Hodeco’s consolidated revenue in Q2 mainly increased thanks to the Ngoc Tuyet 2 project, which offered high-profit margins. However, the business performance remains lackluster due to the challenging real estate market conditions, impacting the company’s sales.

|

The Ngoc Tuyet 2 villa project spans 14.3 hectares and comprises 165 villas and garden houses with areas ranging from 300 to 700 square meters, along with 40 linked houses. Regarding this project, Mr. Le Viet Lien, CEO of HDC, mentioned that they would finalize the 1/500 planning adjustments and decisively handle land encroachment cases. Mr. Lien considers this project quite unique and highly demanded.

|

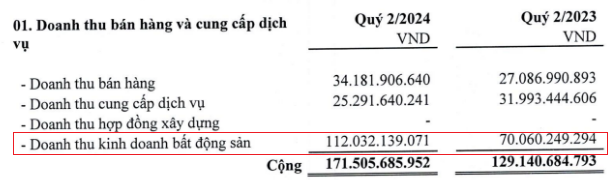

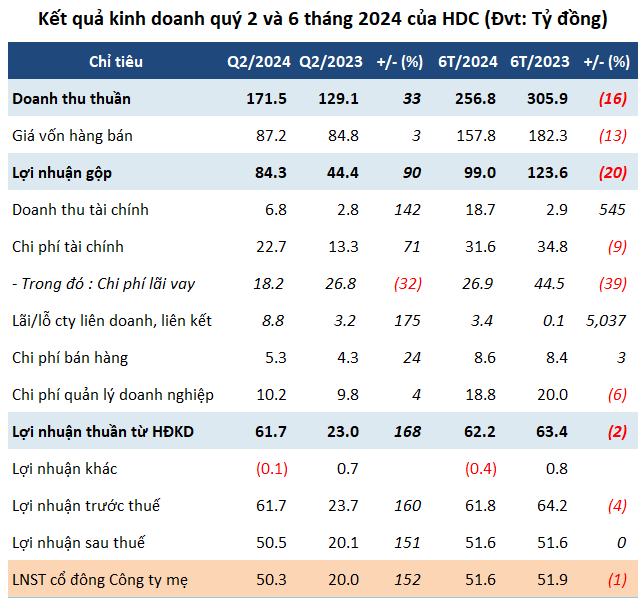

Specifically, HDC’s Q2 revenue increased by 33% year-on-year to nearly VND 172 billion, with real estate business revenue accounting for over VND 112 billion, a 60% surge.

Source: HDC

|

Another notable highlight is the low cost of goods sold, resulting in a gross profit of over VND 84 billion, a 90% increase. Consequently, the gross profit margin improved from 34% to 49%.

Additionally, financial revenue doubled to nearly VND 7 billion, a 2.4-fold increase year-on-year, attributed to a 75% rise in dividends and profit sharing. Despite a 40% increase in total expenses, amounting to VND 38 billion, it was relatively insignificant.

Benefiting from various favorable factors, Hodeco’s net profit exceeded VND 50 billion, a 2.5-fold increase compared to the same period last year, marking the highest profit among the last six quarters (since Q1/2023).

However, as the first quarter only yielded a profit of over VND 1 billion, the cumulative profit for the first six months of HDC stood at nearly VND 52 billion, a slight 1% decrease year-on-year. In relation to the 2024 plan, which targets VND 1,600 billion in revenue and VND 424 billion in post-tax profit, the real estate enterprise based in Vung Tau has accomplished 17% and 12% of these goals, respectively.

Source: VietstockFinance

|

Cash holdings witnessed a remarkable surge, increasing more than 24-fold from the beginning of the year.

As of the end of Q2, Hodeco’s total assets increased by 9% from the beginning of the year to VND 5,103 billion. Notably, cash holdings soared to VND 315 billion, more than 24.4 times higher than at the start of the year, with the majority deposited in banks. Short-term receivables rose by 2% to over VND 949 billion, of which receivables from real estate customers amounted to nearly VND 556 billion.

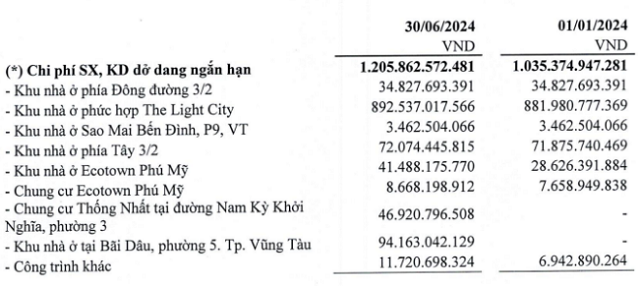

Inventories stood at nearly VND 1,303 billion, a 15% increase, mainly comprising production and business costs in progress, totaling VND 1,206 billion.

Source: HDC

|

Hodeco’s total liabilities exceeded VND 2,846 billion, a 2% increase from the beginning of the year. Financial borrowings accounted for 63% of total liabilities, amounting to over VND 1,802 billion, a 6% rise from the start of the year.

Thanh Tu

Vinamilk: Impressive nearly 20% growth in Q4/2023 export revenue

Vinamilk has announced its financial report for Q4 2023, recording a consolidated total revenue and after-tax profit of VND 15,630 billion and VND 2,351 billion, respectively. This represents an increase of 3.6% and 25.8% compared to the same period last year. For the full year, the consolidated total revenue and after-tax profit reached VND 60,479 billion and VND 9,019 billion, completing 95% of the revenue target and 105% of the profit target.