Services

|

Vietbank’s (UPCoM: VBB) consolidated semi-annual financial report for 2024

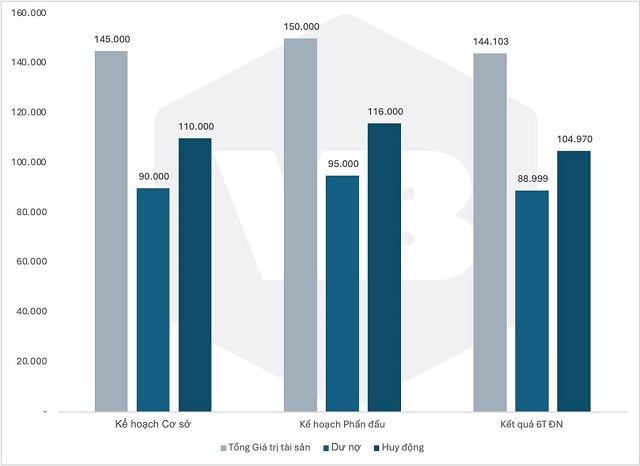

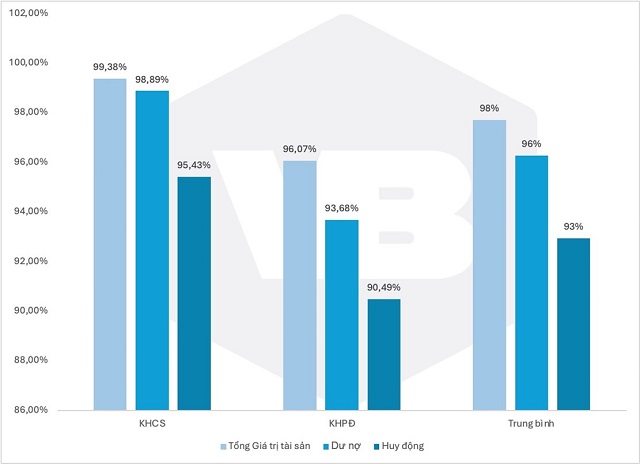

noted impressive progress, with three key targets—fund-raising, total assets, and credit balance growth—achieving over 90% of the ambitious plan, just halfway through the financial year.

Notably, credit balance growth reached 10%, outpacing the industry average of 6% (as of June 28, 2024).

Baseline plan, ambitious plan, and 2024 H1 results (unit: VND billion) |

Completion ratio of targets against baseline plan, ambitious plan, and average completion ratio for the first half of 2024 (unit: %) |

The bank successfully maintained its non-performing loan (NPL) ratio at 2.4%, in line with Circular 11/NHNN’s requirements (<5%).

Additionally, the NPL ratio relative to total credit balance remained stable compared to the beginning of the year.

Effective credit control and quality assurance measures contributed to Vietbank's favorable NPL position.

The bank also benefited from a VND 139.819 billion refund on loan loss provisions.

Operational safety was further assured, with the capital adequacy ratio (CAR) surpassing 11%—well above the State Bank of Vietnam’s requirements and the industry average.

Timely policy adjustments, interest rate management in line with market dynamics, and regulatory compliance propelled Vietbank’s

pre-tax profit to VND 410.541 billion, equivalent to 43% of the annual plan.

The growth rate for the first six months reached 11.3%, with the second quarter making a significant contribution, achieving a 96.5% year-over-year increase.

Elevated operating costs, particularly a 65% surge in personnel expenses, influenced the bank’s profitability.

This increase in staff costs runs counter to the industry trend of downsizing and cost-cutting.

A Vietbank representative affirmed:

“We remain steadfast in our people-centric philosophy. Ensuring competitive compensation and benefits, investing in training, and digitizing HR management are the three pillars of our 2024 HR strategy.”

In the fourth quarter of 2024, the bank plans to implement an electronic “one-stop-shop” HR management system, centralizing various functions,

from executive management and service provision to recruitment through an automated link with the upcoming Vietbank career site (expected to launch in Q3 2024).

This project not only enhances information security but also streamlines processes and reduces manual work, thereby boosting labor productivity.

In terms of training, the Board of Directors has approved investments in a new Training Center (combined with a transaction point) in Ho Chi Minh City.

This timely support and investment from the leadership foster a positive environment for the long-term and sustainable development of the bank’s human resources.

|

The dedication of its staff and the close guidance of its leadership have led to Vietbank’s recognition through multiple awards,

both domestically and internationally, for its innovation, efficient operations, and fast growth.

The bank has also received accolades for its digital transformation projects in core banking and cybersecurity.

To meet and exceed its annual targets, Vietbank must sustain its growth momentum and ensure operational efficiency and safety for the remainder of the financial year.

Given the broader economic and industry context, the bank will need to make timely and appropriate adjustments,

particularly by introducing wide-reaching promotional programs to enhance its appeal and competitiveness across platforms, with a special focus on digital initiatives.

Viglacera Reports First-Ever Loss

Viglacera, the construction equipment giant, reported a net loss of 48 billion VND in Q4/2023, due to declining revenues and high maintenance costs. This marks the first time the company has reported a loss since its inception.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.