HVS to Elect a New CEO Born in 1999 and a Slate of Supervisory Board Members with DSC Roots

On July 26, the HVS Board of Directors received the resignation of Ms. Nguyen Thi Tuyet, a member of the Supervisory Board. Prior to that, on July 24, the Board also received the resignations of two other Supervisory Board members, Ms. Chu Hoang Mai and Ms. Dinh Hoai Huong.

The Board of Directors announced the nomination and election of supplementary members to the Supervisory Board for the 2023-2028 term and requested the inclusion of the resignation of the above three individuals in the agenda of the 1st/2024 Extraordinary General Meeting of Shareholders.

The list of candidates for supplementary election to the Supervisory Board, released by HVS, is notable as all individuals currently hold positions at DSC Securities Company. Specifically, the list includes Mr. Du Ba Phuoc (born in 1997), currently a legal specialist at DSC; Ms. Mai Ngoc Anh (born in 1989), currently a specialist in the Risk Management and Internal Control Department at DSC; and Ms. Ngo Thi Hong Nhung (born in 1994), currently an accounting specialist at DSC.

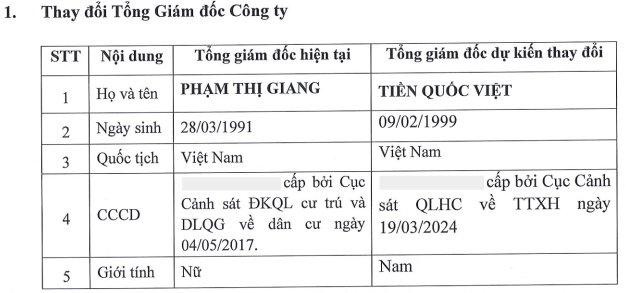

On July 24, the HVS Board of Directors also received the resignation of Ms. Pham Thi Giang (born in 1991) from her position as CEO. Notably, Ms. Giang is also the legal representative of HVS, so the Board requested the inclusion of a change of legal representative in the extraordinary meeting.

Accordingly, the legal representative is expected to shift from the CEO to the Chairman of the Board of Directors.

For the CEO position, the HVS Board of Directors proposed the election of Mr. Tien Quoc Viet, born in 1999, to the General Meeting.

Source: 1st/2024 Extraordinary General Meeting of Shareholders of HVS

|

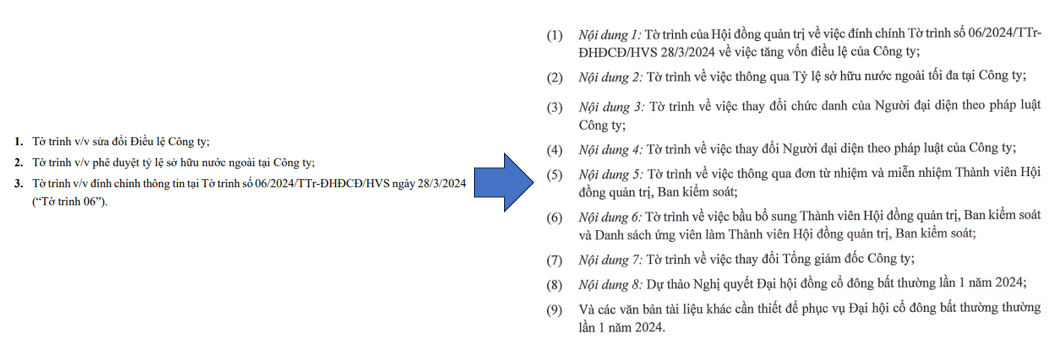

The number of proposals has more than doubled compared to the initial plan.

Looking back to June 24, when the documents for the 1st/2024 Extraordinary General Meeting of Shareholders were first released, the HVS Board of Directors had only planned to propose three agenda items related to amendments to the Company’s charter, foreign ownership ratio, and corrections to the minutes of Proposal No. 06/2024/TTr-ĐHĐCĐ/HVS dated March 28, 2024 (changing the ratio of the implementation of the issuance plan from 1:498 to 1:4.98). The meeting was scheduled for July 15.

