## SRC’s Quarterly Financial Results from 2020

| SRC’s quarterly financial results from 2020 |

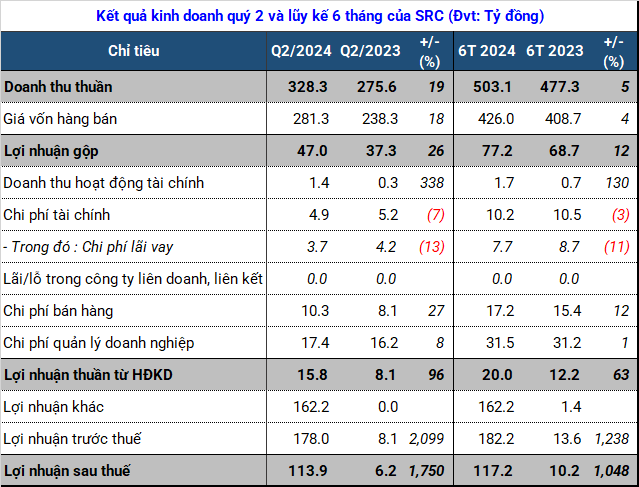

SRC’s revenue for the second quarter reached VND 328 billion, a 19% increase. While not a record-breaker, this number is higher than the 15-year average, mostly below VND 300 billion; only surpassed by the fourth quarter of 2023 with VND 488 billion and the fourth quarter of 2020 with VND 711 billion.

Cost of goods sold, selling and management expenses also increased, but not significantly, resulting in a doubling of business profit compared to the same period last year, reaching nearly VND 16 billion.

However, the company recorded a record net profit of nearly VND 114 billion, a 1750% increase compared to the second quarter of 2023. This was due to the transfer of land lease rights with infrastructure and attached assets during the period, recognizing VND 306 billion in other income. After deducting expenses, the company reported a profit from non-business activities of VND 162 billion.

Although not specifically mentioned, this is likely related to the 212,000 m2 of real estate in Chau Son Industrial Park, Phu Ly city, Ha Nam province. In 2016, SRC leased this land from Hanoi VPID Joint Stock Company for 40 years to implement the project of relocating and producing radial tires in this industrial park. However, in 2020, the company’s leadership decided to halt the project and lease the land to other companies.

The two lessees were Casla Joint Stock Company and Casablanca Vietnam Joint Stock Company, leasing 102,538 m2 and 110,000 m2 respectively. The transfer price of the two contracts was more than VND 1.4 million/m2, equivalent to about VND 303 billion – matching the amount SRC recognized.

A rubber company transfers more than 21 hectares of industrial land, earning nearly VND 304 billion

In the first six months, SRC recorded a net profit of VND 117 billion, 11 times higher than the same period last year, exceeding 182% of the annual profit target. Revenue improved by 5% to VND 503 billion, but has only achieved 25% of the full-year target.

The North continues to be the main contributor to the company’s business, with VND 327 billion, accounting for 65% of total revenue. This is followed by exports, reaching VND 82 billion. The Central and Southern regions brought in VND 53 billion and VND 40 billion, respectively.

Source: Vietstock Finance

|

The company’s total assets at the end of the period were approximately VND 1,100 billion, a 15% decrease. Notable changes include a reduction in short-term receivables from Vietnam Commercial and Import-Export Joint Stock Company, a decrease of VND 211 billion, with a remaining debt of VND 45 billion. SRC increased its bets and deposits by VND 92 billion but did not provide specific explanations. After leasing the real estate, the long-term prepaid amount of VND 141 billion no longer exists.

The report also shows that SRC collected VND 300 billion from the liquidation and sale of fixed assets and other long-term assets, but paid VND 63 billion in corporate income tax. The money received was likely prioritized to repay principal debt, with principal repayment more than doubling compared to the same period last year to VND 594 billion.

As a result, long-term debt decreased by VND 130 billion to VND 2.6 billion, after settling the loan from Hoanh Son Group Joint Stock Company – a major shareholder of SRC (holding 50.21% of capital) – for contributing charter capital to Sao Vang – Hoanh Son Company, without interest or collateral. The loan term is adjusted according to SRC’s capital withdrawal roadmap at Sao Vang – Hoanh Son Company. Short-term debt also decreased by half to VND 164 billion.

The company has continuously reduced its workforce over the past 1.5 years. As of the end of June 2024, there were 755 employees, a decrease of 12 people in just six months. The number at the beginning of 2023 was 800 people.

In 2024, SRC aims to produce 5 million bicycle tires, 4.5 million bicycle tubes, 1.5 million motorcycle tires, 5.5 million motorcycle tubes, 216,000 car tires, 210,000 car tubes, and 110,000 car flaps. These plans are 12-40% higher than the previous year’s performance.

The company’s leadership acknowledges the trend of switching from bias to radial car tires as one of the challenges, as SRC has not yet been able to produce this type of product. Additionally, while SRC has successfully manufactured tubeless tires, the lack of diversity in their product range limits their ability to meet market demands. Another obstacle is the absence of a GSO quality certificate, which creates technical barriers and negatively impacts export volume.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.