Mobile World Investment Corporation (MWG) has released its Q2 2024 financial report. Notably, Bach Hoa Xanh Joint Stock Commercial Company (BHX) recorded a profit of nearly VND 7 billion in Q2 2024. This is the first time that this supermarket chain has turned a profit since its inception.

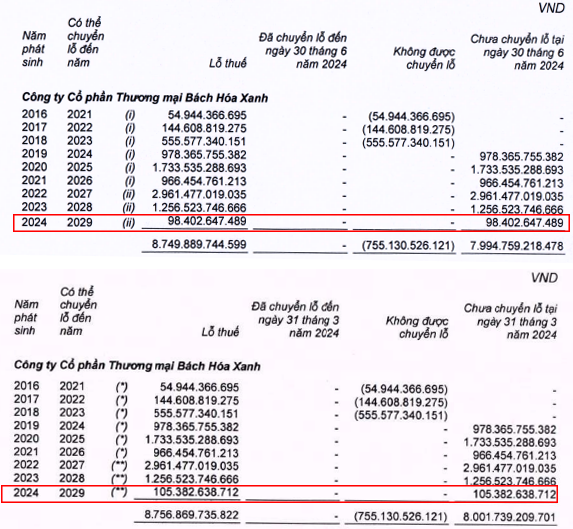

Previously, in Q1 2024, Bach Hoa Xanh had reported a loss of VND 105 billion. This quarter’s profit, bringing money back to the parent company, is what MWG’s shareholders have long awaited.

However, cumulatively, from 2016 until now, Bach Hoa Xanh has incurred a loss of nearly VND 8,750 billion, with a loss of over VND 98 billion in 2024.

