Main Conspirator Role

After 5 days of questioning, on July 26, the Hanoi People’s Procuracy gave their views on sentencing, requesting that the court sentence the defendant, Trinh Van Quyet, former Chairman of FLC Group, to 19-20 years in prison for “Fraudulent Appropriation of Property” and 5-6 years for “Stock Market Manipulation.” The total sentence requested is 25-26 years in prison.

The prosecution argued that the stock market is an individual investment channel and a place for businesses to raise capital, protected by the state during its operation. However, Trinh Van Quyet and the other defendants, with their financial expertise, conspired to list stocks on the Ho Chi Minh City Stock Exchange (HOSE) in violation of regulations.

Quyet’s actions, according to the prosecution, endangered society and infringed on the state-managed economic activities, negatively impacting public opinion.

In this case, the prosecution assessed that Quyet played the role of the main conspirator, directing the purchase of Faros Company and orchestrating all activities related to inflating the company’s capital, buying and selling stocks, and setting up securities accounts to transact and appropriate funds from investors. Therefore, the maximum penalty should be applied.

For the same charges as Quyet, the prosecution proposed sentences for the following defendants: Trinh Thi Minh Hue, an official from the FLC Group’s accounting department, 17-19 years; Trinh Thi Thuy Nga, Vice President of BOS Securities Company, 10-12 years; and Huong Tran Kieu Dung, Permanent Vice Chairman of FLC Group’s Board of Directors, 11-13 years.

This group was assessed as accomplices to Quyet. Notably, Trinh Thi Minh Hue was the most active perpetrator, creating documents to inflate the company’s charter capital, borrowing personal identification documents to open securities accounts, and receiving instructions for placing buy and sell orders for stocks.

For the group of defendants from the Ho Chi Minh City Stock Exchange (HOSE), the prosecution proposed a sentence of 8-9 years for Tran Dac Sinh, former Chairman of HOSE; 6-7 years for Le Hai Tra, former member of the Board of Directors, Permanent Vice President, and independent member of the HOSE Listing Council; 6-7 years for Tram Tuan Vu, former Vice President and Vice Chairman of the HOSE Listing Council; and 3-4 years for Le Thi Tuyet Hang, Director of the Management and Listing Evaluation Department and member of the HOSE Listing Council, all for “Abuse of Position and Power while Performing Official Duties.”

For the group of defendants from the State Securities Commission, including Le Cong Dien, former head of the Public Company Supervision Department, a sentence of 36-42 months was proposed; Duong Van Thanh, former General Director of the Vietnam Securities Depository Center, 24-30 months; and Pham Trung Minh, former head of the Securities Registration Department under the Vietnam Securities Depository Center, 18-24 months, all for “Providing False Information or Concealing Information in Securities Activities.”

The remaining 39 defendants were proposed sentences ranging from 18 months to over 10 years in prison for one or both of the charges of “Stock Market Manipulation” and “Fraudulent Appropriation of Property.” Some defendants were charged with both offenses.

Trinh Van Quyet (in white, front row) and his accomplices in court.

Continued Asset Freeze

Regarding civil matters, the prosecution requested the continued freeze and seizure of some of Trinh Van Quyet’s assets to ensure the enforcement of the sentence.

Based on the case file and the court debate, the prosecution determined that Quyet established and chaired the FLC Group’s Board of Directors from 2009 to 2020. By 2020, the FLC ecosystem had 15 subsidiaries, 2 associated companies, and 5 listed stock codes on the stock exchange.

During the company’s operation, Quyet instructed his subordinates to inflate the capital contribution of Faros Company (stock code ROS) from VND 1.5 billion to VND 4,300 billion and list it on the stock exchange.

According to the prosecution, following Quyet’s instructions, the defendant Doan Van Phuong, former General Director of FLC (currently at large), and the defendant Trinh Thi Minh Hue asked several individuals to act as shareholders to receive the transferred capital contribution of Faros. The company’s leadership then recorded this “false” information in the audited financial statements and the white paper to complete the listing dossier for ROS shares. The group from the State Securities Commission, the Securities Depository Center, and the HOSE officials used this information to approve the listing of 430 million ROS shares.

Specifically, HOSE leaders Tran Dac Sinh, Le Hai Tra, Tram Tuan Vu, and Le Thi Tuyet Hang, aware of the lack of basis for determining Faros’ actual capital, agreed to “expedite” the listing process due to Sinh’s relationship with Quyet.

The defendants from the State Securities Commission—Le Cong Dien, Duong Van Thanh, and Pham Trung Minh—despite knowing that Faros’ capital was not yet confirmed to be VND 4,300 billion, still approved the registration of ROS shares.

The collusion among the defendants misled stock investors into believing that ROS shares had real value. As a result, Quyet sold 391 million shares to over 30,400 investors, appropriating VND 3,620 billion.

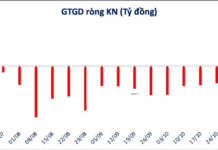

Regarding the charge of “Stock Market Manipulation,” the prosecution alleged that the former FLC Chairman instructed Trinh Thi Minh Hue to borrow documents from 45 other individuals to set up 20 businesses and open 500 securities accounts to profit from the 5 stock codes—AMD, HAI, GAB, FLC, and ART—listed under the FLC ecosystem.