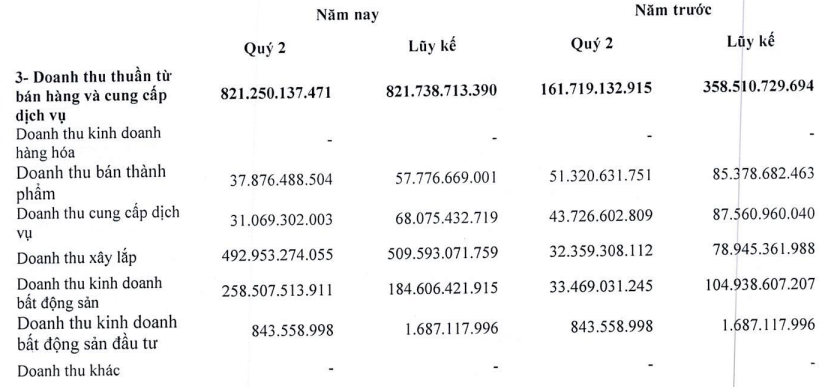

In particular, DIG’s net revenue in the quarter recorded more than VND 821 billion, five times higher than the same period last year. Notably, revenue from real estate business and construction installation recorded VND 259 billion and VND 493 billion, respectively, 7.7 times and 15.2 times higher than Q2 last year.

|

Q2 2024 Revenue Structure of DIG

Source: DIG

|

According to the explanation, revenue from the real estate business mainly came from the transfer of apartments in the Cap Saint Jacques (CSJ) project, the transfer of unfinished houses in the Dai Phuoc and Hau Giang projects (Vi Thanh project).

DIG transfers Cap Saint Jacques commercial service area – phase 1

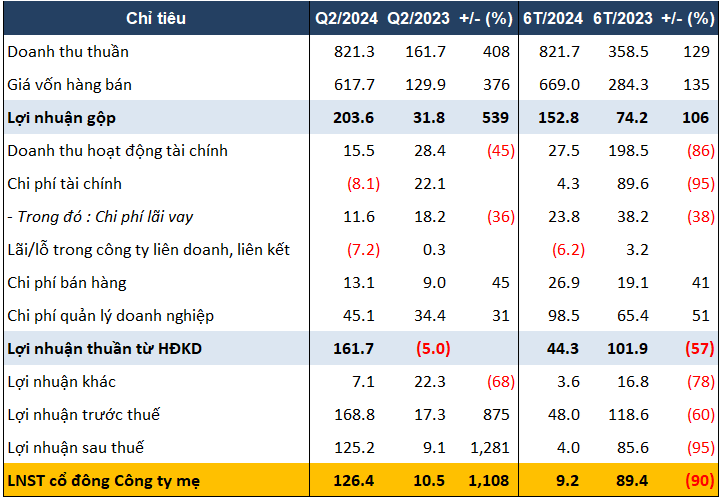

While net revenue “exploded”, the company’s financial revenue decreased by 45% to nearly VND 16 billion due to no income recognition from investments.

In terms of expenses, thanks to a 36% reduction in interest expenses and a reversal of VND 20 billion in financial provisions, DIG reversed more than VND 8 billion in financial expenses for the period. However, selling and management expenses still increased by 45% and 31%, respectively, to over VND 13 billion and VND 45 billion.

With the above net revenue, DIG recorded a net profit of over VND 126 billion, 12 times higher than the same period last year. However, due to a loss of more than VND 117 billion in Q1, the company’s cumulative profit for the first six months was just over VND 9 billion, down 90%.

|

Q2 2024 Financial Results of DIG. Unit: Billion VND

Source: VietstockFinance

|

On the other hand, DIG’s net profit for the first half of the year reached only VND 4 billion, a decrease of 95%, and this result was just 0.5% of the target of VND 760 billion set for 2024.

On the balance sheet, DIG’s total assets were recorded at over VND 18,400 billion, up 10% from the beginning of the year. In particular, cash increased by 19% to nearly VND 3,000 billion. Inventories also increased by 17% to nearly VND 7,700 billion, mainly due to the increase in unfinished construction costs for the Dai Phuoc eco-tourism urban area project from VND 1,300 billion to VND 2,100 billion.

On the other side, payables increased by 18% to nearly VND 10,600 billion. Notably, borrowings increased by 39%, exceeding VND 4,300 billion.

This was due to DIG’s bond issuance to HDBank, which exceeded VND 1,550 billion at the end of March 2024, while it was only over VND 250 billion at the beginning of the year. Explaining this item, DIG stated that this was the company’s fundraising from HDBank through two bond lots with a total value of VND 1,600 billion, with the same term of 36 months. The interest rate for the first two interest calculation periods (12 months) is 11.25%/year, and the interest rate for the remaining periods is calculated as the sum of 4%/year + HDBank’s 12-month term deposit interest rate.

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.

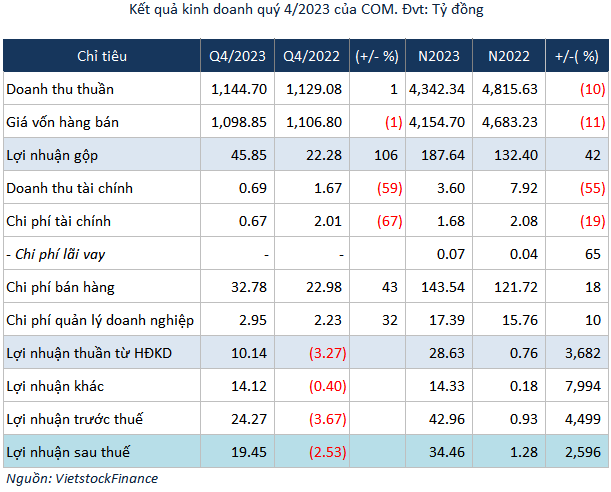

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.