|

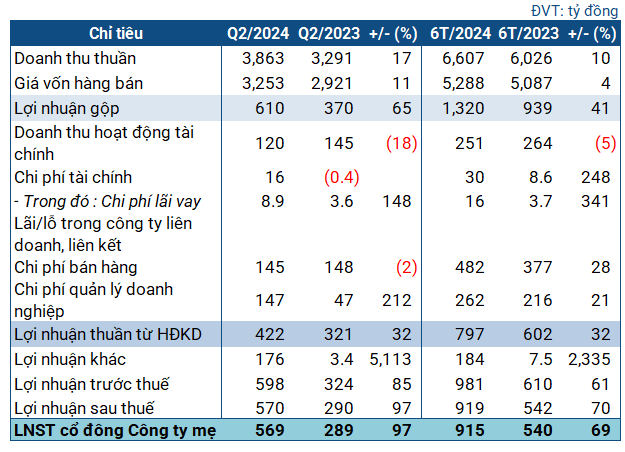

Ca Mau Urea’s Business Targets in Q2 2024

Source: VietstockFinance

|

In the second quarter, the fertilizer giant recorded nearly VND 3,900 billion in revenue, up 17% over the same period last year. Cost of goods sold increased slightly, by only 11%. After deductions, the company’s gross profit was VND 610 billion, up 65% from the previous year.

Despite a decline in financial revenue (18%), a surge in selling and administrative expenses (threefold increase), and persistently high selling expenses (VND 145 billion), Ca Mau Urea remained resilient, posting a net profit of VND 422 billion, a 32% increase.

Notably, the company unexpectedly recognized other income of VND 176 billion, compared to just over VND 3.4 billion in the same period last year, mostly from profitable trading transactions. This windfall propelled Ca Mau Urea to a net profit of VND 569 billion, nearly double that of the previous year.

According to a representative from Ca Mau Urea, the profitable trading transaction was the acquisition of Han – Viet Fertilizer Company (KVF), a company that owns a fertilizer plant with a total investment of $60 million. The representative added that the transaction, after a revaluation, was determined to be cheaper than the actual amount paid, and the difference was recognized as other income.

It is known that Ca Mau Urea completed the acquisition of KVF in May 2024. At the 2024 Annual General Meeting of Shareholders, General Director Van Tien Thanh revealed that the deal aimed to increase NPK fertilizer production. Additionally, KVF’s strategic location, just 500 meters from Hiep Phuoc Port, facilitates cargo transshipment and contributes to the improvement of the company’s logistics infrastructure. Notably, the plant turned profitable just one month after the takeover and is expected to add 60,000-70,000 tons of NPK production capacity in 2024.

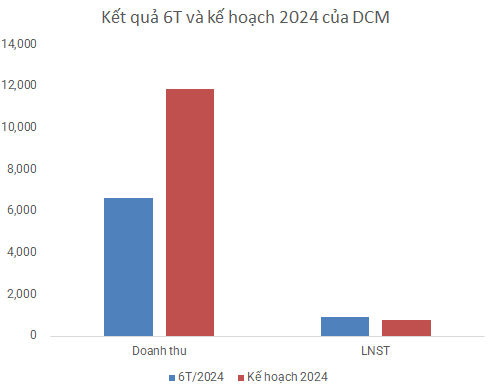

The successful second quarter enhanced Ca Mau Urea’s cumulative performance. In the first six months, the company achieved over VND 6,600 billion in revenue, a 10% increase year-on-year, with a net profit of VND 915 billion, up 69%. Compared to the plan approved at the 2024 Annual General Meeting of Shareholders, the company has accomplished 56% of its revenue target and exceeded the full-year net profit plan by nearly 16%.

Source: VietstockFinance

|

As of the end of the second quarter, the fertilizer giant’s total assets increased by 10% from the beginning of the year to over VND 16,800 billion, with over VND 14,500 billion in short-term assets, an 8% increase. Notably, over VND 10,600 billion of this was in cash, held in the form of cash and cash equivalents.

Accounts receivable from customers increased significantly to VND 502 billion, 2.5 times higher than at the beginning of the year. Inventories also rose by 29% to nearly VND 2,800 billion.

On the capital side, the company’s liabilities were mostly short-term, totaling over VND 6,000 billion, a 34% increase from the beginning of the year. With a substantial cash balance of over VND 10,600 billion, there is no doubt about Ca Mau Urea’s ability to fulfill its upcoming debt obligations.

Regarding borrowings, the company recorded short-term borrowings of over VND 1,300 billion as of the end of June, a 59% increase from the beginning of the year, and long-term borrowings of VND 144 billion (nearly VND 3 billion at the beginning of the year). All borrowings were from Vietcombank.