62% of Small and Medium-Sized Enterprises’ Financial Needs Remain Unmet

On July 24th, FiinGroup, in collaboration with IFC and S&P Market Intelligence, Singapore, organized a workshop titled “Innovating Financial Services and Products for Small and Medium-Sized Enterprises in Vietnam.”

Mr. Nguyen Minh Tu, Executive Director of FiinGroup’s Enterprise Information Block, shared that Small and Medium-sized Enterprises (SMEs) currently account for nearly 85% of the total number of enterprises in Vietnam. This group contributes approximately 20% of the revenue of all Vietnamese businesses. In comparison to GDP, the revenue of SMEs is equivalent to 70% of Vietnam’s GDP.

“SMEs are distributed across urban and rural areas, with a concentration in major cities such as Hanoi, Ho Chi Minh City, and Danang, as well as provinces with many industrial zones such as Binh Duong, Dong Nai, and Hai Phong. More than 40% of Vietnamese SMEs are engaged in wholesale and retail activities. This sector is considered an important industry, acting as an intermediary between manufacturers, agents, and consumers,” said Mr. Tu.

Despite their crucial role in the economy, according to FiinGroup experts, SMEs are facing numerous challenges.

“First is access to finance. Second, difficulty in reaching new customers, as post-Covid-19, face-to-face meetings and traditional trade promotions are no longer effective. Third, lack of risk management tools. Fourth, the business environment and policies,” said Mr. Nguyen Minh Tu.

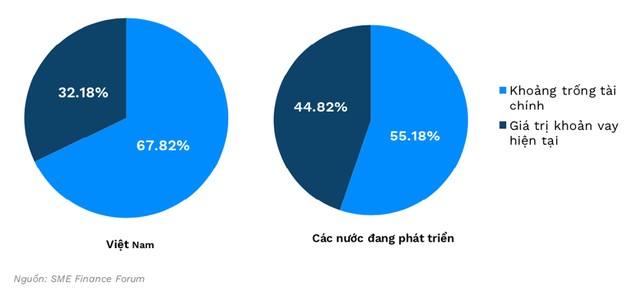

Regarding the challenge of accessing capital, FiinGroup’s data reveals that approximately 62% of the total financial needs of SMEs remain unmet, equivalent to a financial gap of about $24 billion. The financial gap for SMEs in Vietnam is about 2.11 times higher than the current SME lending level. In contrast, this figure is only 1.23 times higher in developing countries.

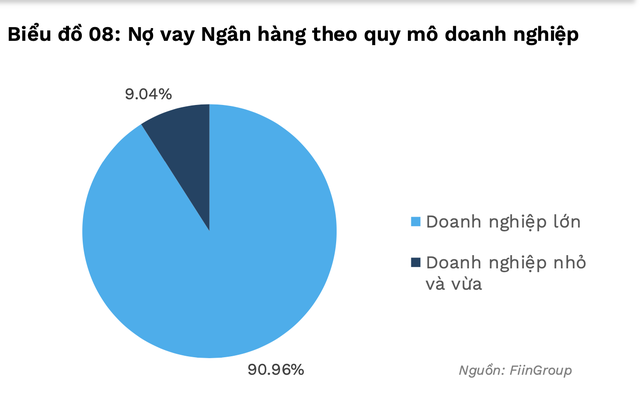

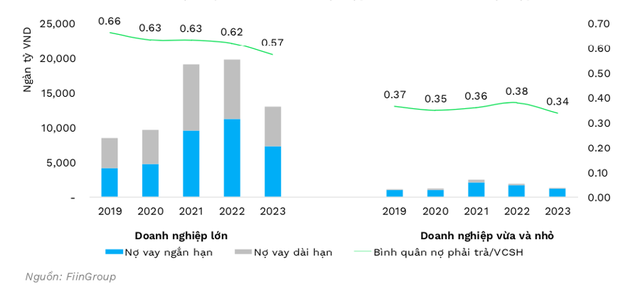

Moreover, while SMEs account for nearly 85% of the total number of enterprises in the country, their borrowing capacity remains low. The total bank loans of SMEs account for just over 9% of the total loans of all Vietnamese enterprises, significantly lower than that of large enterprises, which constitute less than 20% of the total number of enterprises but hold more than 90% of the total loans.

