**VIP’s Q2 2024 Financial Results: A Comprehensive Overview**

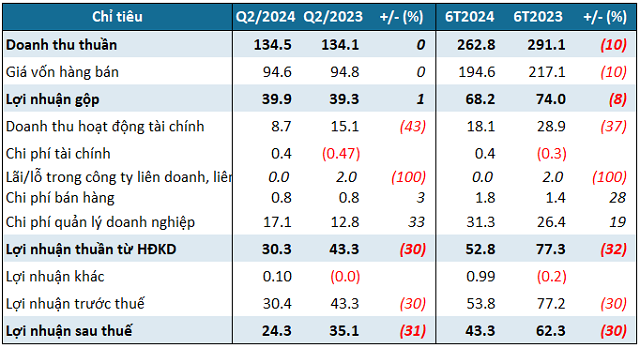

In Q2 2024, VIP reported steady revenue of over 134 billion VND, maintaining its performance from the previous year. The company attributed this stability to its consistent fleet operations in the liner trade, with favorable freight rates and vessel days.

A notable development was the decline in profit from financial activities, halving to just over 8 billion VND. VIP explained that this decrease was due to lower interest rates on bank deposits compared to the same period last year.

Additionally, the company incurred higher administrative expenses, totaling more than 17 billion VND, a significant 33% increase. This rise in expenses further pressured their profit margins.

Consequently, VIP’s net profit for the quarter stood at over 24 billion VND, reflecting a 31% decrease year-on-year. This trend continued for the first half of 2024, with net profit reaching just over 43 billion VND, a 30% decline compared to the previous year.

In comparison to their 2024 target of achieving a net profit of over 75 billion VND, VIP has accomplished 58% of their goal by the end of the first half. It is important to note that VIP’s 2024 profit plan already accounted for a 14% decrease from their 2023 performance, where they nearly reached 87 billion VND.

|

VIP’s Financial Performance for Q2 and the First Half of 2024

Unit: Billion VND

Source: VietstockFinance

|

As of June 30, 2024, VIP’s total assets amounted to over 1,357 billion VND, a 5% decrease from the beginning of the year. This included 670 billion VND in short-term financial investments, entirely comprised of fixed-term bank deposits. The value of these deposits has decreased by 4% compared to the start of the year.

Regarding their capital structure, VIP’s payables decreased by 18% from the beginning of the year, totaling nearly 126 billion VND. This accounts for approximately 9% of their total capital sources. Overall, the company maintains a healthy financial position with minimal long-term debt.

Huy Khai

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.