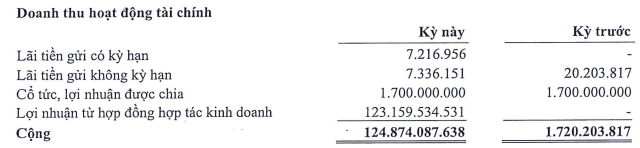

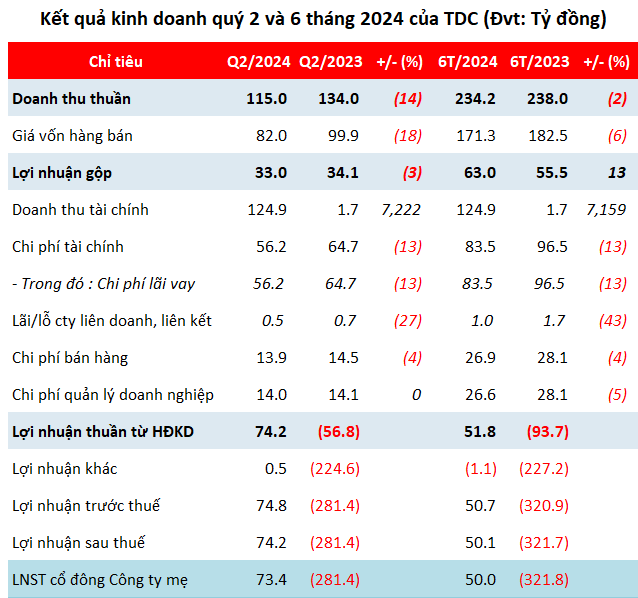

While Q2 net revenue decreased by 14% year-on-year to 115 billion VND, financial income surged to nearly 125 billion VND, a remarkable 73-fold increase compared to the same period last year. The significant spike in financial income was primarily driven by a substantial profit from a joint business venture, amounting to over 123 billion VND.

Source: TDC

|

On the other hand, total expenses amounted to 84 billion VND, a 10% decrease year-on-year. Among these expenses, interest expenses accounted for more than 56 billion VND, reflecting a 13% reduction.

These factors contributed to TDC’s return to profitability after six consecutive quarters of losses (since Q4 2022), with a net profit of over 73 billion VND (compared to a loss of over 281 billion VND in the same period last year).

However, with a loss of more than 23 billion VND in the first quarter, TDC’s net profit for the first six months stood at 50 billion VND (compared to a loss of nearly 322 billion VND in the same period last year). In relation to the 2024 plan, which aims for a total revenue of 2,441 billion VND and a net profit of nearly 408 billion VND, TDC has accomplished 15% and 12% of these targets, respectively.

Source: VietstockFinance

|

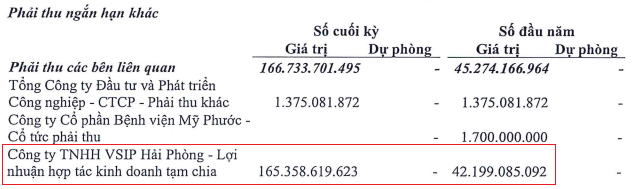

The positive Q2 results have had a slight impact on TDC’s total assets as of June 30, 2024, which increased by 1% from the beginning of the year to over 3,661 billion VND. Short-term receivables amounted to nearly 399 billion VND, a 22% increase, with a notable receivable being the temporarily divided joint business venture profit of over 165 billion VND from VSIP Hai Phong JSC.

Source: TDC

|

|

TDC has entered into a joint business venture with VSIP Hai Phong JSC to invest in the Bac Song Cam Townhouse Project in Thuy Nguyen District, Hai Phong City. The capital contribution and profit-sharing ratio is 50:50, with a total investment of nearly 1,700 billion VND. The project is expected to be completed by the end of 2026. |

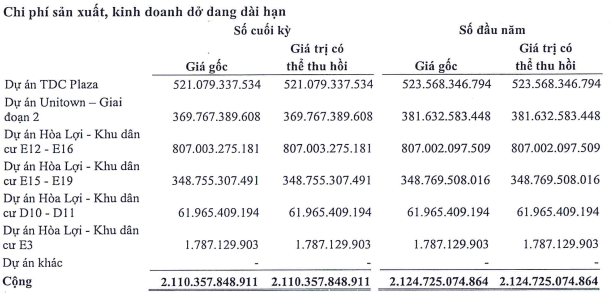

Inventories stood at nearly 407 billion VND, a 2% increase from the beginning of the year, while work-in-progress expenses decreased by 1% to over 2,110 billion VND.

Source: TDC

|

TDC has nearly 2,822 billion VND in payables, of which financial debt accounts for 1,550 billion VND, a 2% decrease from the beginning of the year and representing 55% of total debt. The Q2 profit also helped TDC reduce its accumulated loss to nearly 318 billion VND (compared to 367 billion VND at the beginning of the year).

TDC appoints new Chairman and CEO in one day

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.