The Ho Chi Minh City Stock Exchange has announced the mandatory delisting of shares of HAGL Agrico, a subsidiary of Hoang Anh Gia Lai Group, from the stock exchange due to significant losses in 2021, 2022, and 2023.

According to the exchange’s statement, the delisting is based on Clause 1, Point e, Article 120 of Decree No. 155/2020/ND-CP, which states that shares of a public company shall be subject to mandatory delisting if the “production and business results incur losses for three consecutive years or the total accumulated loss exceeds the actually contributed charter capital, or the owner’s equity is negative in the audited financial statements of the latest year before the time of consideration.” The delisting of HNG shares was considered by the State Securities Commission of Vietnam in Official Dispatch No. 4615/UBCK-PTTT issued on July 24, 2024.

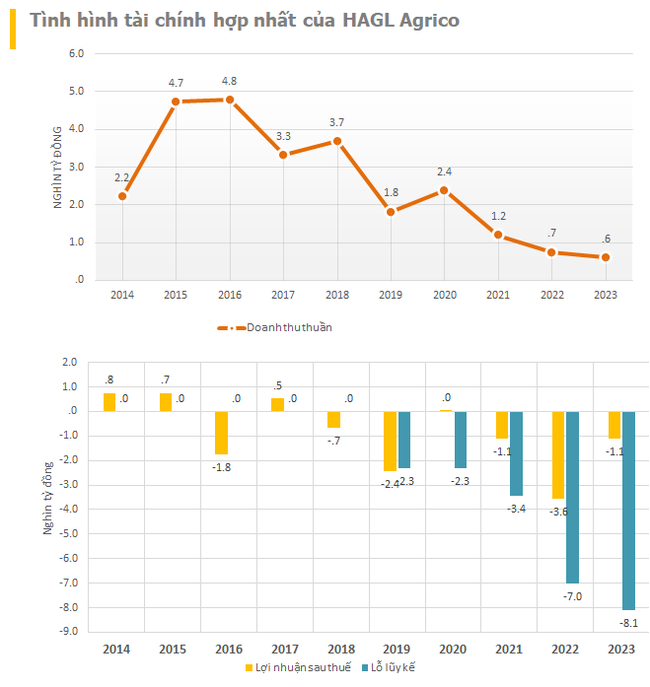

HAGL Agrico has been experiencing financial difficulties, with a net loss to shareholders of 1,119 billion VND in 2021, 3,576 billion VND in 2022, and an expected loss of 1,098 billion VND for 2023. The company’s plans for a large-scale agricultural project in Laos, with a total investment of 18,090 billion VND, have also raised concerns.

Despite these challenges, HAGL Agrico remains committed to its agricultural business model, focusing on three main areas: fruit trees, rubber, and cattle farming across 27,000 hectares of land. Thaco Agri, a subsidiary of Thaco, manages the agricultural division of the group.

At the 2024 Annual General Meeting, Chairman of the Board of Directors, Tran Ba Duong, assured shareholders that the company would continue to maintain transparency in its financial reporting, even if the shares are delisted from the Ho Chi Minh Stock Exchange and traded on the UPCoM. He emphasized the importance of creating real value and expressed confidence that the share price could still increase if the company performs well.

Tran Ba Duong, Chairman of HAGL Agrico

HAGL Agrico’s ambitious project in Laos aims to develop a large-scale fruit tree and cattle farming operation, with expected revenues of 13,500 billion VND (550 million USD) and profits of 2,450 billion VND (100 million USD) annually. However, the company’s financial performance in the first quarter of 2024 continued to show losses, with a 26% decline in revenue and a net loss of 47 billion VND.

As of the first quarter of 2024, the company has accumulated losses of 8,149 billion VND, resulting in a significant decline in owner’s equity. HAGL Agrico’s plans for recovery and profitability remain uncertain, and the delisting of its shares from the stock exchange is a significant development that highlights the company’s ongoing challenges.

Pomina Steel (POM) addresses delayed financial report submission, pledges to meet deadline to avoid delisting

Pomina has implemented measures to address the delay in completing the audit report and is committed to preventing any risks from occurring in meeting the deadline for submitting the 2023 audit report.