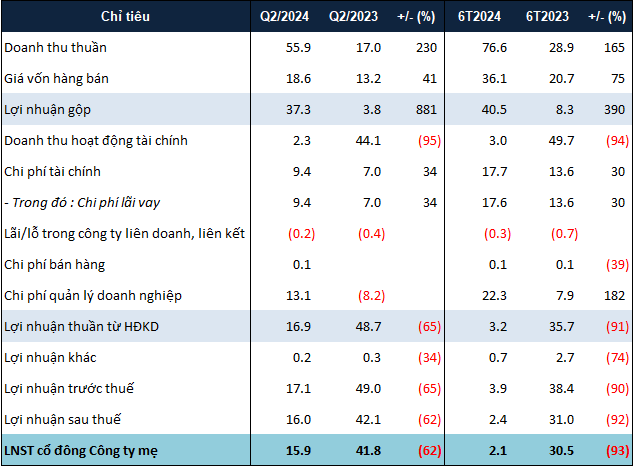

SGR’s Q2 2024 financial statement reveals a significant surge in revenue compared to the previous year, recording nearly VND 56 billion, a 3.3x increase, primarily from project sales. While cost of goods sold rose by 41%, the company’s gross profit soared to over VND 37 billion, a 9.8x jump.

However, the revenue growth failed to offset the decline in financial income, which stood at just over VND 2 billion, in contrast to the previous year’s figure of over VND 44 billion (a 95% drop). In Q2 2023, SGR had earned over VND 38 billion in interest on loans and late payment fees, but this amount plummeted to less than VND 600 million in the same quarter this year.

Additionally, the company’s expenses rose notably, with a 34% increase in interest expenses, totaling over VND 9 billion. Selling expenses also emerged at over VND 58 million, while there were none in the previous year. Furthermore, in Q2 of the previous year, the company benefited from a reversal of over VND 8 billion in management expenses, but this year, due to a significant reduction in the reversal of allowances for doubtful accounts, they had to recognize management expenses of over VND 13 billion.

Amid these fluctuations, SGR’s net profit for Q2 2024 reached nearly VND 16 billion, a 62% decrease compared to the same period last year. Coupled with a loss of nearly VND 14 billion in Q1, the company’s net profit for the first half of 2024 stood at just over VND 2 billion, a 93% decline. Despite the drop in financial performance, the company’s operating cash flow for the first half turned positive, with over VND 56 billion, compared to a negative VND 210 billion in the same period last year.

|

SGR’s Financial Performance for the First Half of 2024 in VND billion

Source: VietstockFinance

|

In terms of their 2024 business plan, SGR aims for a total revenue of VND 628 billion and a pre-tax profit of VND 190 billion. However, as of the first six months, they have only achieved 12% of their revenue target and 2% of their profit goal.

As of June 30, 2024, SGR’s total assets exceeded VND 2,100 billion, a 3% increase from the beginning of the year. Notably, their cash holdings rose by 68% to VND 92 billion, and the amount receivable from apartment purchasers also increased by nearly 17% to almost VND 133 billion.

The company’s liabilities also grew by 5%, reaching nearly VND 1,200 billion. Within this, total borrowings increased by 16% to nearly VND 408 billion, mainly due to a new loan of over VND 56.6 billion from BIDV – Truong Son Branch, intended to supplement working capital.

Another notable increase was in the short-term payable category for deposits received, which rose by over 46% to more than VND 290 billion. SGR attributed this to over VND 274 billion in deposits from Saigon Riverside Investment Joint Stock Company, per their 2022 transfer agreements.

Ha Le

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.