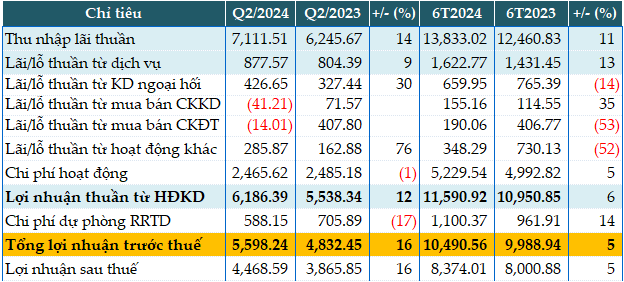

ACB reported a strong second quarter of 2024, with net interest income reaching 7,112 billion VND, a 14% increase year-over-year. The bank saw growth in non-interest income, including a 9% rise in service fees, a 30% jump in foreign exchange trading profits, and a 90% surge in other operating income. However, investment and trading securities reported losses compared to profits in the same period last year.

Additionally, a 17% reduction in credit risk provisions to just over 588 billion VND boosted pre-tax profits to over 5,598 billion VND, marking a 16% increase year-over-year.

For the first half of 2024, ACB achieved 11,590 billion VND in net operating income, a 6% increase year-over-year. The bank increased its risk provisions by 14% to 1,100 billion VND, resulting in a pre-tax profit of nearly 10,491 billion VND, a 5% rise.

With these results, ACB has accomplished 48% of its full-year 2024 target of 22,000 billion VND in pre-tax profits. The ROE ratio remains steady at 23.4%.

|

ACB’s Q2 2024 Financial Results. In VND billion

Source: VietstockFinance

|

As of June 30, 2024, ACB’s total assets grew by 7% since the beginning of the year, reaching 769,678 billion VND. Meanwhile, deposits with the State Bank decreased by 15% to 15,724 billion VND, and deposits and loans with other credit institutions dropped by 8% to 105,419 billion VND.

Notably, customer loans saw a significant increase of 13% since the start of the year, totaling 550,172 billion VND. ACB attributed this growth to its balanced approach, targeting both individual and corporate segments, which grew by over 12% compared to the beginning of the year. Customer deposits also rose by 6% to 511,696 billion VND during the same period, with a CASA ratio of 22%.

|

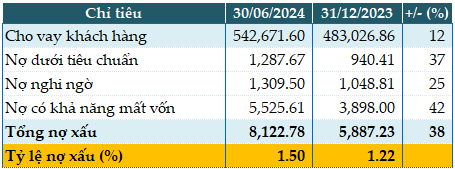

ACB’s Loan Quality as of June 30, 2024. In VND billion

Source: VietstockFinance

|

Excluding the 7,500 billion VND in margin loans from ACBS, ACB’s total non-performing loans as of June 30, 2024, stood at 8,123 billion VND, a 38% increase since the beginning of the year. The NPL ratio slightly increased from 1.22% to 1.5%, influenced by market conditions and the impact of CIC-related loans. The LDR ratio was 82.2%, and the ratio of short-term capital used for medium and long-term loans was 17.6%.

Han Dong

Banking: Huge Profits Yet Worried

Several banks have announced their 2023 financial results, showing outstanding growth. However, they are also facing increased pressure in setting aside provisions for credit risk.