However, on June 28, the HVS Board of Directors had to supplement the proposal for the dismissal of the qualification of the Company’s Board of Directors members, after receiving three consecutive resignations from leadership positions, including Ms. Truong Thi Hong Nga, the Chairman of the Board of Directors, and two Board members, Mr. Ngo Van Do and Mr. Thai Dinh Sy.

It is known that all three were elected to the HVS Board of Directors on April 30, 2021. The resignations were submitted on the same day, June 24, for personal reasons.

On the same day, June 28, HVS announced the nomination of Board of Directors members for the 2023-2028 term for the vacant positions. As of July 26, the list of supplementary Board members included three individuals: Ms. Van Le Hang, Ms. Nguyen Thi Thuy, and Mr. Trinh Binh Long.

Ms. Van Le Hang, born in 1993, is currently a business specialist at TCG Land Company Limited. Ms. Nguyen Thi Thuy, born in 1982, is currently the secretary-assistant at Thanh Cong Group Joint Stock Company. Ms. Thuy previously served as Deputy Head of Import-Export Department at Thanh Cong Vietnam Automobile Joint Stock Company from 2011 to 2019 and prior to that, as an import-export business staff at Thanh Cong Mechanical Company Limited from August 2005 to 2011.

Mr. Trinh Binh Long, born in 1975, has held important positions in several companies, notably Thanh Cong Group Joint Stock Company, Hyundai Lam Kinh, Vnsteel, and the Coma-Cotana Joint Venture. He is currently the General Secretary to the CEO at Thanh Cong Group Joint Stock Company.

On July 5, the HVS Board of Directors passed a resolution to postpone the meeting to August 6 to ensure thorough preparation and organization.

Thus, with the consecutive resignations submitted recently, the documents for the 1st/2024 Extraordinary General Meeting of Shareholders of HVS have undergone significant changes compared to the initial plan. The number of proposals has increased from three to seven.

|

HVS supplements proposals for the 1st/2024 Extraordinary General Meeting of Shareholders

Source: HVS, compiled by the author

|

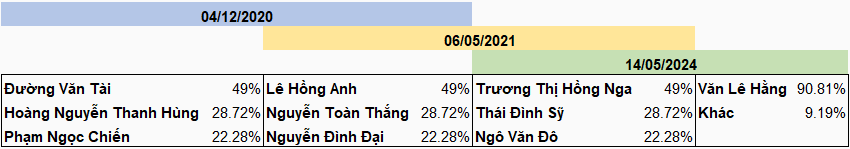

Major changes in shareholder structure

On May 14, HVS’s shareholder structure witnessed significant changes as Ms. Truong Thi Hong Nga, Mr. Ngo Van Do, and Mr. Thai Dinh Sy, who had just submitted their resignations as Chairman and members of the Board of Directors, sold all their shares. Ms. Truong Thi Hong Nga sold nearly 2.5 million shares (49% stake), Mr. Thai Dinh Sy sold over 1.4 million shares (28.72% stake), and Mr. Ngo Van Do sold over 1.1 million shares (22.28% stake).

On the opposite side, Ms. Van Le Hang, a candidate for the Board of Directors, became a major shareholder after purchasing nearly 4.6 million shares (90.81% stake), corresponding to most of the shares sold by the above three individuals.

Thus, in just under four years, the shareholder structure of HVS has changed hands three times. The first change occurred in December 2020 when the three existing shareholders, Duong Van Tai, Hoang Nguyen Thanh Hung, and Pham Ngoc Chien, transferred their shares to three individuals, Le Hong Anh, Nguyen Toan Thang, and Nguyen Dinh Dai. Soon after, the shares were transferred to Ms. Truong Thi Hong Nga, Mr. Ngo Van Do, and Mr. Thai Dinh Sy. Now, these three shareholders have completely divested, making way for Ms. Van Le Hang.

|

Shareholding structure of HVS Securities

Source: Compiled by the author

|

Regarding business operations, HVS is in a state of paralysis due to the withdrawal of brokerage operations, termination of membership, and revocation of depository membership, all of which occurred in 2018. Additionally, the auditing firm has emphasized the company’s operating status in the 2023 audited financial statements.

HVS is still in the process of working with the State Securities Commission, which is considering the conditions for maintaining and licensing the company. This raises concerns about the company’s ability to continue operating.

[HVS Securities “Paralyzed” for Years, Existing Shareholders Want to Divest 100% Capital]

Huy Khai