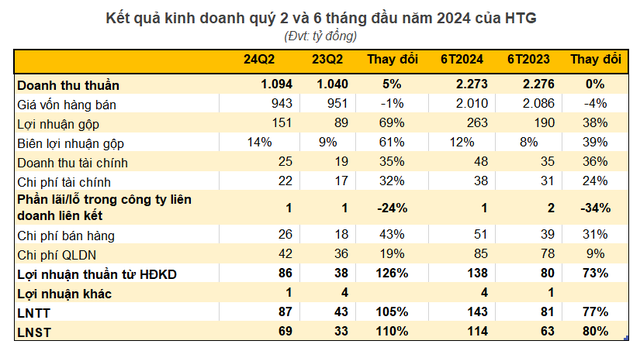

According to the recently published Q2 2024 financial statements, Hoa Tho Garment Joint Stock Company (code: HTG) recorded a 5% year-on-year increase in net revenue, reaching VND 1,094 billion. A slight 1% decrease in cost of goods sold improved the gross profit margin from 9% in Q2 2023 to 14%. As a result, gross profit surged by 69% year-on-year to VND 151 billion.

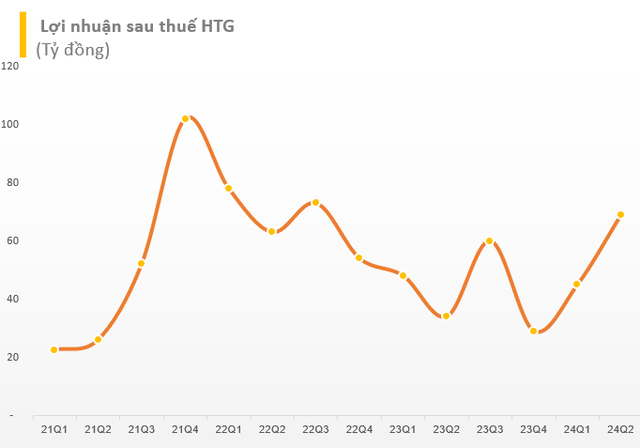

Additionally, financial income and expenses were recorded at VND 25 billion and VND 22 billion, respectively, representing a 35% and 32% increase compared to the same period last year. After deducting other expenses, Hoa Tho Garment reported a post-tax profit of VND 69 billion, a remarkable 110% increase from the previous year, marking the highest profit in the past seven quarters.

For the first six months of the year, net revenue remained relatively unchanged at VND 2,273 billion. Post-tax profit increased significantly by 80% year-on-year to nearly VND 114 billion. The after-tax profit attributable to the parent company’s shareholders exceeded VND 115 billion, a substantial improvement from the VND 75 billion profit recorded in the same period last year.

At the 2024 Annual General Meeting of Shareholders, HTG approved a revenue target of VND 4,500 billion and a pre-tax profit target of VND 220 billion. With the aforementioned results, the company has achieved 51% of its revenue target and 65% of its pre-tax profit target.

According to the company’s explanation, since the beginning of Q2 2024, the textile industry has witnessed positive changes and started to grow. The demand and selling prices in the fiber industry have improved compared to the previous year. Additionally, increased engagement in short-term financial investments during the period also contributed to enhanced financial performance compared to the same period last year.

Furthermore, the company adjusted the Separate and Consolidated Financial Statements for 2022, increasing the 2022 after-tax profit as per the requirements of Official Letter 04/KTNN-TH dated January 25, 2024, and the Notification of Audit Results by the State Audit Office of Vietnam. This adjustment resulted in a decrease in the after-tax profit for Q2 2023.

Following the disclosure of this positive financial performance, HTG shares on the stock exchange received an immediate positive reaction. At the close of the trading session on July 26, the share price surged by nearly 3% to VND 44,100 per share, reaching a new all-time high. Since mid-April, the stock has climbed steadily by 46% without any significant corrections. As a result, the market capitalization has reached nearly VND 1,600 billion.

HTG Share Price Movement

Hoa Tho Garment, established in 1962 and headquartered in Da Nang, is a member of the Vietnam National Textile and Garment Group (Vinatex), which currently holds 61.87% of its capital. With a long history and large-scale operations, Hoa Tho Garment specializes in two main fields: manufacturing, trading, and exporting various garment products and fibers; and importing essential materials, equipment, and machinery for spinning and garment production.

The company boasts a total factory area of 20.5 hectares and employs 10,000 people. They produce for renowned brands such as Snickers, Burton, Novadry, Haggar, Perry Ellis Portfolio, and Calvin Klein. Their product portfolio includes suits, workwear, jackets, trousers, and fiber products.