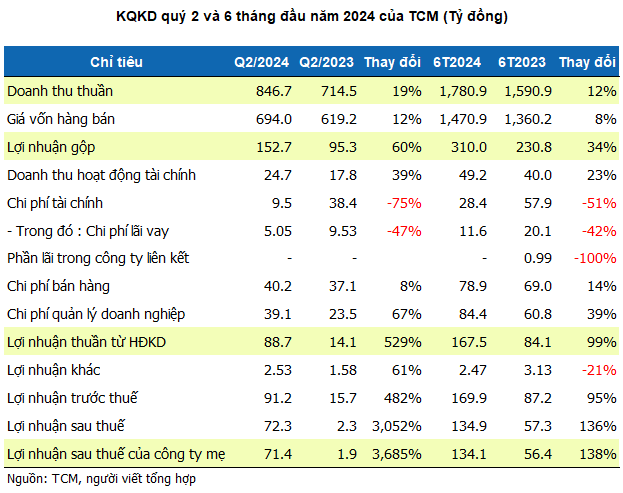

Thanh Cong Textile Garment Investment Trading Joint Stock Company (HOSE: TCM) has just announced its Q2 2024 results, with net revenue reaching nearly VND 847 billion, a 19% increase compared to the same period last year. The slower rise in cost of goods sold compared to revenue led to an improved gross profit margin, climbing from 13.3% in the previous year to 18%. Gross profit surged by 60% to nearly VND 153 billion.

During this period, financial activities also picked up, bringing in nearly VND 25 billion, a 39% increase from the previous year. This improvement was largely due to realized foreign exchange gains. As of the end of Q2, the Company had over VND 857 billion in bank deposits, a VND 109 billion increase from the beginning of the year.

Meanwhile, financial expenses were 75% lower than the previous year, offsetting the growth in selling and management expenses, and contributing to a significant improvement in overall profitability. As a result, the Company’s net profit reached VND 71.4 billion, a remarkable 3,685% increase compared to the same period last year, and the highest in nearly two years.

It is worth noting that the sharp rise in Q2 profit was influenced by a low comparative base in the previous year, when TCM posted a profit of less than VND 2 billion, the lowest since Q4 2021.

| TCM’s Net Profit by Quarter for 2021-2024 |

For the first six months of the year, TCM‘s net revenue was nearly VND 1,781 billion, and net profit exceeded VND 134 billion, representing a 12% and 138% increase, respectively, compared to the same period last year. The Company has achieved 48% of its annual revenue target and 83% of its profit goal.

As of June 30, 2024, TCM‘s total assets stood at over VND 3,962 billion, a VND 413 billion (or 13%) increase from the beginning of the year. Correspondingly, its total liabilities were nearly VND 1,564 billion, a rise of VND 295 billion from the start of the year, with total borrowings (mainly short-term bank loans) amounting to nearly VND 694 billion.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.