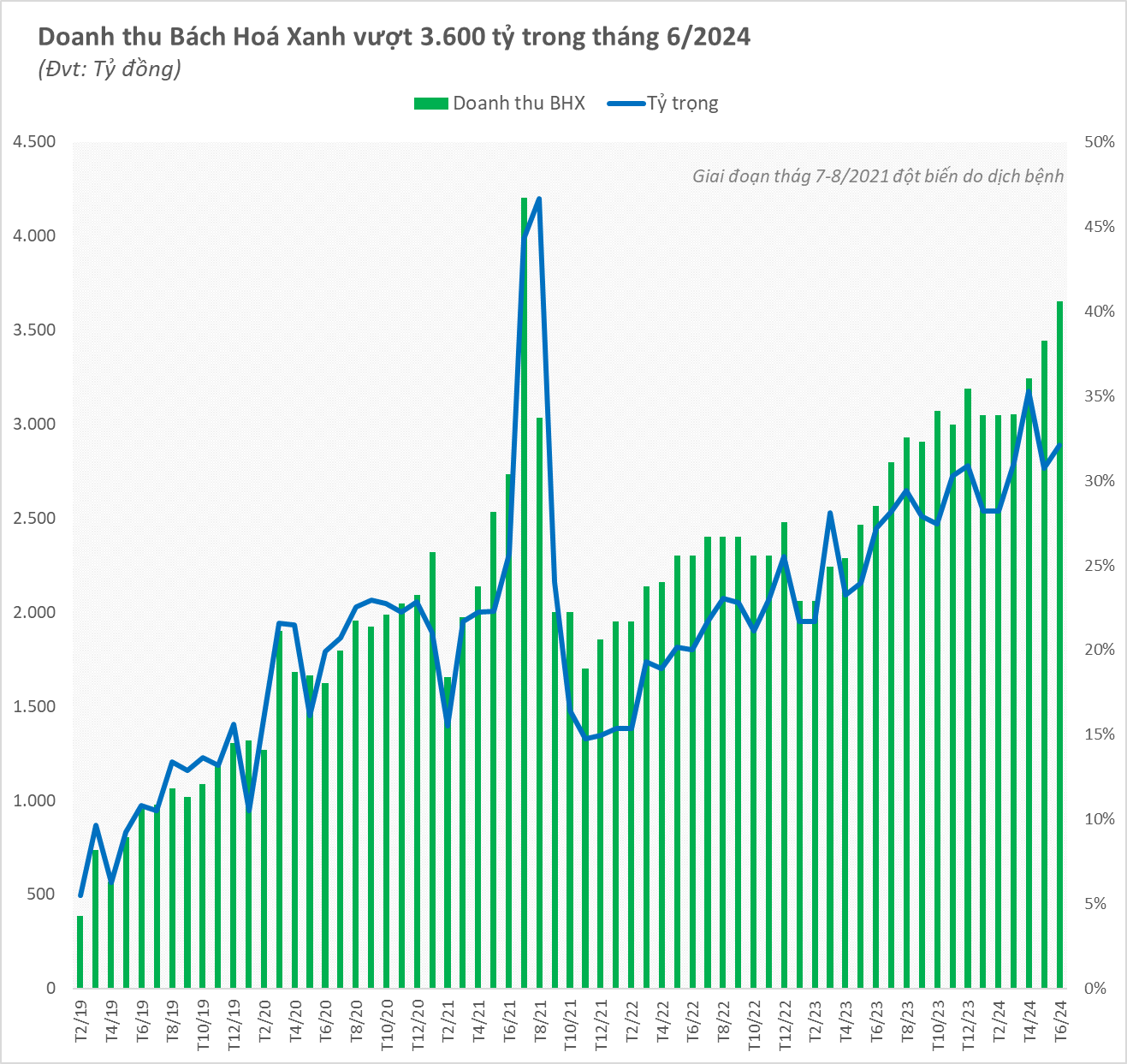

In reality, Bach Hoa Xanh’s “sweet success” has been highly anticipated by investors, given its consistently impressive business performance. In the first half of 2024, the company achieved a revenue of VND 19,400 billion, a 42% increase compared to the same period last year, contributing to 29.7% of MWG’s total revenue—the highest proportion ever.