Why do SMEs face challenges in accessing credit?

According to experts, the difficulty SMEs face in accessing credit is due to various factors, including high collateral requirements, complex credit approval processes, and a lack of transparent financial information from these enterprises.

Ms. Pham Thi Thanh Huyen, Program Manager for Vietnam and Cambodia Infrastructure Development, IFC, attributed the challenges faced by SMEs in accessing credit to both subjective and objective reasons.

From the subjective perspective of the enterprises, SMEs often lack transparency in financial information, governance, and compliance with financial standards and industry trade practices.

However, objectively, the financial market in Vietnam severely lacks banking products and financial services tailored for micro, small, and medium-sized enterprises. Additionally, the lending culture in Vietnam heavily relies on real estate collateral without giving due attention to lending based on movable assets such as receivables, inventory, ownership papers, and commercial papers.

Ms. Huyen emphasized the need to diversify financial products for SMEs and improve data quality for customer evaluation. With comprehensive data, enterprises will find it easier to address their financial needs. Data and data analysis are indispensable in digital finance.

The IFC representative suggested several solutions to enhance financial inclusion for Vietnamese SMEs, including improving the financial infrastructure and creating an enabling environment for the banking sector’s digital transformation, diversifying loan products to align with the nature of SMEs’ businesses, diversifying financial institutions, and leveraging and optimizing technology in lending activities.

Sharing a similar viewpoint, the Deputy Director of the Enterprise Information Block, in charge of Risk Model and Data Analysis at Fiin Group, stated that in the coming time, SMEs would continue to face challenges in accessing finance, such as a lack of transparency in information, stricter lending standards from credit institutions, inability to provide collateral, inadequate credit scoring and risk management capabilities, insufficient data, and traditional credit products and processes.

However, this group of enterprises also has access to various opportunities: governmental support through the Law on Supporting Small and Medium-Sized Enterprises, digital transformation trends such as the Management Platform for SMEs, Digital Transformation in the Banking Sector, National Data Infrastructure, and assistance from Green Credit and Sustainable Development.

Based on this, Mr. Nguyen Van Nam proposed that credit institutions could optimize their SME lending portfolios based on enhanced risk analysis capabilities to improve access to SME customers, especially younger enterprises.

From a positive perspective, experts believe that the significant financial gap also presents opportunities for banks and financial institutions to develop more suitable financial products for SMEs and encourages the government to consider supportive policies for SMEs to improve the business environment and facilitate easier access to capital.

Data analysis from the State Bank of Vietnam and financial reports of non-bank and bank financial institutions in Vietnam by FiinGroup revealed that the total SME credit balance of non-bank financial companies reached VND 74,030 billion, while the bank group recorded over VND 2,739 million billion in 2023. However, the group of non-bank financial institutions has shown robust growth in recent years, with a growth rate of 26.8% in 2023.

Mr. Jimmy Nguyen, Deputy Director and Credit Product Expert (ASEAN) at S&P Global Market Intelligence, forecasted that Vietnam’s economic growth this year could reach 5.8%, higher than in 2023. However, credit growth is too high compared to the target of 15%, which is a relatively high growth rate compared to many countries in the region, such as Indonesia, with only about 6%. Therefore, when providing additional credit, it must be managed reasonably; otherwise, it will pose a risk to the entire system.

“Regarding credit support for SMEs, there are risks, but it doesn’t mean we shouldn’t lend. Instead, we need to effectively manage these risks. For example, in addition to assessing the risks of the enterprise, it is necessary to evaluate industry risks, including profitability, profits and losses, number of contracts, revenue, etc. And to do this, banks need reliable data to assess risks,” said Mr. Jimmy Nguyen.

Need to excel at writing ads that grab attention, engage readers, and drive results?

Even in a stable market with low and stable interest rates, offering an attractive credit package remains essential and meaningful for the Bank-Business Connection program.