.9% decrease compared to 2023.

In the high scenario, the company forecasts revenue of VND 11,500 billion, a 14.6% increase year-over-year, and anticipates a net profit after tax of VND 1,000 billion, an 8.8% increase compared to 2023.

As of the end of the first half of 2024, Vinh Hoan has achieved 60% of its net profit target of VND 800 billion and 48% of its VND 1,000 billion net profit goal for the year.

In terms of asset size, as of June 30, 2024, Vinh Hoan’s total assets increased slightly by 2% from the beginning of the year to VND 12,219 billion.

Inventory accounted for 28% of total assets, valued at VND 3,417 billion. Cash and cash equivalents decreased by 32% to VND 158 billion, while term deposits at banks increased by 21% to VND 2,341 billion over the six-month period. Short-term receivables were recorded at VND 1,765 billion.

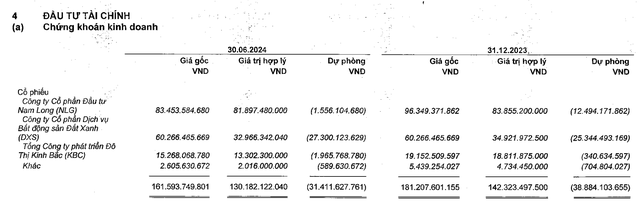

Additionally, Vinh Hoan invested VND 161.6 billion in securities, but none of the three stockholdings in the portfolio were profitable, with a total provision of VND 31.4 billion, equivalent to a temporary loss of 19% of the total investment portfolio.

Specifically, the investment in the shares of Dat Xanh Real Estate Service Joint Stock Company (DXS on HoSE) had a original value of VND 60.3 billion, with a provision of VND 27.3 billion. The investment in Nam Long Investment Joint Stock Company (NLG on HoSE) had a original value of VND 83.5 billion, with a provision of VND 1.6 billion. The company also invested VND 15.3 billion in Kinh Bac City Development Holding Corporation (KBC on HoSE), with a provision of VND 1.97 billion. The remaining VND 2.61 billion was invested in other stocks, with a provision of VND 590 million.

Vinh Hoan’s securities investment portfolio as of the end of Q2. Source: VHC

On the capital side, Vinh Hoan’s total financial borrowings increased by 6.7% from the beginning of the year to VND 2,410 billion.

Short-term borrowings amounted to VND 2,342.6 billion, an increase of 8.5% mainly due to a significant rise in borrowings from HSBC Vietnam to VND 495 billion and United Overseas Bank (Vietnam) Limited to VND 318 billion.

Long-term borrowings decreased by 34% from the beginning of the year, pertaining to a loan from Vietcombank – Ho Chi Minh City Branch.