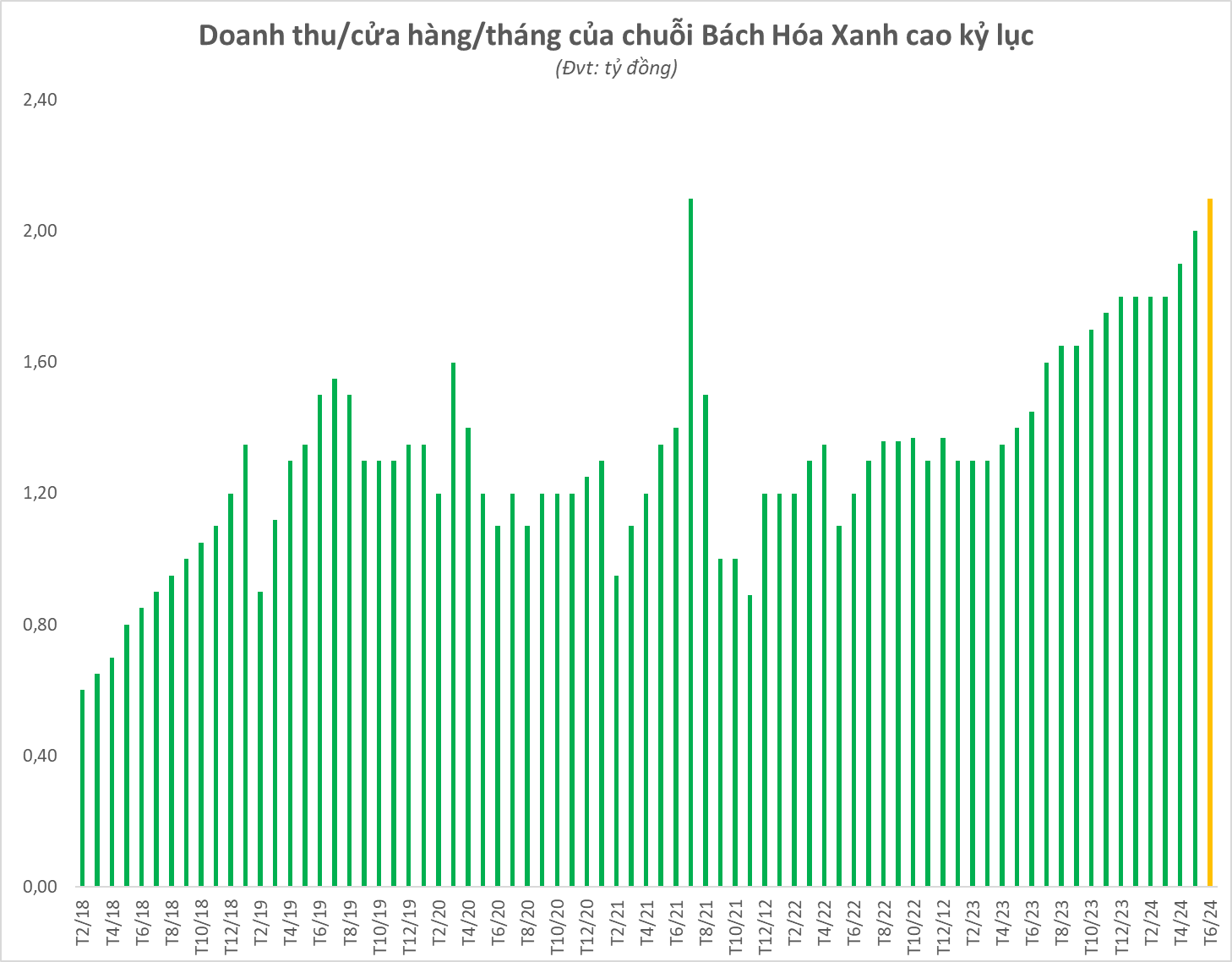

On a monthly basis, revenue for this quarter was higher than the previous one, with June 2023 surpassing VND 3,650 billion. Notably, Bach Hoa Xanh’s average revenue per store hit a record high of VND 2.1 billion per store per month—the highest ever, except for July 2021, which was affected by the Covid pandemic, leading to a sudden spike in revenue to this level.

Bach Hoa Xanh, chaired by Mr. Nguyen Duc Tai, is expected to be the main driver of MWG’s growth in the next five years. In April 2024, Bach Hoa Xanh Investment and Technology Joint Stock Company (BHX Investment)—a subsidiary of MWG—completed a private placement of shares to CDH Investments (through Green Bee 2 Private Limited).

The offered share ratio was 5% of the total issued shares of BHX Investment. Based on the transaction value, BHX Investment is valued at approximately VND 35,500 billion (~USD 1.4 billion).

Mr. Tai, Chairman of MWG, also stated that Bach Hoa Xanh would grow to a significant scale and be listed on the stock exchange as committed to the new investor and expected by shareholders.

“When we reach a large enough scale, the figure of trillions of profits will emerge, and that is when Bach Hoa Xanh will be ready to go public,” emphasized Mr. Tai.

Previously, when asked about the projected profit of the supermarket chain in the future, Mr. Pham Van Trong, CEO of Bach Hoa Xanh, confidently shared that he believed that a four-digit profit (thousands of billions) would be achievable within the next one to two years.

In a recent report, DSC Securities stated that repositioning the BHX chain as a “mini-supermarket” is a turning point, creating favorable conditions for MWG to grow by catering to the habits of Vietnamese consumers who prefer lower purchase values (around $4-5) but with a high purchase frequency, mainly on motorcycles. Additionally, rental costs are much lower compared to large supermarket models, and the minimart format can already meet over 70% of essential product needs. Moreover, the minimart model currently accounts for only about 50% of the consumer market, leaving significant room for expansion.

As MWG restructures its business lines and focuses on Bach Hoa Xanh, DSC believes that this chain will gradually increase its revenue contribution and become the main growth driver for the company in the future. More optimistically, DSC expects that by diversifying its product portfolio, Bach Hoa Xanh can achieve new revenue milestones per store this year.

Regarding the parent company, Mobile World Group (MWG), in the first half of the year, the company recorded net revenue of VND 65,621 billion and net profit after tax of VND 2,075 billion, an increase of 16% and 5,200%, respectively, compared to the first half of 2023. With these results, the company has achieved 52.5% of its revenue plan and 86.5% of its profit target for the year.