Many banks in Vietnam are now offering attractive interest rates for large deposits, with some banks even providing tiered interest rate structures. Among these banks are SeABank, VIB, ACB, Techcombank, and VPBank.

SeABank offers the highest interest rate of 6.2% per annum

SeABank currently offers the highest interest rate in the market, at 6.2% per annum for deposits of 10 billion VND or more with a tenure of 15 to 36 months. The bank provides a tiered interest rate structure for deposits made at the counter, with five different tiers based on the amount deposited, ranging from 100 million VND to over 10 billion VND.

For deposits between 100 million VND and under 500 million VND, the interest rates for tenures of 1 to 2 months are set at 3.2% per annum, gradually increasing to 4.57% per annum for 10 months, 4.6% per annum for 11 months, and 5.52% per annum for 12 months. The interest rate then decreases to 5.45% per annum for 13 months.

Notably, SeABank offers an interest rate of 6% per annum for tenures ranging from 15 to 36 months, which is higher than most other banks in the market.

| SEABANK COUNTER DEPOSIT INTEREST RATE CHART AS OF JULY 27, 2024 (% PER ANNUM) | |||||

| Tenure | 100 MILLION TO LESS THAN 500 MILLION | 500 MILLION TO LESS THAN 1 BILLION | 1 BILLION TO LESS THAN 5 BILLION | 5 BILLION TO LESS THAN 10 BILLION | 10 BILLION AND ABOVE |

| 1 MONTH | 3.2% | 3.2% | 3.2% | 3.2% | 3.2% |

| 3 MONTHS | 3.7% | 3.7% | 3.7% | 3.7% | 3.7% |

| 6 MONTHS | 4.4% | 4.45% | 4.5% | 4.55% | 4.6% |

| 9 MONTHS | 4.54% | 4.59% | 4.64% | 4.69% | 4.74% |

| 12 MONTHS | 5.25% | 5.3% | 5.35% | 5.4% | 5.45% |

| 15 MONTHS | 6% | 6.05% | 6.1% | 6.15% | 6.2% |

| 18 MONTHS | 6% | 6.05% | 6.1% | 6.15% | 6.2% |

| 24 MONTHS | 6% | 6.05% | 6.1% | 6.15% | 6.2% |

| 36 MONTHS | 6% | 6.05% | 6.1% | 6.15% | 6.2% |

For deposits below 100 million VND, SeABank offers the same interest rates as for online deposits, with the highest rate being 5.7% per annum for tenures of 18 to 36 months.

VPBank offers an interest rate of up to 5.8% per annum

VPBank provides interest rates based on three tiers of deposit amounts: below 10 billion VND, from 10 billion VND to less than 50 billion VND, and 50 billion VND and above. The interest rates for the latter two tiers are 0.1% and 0.2% per annum higher than the first tier, respectively, except for tenures of 12 to 36 months, where the difference is only 0.1% per annum.

Currently, the highest interest rate offered by VPBank is 5.7% per annum for online deposits of 10 billion VND or more with a tenure of 24 to 36 months. Additionally, VPBank offers a bonus interest rate of 0.1% per annum for customers with a minimum balance of 100 million VND and a tenure of at least one month.

Therefore, the highest effective interest rate offered by VPBank is 5.8% per annum for tenures of 24 to 36 months, including the bonus interest.

VPBank’s online deposit interest rate as of July 27. (Screenshot) |

Techcombank offers an interest rate of up to 5.55% per annum

Techcombank defines three tiers of deposit amounts: below 1 billion VND, from 1 billion VND to less than 3 billion VND, and 3 billion VND and above. According to the bank’s online deposit interest rate chart for new savings accounts below 1 billion VND, the interest rates for tenures of 1 to 2 months are 2.85% per annum, 3 to 5 months are 3.25% per annum, 6 to 11 months are 4.25% per annum, and 12 to 36 months are 4.95% per annum.

The interest rates for the other two tiers are slightly higher, ranging from 0.05% to 0.2% per annum more than the first tier. As a result, the highest interest rate offered by Techcombank is 5.05% per annum for deposits of 3 billion VND or more with a tenure of 12 to 36 months.

Additionally, Techcombank offers a bonus interest rate of 0.5% per annum for individual customers whose savings and/or term deposit balances increase by at least 50 million VND or more in a month. This bonus interest rate is applicable for tenures of 3, 6, and 12 months, bringing the highest effective interest rate to 5.55% per annum for a 12-month tenure.

| TECHCOMBANK ONLINE DEPOSIT INTEREST RATE CHART AS OF JULY 27, 2024 (% PER ANNUM) | |||

| Tenure | LESS THAN 1 BILLION | 1 BILLION TO LESS THAN 3 BILLION | 3 BILLION AND ABOVE |

| 1 MONTH | 2.85% | 2.95% | 3.05% |

| 3 MONTHS | 2.85% | 3.35% | 3.45% |

| 6 MONTHS | 4.25% | 4.3% | 4.35% |

| 9 MONTHS | 4.25% | 4.3% | 4.35% |

| 12 MONTHS | 4.95% | 5% | 5.05% |

| 18 MONTHS | 4.95% | 5% | 5.05% |

| 24 MONTHS | 4.95% | 5% | 5.05% |

| 36 MONTHS | 4.95% | 5% | 5.05% |

VIB offers an interest rate of up to 5.2% per annum

VIB recently increased its interest rates by 0.1% per annum for tenures of 2 to 8 months and 24 to 36 months, effective July 26. The bank provides a tiered interest rate structure based on three deposit amount thresholds: below 300 million VND, from 300 million VND to less than 3 billion VND, and 3 billion VND and above.

