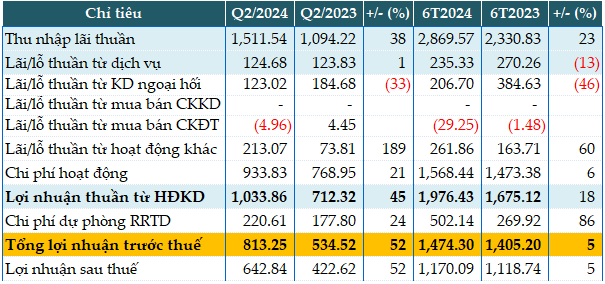

Eximbank’s second-quarter performance for 2024 showed a recovery compared to the same period last year. Net interest income increased by 38%, reaching nearly VND 1,512 billion.

Despite a decline in non-interest income sources such as foreign exchange activities (-33%) and securities investment activities (a loss of VND 5 billion), the bank recorded a significant surge in other income. Net profit from other activities exceeded VND 213 billion, triple that of the previous year.

However, operating expenses also rose by 21% to VND 934 billion, resulting in a net profit of nearly VND 1,034 billion, an increase of 45%. Eximbank allocated nearly VND 221 billion for credit risk provisions (+24%), yet the pre-tax profit still reached over VND 813 billion (+52%).

For the first six months of the year, Eximbank’s pre-tax profit surpassed VND 1,474 billion, a 5% increase year-on-year.

Compared to the full-year pre-tax profit target of VND 5,180 billion for 2024, Eximbank has only achieved 28% of its goal halfway through the year.

|

EIB’s Q2 2024 Business Results. Unit: VND billion

Source: VietstockFinance

|

The bank’s total assets as of the end of Q2 increased by 5% from the beginning of the year to VND 211,999 billion. Specifically, deposits at the State Bank of Vietnam rose by 38% (VND 5,599 billion), while deposits at other credit institutions decreased by 27% (VND 31,542 billion), and loans to customers increased by 8% (VND 151,327 billion)…

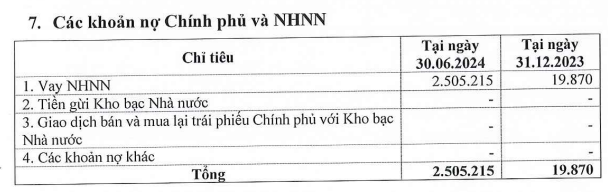

On the funding side, borrowings from the State Bank of Vietnam amounted to VND 2,505 billion, a significant increase from the nearly VND 20 billion at the start of the year. Customer deposits also grew by 4% year-to-date, reaching VND 163,051 billion.

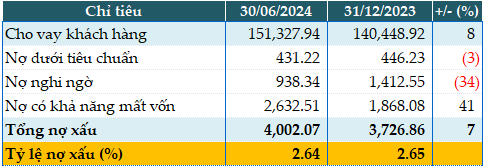

As of June 30, 2024, the total non-performing loans (NPLs) stood at VND 4,002 billion, a 7% increase from the beginning of the year. Notably, there was a shift from substandard and doubtful loans to loans with potential losses. The NPL ratio slightly decreased from 2.65% at the beginning of the year to 2.64%.

|

EIB’s Loan Quality as of June 30, 2024. Unit: VND billion

Source: VietstockFinance

|

Han Dong