On July 29, exactly 24 years since the first trading session of Vietnam’s stock market, the VN-Index reached 1,246 points, an increase of about 80 points compared to the end of last year, but far below the historical peak of 1,500 points set in April 2022.

Has a short-term bottom been formed?

Mr. Nguyen Thanh Lam, Director of Analysis at Maybank Securities, opined that the Vietnamese stock market has certain limitations, such as still being classified as a frontier market while most regional markets have been upgraded to emerging markets. This, to some extent, restricts the evaluation of the Vietnamese market. Market upgrade is one of the urgent priorities at present.

DNSE Securities Joint Stock Company is the newest firm to be listed on the HoSE in 2024. Photo: LAM GIANG

Regarding the current VN-Index, after a downward adjustment from the 1,300-point region causing losses for many investors, the market is recovering but the disappearance of cash flow reflects investors’ caution and distrust. For example, on July 29, the VN-Index rose nearly 5 points to 1,246 points, but the trading value on the HoSE only reached more than VND11,300 billion.

Mr. Ho Sy Hoa, Director of Research and Investment Consulting at DNSE Securities, attributed the weak market liquidity recently mainly to investors’ cautious sentiment after the sharp decline, combined with the season of publishing second-quarter business results of 2024. Investors are observing and awaiting the second-quarter reports to assess enterprises’ prospects and make investment decisions for the second half of the year. “The market is still under pressure from foreign investors’ net selling. Therefore, investors’ cautious sentiment leads to low liquidity,” the expert stated.

As a foreign investor who has participated in Vietnam’s stock market since its early days, Mr. Dominic Scriven, Chairman of Dragon Capital, said that although the market has experienced ups and downs in the past 24 years, it has created a lot of value for Vietnam, Vietnamese enterprises, and foreign investors. “I have talked to many foreign investors, and they see Vietnam as an emerging market with a population of 100 million that is dynamic, proactive, efficient, united, and stable. They want to invest in Vietnam. However, many funds are disappointed when they do not see Vietnam’s name on the list of emerging stock markets. This time, I see a great determination and effort from the Ministry of Finance and the State Securities Commission to soon upgrade the market,” said Mr. Dominic Scriven.

There are always opportunities in the market

Mr. Nguyen Thanh Trung, Director of Investment Consulting at Thanh Cong Securities, analyzed that although the VN-Index has been lingering in the 1,200-point region for many years, looking at the long-term performance over the past 24 years, the market’s annual growth rate of about 11.5-12% is not too low. In fact, this growth rate is close to that of international stock markets that have been operating for hundreds of years, such as the US and the EU.

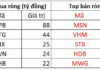

If investors participated in the market in the last 5-10 years, it is true that the performance has not been as good as in many other countries because the market still has many listed companies in the real estate sector, and there are few technology stocks. In contrast, the record-breaking markets in the past years were driven by technology stocks… “Looking at the positive side, liquidity has improved significantly, increasing several times compared to previous years. If previously it fluctuated around VND10,000 billion per session, it has now risen to VND15,000-20,000 billion, and there have even been trading sessions with a value of billions of USD. Foreign investors also have many choices of enterprises on the exchange, including large-cap companies,” Mr. Nguyen Thanh Trung analyzed.

According to experts, whether in the Vietnamese or global markets, there is always a differentiation between groups and industries of stocks, and there are always opportunities at all stages. If investors know how to choose, there are still stocks that grow much higher than the VN-Index, such as REE shares, which have increased nearly 30 times after 24 years of listing.

Dr. Ho Sy Hoa believed that macroeconomic pressures have eased compared to the first six months of the year. Currently, the exchange rate is much lower than at the time of tension in the first half of the year. After enterprises announce their second-quarter financial reports, it is also time for stock groups to accumulate and wait for confirmation of the leading cash flow in the market.

Even in the banking sector, only a few banks have published their financial statements so far, and most of them have achieved good growth, including Techcombank and LPBank, with after-tax profit growth of over 39% and 241%, respectively, compared to the same period last year. “The market expects the remaining banks and the banking industry as a whole to have impressive business results, thereby supporting the VN-Index. The two cash flows of credit and public investment disbursement are really challenging puzzles, but if they are positive in the second half of the year, they will be a driving force for the market,” said Dr. Ho Sy Hoa.

Mr. Nguyen Thanh Lam also stated that solid progress is being made in removing the pre-funding requirement. This is the last barrier to Vietnam’s upgrade to an emerging market. It is expected that the pre-funding requirement will be officially removed in the third quarter of 2024, and FTSE will upgrade Vietnam to an emerging market in September 2025. “We can expect that starting from the end of this year, the upgrade wave may occur and help the VN-Index gain further momentum,” said Mr. Nguyen Thanh Lam.

According to Mr. Nguyen Thanh Trung, foreign investors may reduce net selling from the end of this year and the next two years when the US Federal Reserve (Fed) starts cutting interest rates and the US dollar weakens… At that time, capital flows will return to developing countries, including Vietnam. Moreover, Vietnam is making great efforts to remove obstacles to the market upgrade in 2025, and foreign capital will then return.

A remarkable step forward

The first trading session of the stock market on July 28, 2000, with the first two stock codes REE and SAM, marked a new phase in the development of the securities industry and the economy. Up to now, the market has more than 700 listed stocks and fund certificates on the two exchanges HoSE and HNX, along with more than 800 stocks registered for trading on UPCoM. The total market capitalization of enterprises on the three exchanges is about VND6.9 quadrillion, equivalent to 67% of GDP in 2023, including dozens of billion-USD valued companies.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.