For online deposits below 200 million VND, the interest rates for tenures of 1 month, 2 months, 3 to 5 months, 6 to 11 months, and 15 to 18 months are 3.1% per annum, 3.2% per annum, 3.4% per annum, 4.4% per annum, and 4.9% per annum, respectively. The highest interest rate offered for this tier is 5.2% per annum for tenures of 24 to 36 months.

For deposits between 300 million VND and less than 3 billion VND, VIB adds a bonus interest rate of 0.1% per annum for tenures of 1 to 11 months. Similarly, for deposits of 3 billion VND and above, the bank offers a bonus interest rate of 0.2% per annum for the same tenures. However, for tenures of 15 to 36 months, VIB applies a uniform interest rate for all deposit amounts, with the highest rate remaining at 5.2% per annum.

| VIB ONLINE DEPOSIT INTEREST RATE CHART AS OF JULY 27, 2024 (% PER ANNUM) | |||

| Tenure | LESS THAN 300 MILLION | 300 MILLION TO LESS THAN 3 BILLION | 3 BILLION AND ABOVE |

| 1 MONTH | 3.1% | 3.2% | 3.3% |

| 3 MONTHS | 3.4% | 3.5% | 3.6% |

| 6 MONTHS | 4.4% | 4.5% | 4.6% |

| 9 MONTHS | 4.4% | 4.5% | 4.6% |

| 15 MONTHS | 4.9% | 4.9% | 4.9% |

| 18 MONTHS | 4.9% | 4.9% | 4.9% |

| 24 MONTHS | 5.2% | 5.2% | 5.2% |

| 36 MONTHS | 5.2% | 5.2% | 5.2% |

ACB offers an interest rate of up to 5.1% per annum

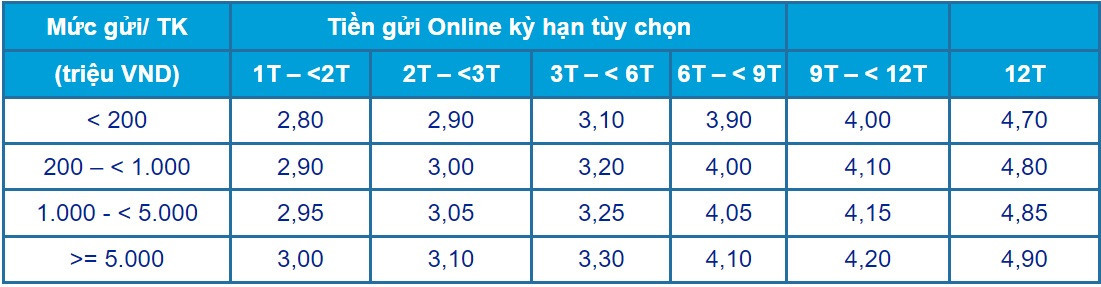

ACB categorizes its deposit interest rates into four tiers based on the amount deposited: below 200 million VND, from 200 million VND to less than 1 billion VND, from 1 billion VND to less than 5 billion VND, and 5 billion VND and above. Compared to the online deposit interest rates for accounts below 200 million VND, the interest rates for the other three tiers are 0.1% to 0.2% per annum higher.

For customers with a deposit balance of 5 billion VND or more, the online deposit interest rates for tenures of 1 month, 2 months, 3 months, 6 months, 9 months, and 12 months are 3% per annum, 3.1% per annum, 3.3% per annum, 4.1% per annum, 4.2% per annum, and 4.9% per annum, respectively. However, ACB is currently among the banks offering the lowest deposit interest rates, even with its bonus interest rate policy.

ACB offers bonus interest rates based on a tiered structure, with 0.1% per annum for accounts between 200 million VND and less than 1 billion VND, 0.15% per annum for accounts between 1 billion VND and less than 5 billion VND, and 0.2% per annum for accounts of 5 billion VND and above. As a result, the highest effective interest rate offered by ACB is 5.1% per annum for customers with deposits of 5 billion VND or more for long tenures.

ACB’s online deposit interest rate as of July 27. (Screenshot) |

For customers with a deposit balance of 200 billion VND or more, ACB offers a “special” interest rate

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.

Banks Sacrificing Profits to Support the Economy

In 2023, the question “which bank has the lowest interest rates?” is being talked about more than ever. With the prevailing difficult economic situation affecting individuals and businesses, in line with the directive of the State Bank of Vietnam (SBV), banks have unanimously sacrificed their profits by reducing lending rates and introducing credit packages with interest rates as low as 0%.