**Aloha Mall’s Expansion and the Man Behind Its Success**

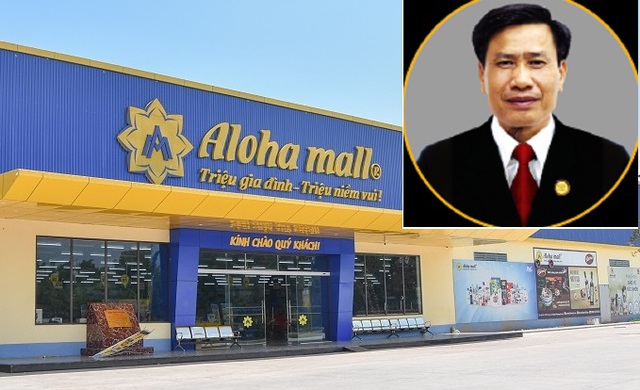

Earlier this month, Thai Hung Co., Ltd. received approval from the People’s Committee of Thai Nguyen Province to convert over 1.3 hectares of agricultural land, purchased from households and individuals, into commercial and service land for the development of the Aloha Mall Phu Luong project. This will be Thai Hung’s third Aloha Mall in Thai Nguyen Province and the 13th in the Aloha Mall chain.

Thai Hung Co., Ltd. was established in 2005. As of September 2012, the company had a charter capital of VND 30 billion, contributed by five individual shareholders. Mr. Le Khanh Thien (born in 1966) served as the director and legal representative. Today, Mr. Thien remains the company’s director, but he is not the actual owner.

According to our sources, the real owner behind the Aloha Mall chain is Mr. Nguyen Van Nghia (born in 1963) from Phu Tho province, who holds 86.52% of the ownership stake in Thai Hung. Mr. Nghia previously worked as the chief accountant at CMC Phu Tho Joint Stock Company. From 1999 to 2016, he held various positions, including chief accountant, director, deputy general director, and vice chairman of the board at Prime Group Joint Stock Company.

Mr. Nguyen Van Nghia, the owner of the Aloha Mall chain

Mr. Nghia has since become a major shareholder and served on the boards of several public companies, amassing a fortune worth thousands of billions of dong. His first venture was with Thanh Cong Garment Corporation (TCM code), where he became a major shareholder in September 2020 and is now a member of the board. Mr. Nghia currently holds 17.19 million TCM shares, valued at approximately VND 857 billion.

Recently, Mr. Nghia registered to sell 7 million TCM shares to reduce his ownership stake in the company. The sale is planned to take place between July 16 and August 14, 2024, through matching or negotiated transactions. If successful, his holdings will decrease from 17.19 million shares (16.8%) to 10.19 million shares (10%). Based on TCM’s closing price of VND 49,850 per share on July 26, Mr. Nghia is expected to earn about VND 350 billion from this transaction.

In addition to TCM, Mr. Nghia is also a board member at LIZEN Joint Stock Company (LCG code) and Savimex Economic Cooperation and Import-Export Joint Stock Company (SAV code). He also serves as the chairman of the board at AMECC Mechanical and Construction Joint Stock Company (AMS code) and TASA Group Joint Stock Company, as well as the chairman of the members’ council at Thanh Long Trading, Construction, and Transport Limited Liability Company.

At LIZEN, Mr. Nghia holds 9.78 million LCG shares (5.1% stake), valued at over VND 108 billion based on LCG’s closing price of VND 11,050 per share on July 26. At AMS, he owns 10.4 million shares (17.32% stake), worth approximately VND 114 billion at a share price of VND 11,000.

Mr. Nghia also holds 20.86 million shares of TIG (10.77% stake) in Thang Long Investment Group Joint Stock Company, valued at approximately VND 310 billion based on the market price of VND 14,900 per share. This brings his total estimated wealth in these listed companies to over VND 1,300 billion.

Additionally, Mr. Nghia holds shares worth hundreds of billions of dong in unlisted companies such as Tasa Group, Thai Hung, and Gemmy Wood. According to our sources, in December 2023, he used 27% of Gemmy Wood’s charter capital (equivalent to VND 70.2 billion) as collateral at BIDV – Hung Vuong Branch. His son also used 5% of the capital owned by his father in Gemmy Wood as collateral at the same bank.