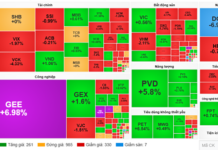

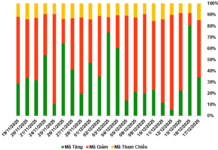

The Vietnamese stock market witnessed a positive trading session on the last trading day of the week, with the VN-Index climbing 8.92 points (+0.72%) to close at 1,242.11. Despite improved liquidity on the HoSE compared to the previous session, trading value remained low, with only VND10.1 trillion in matched orders.

As the broader market rebounded, foreign trading also turned positive, with net buying of nearly VND366 billion across all three exchanges.

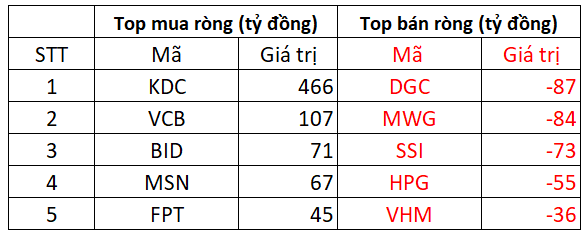

On the HoSE, foreign investors net bought VND379 billion

In the buying column, shares of KDC of Kido Group were the highlight, with a sudden net buying value of VND466 billion. This was followed by VCB, which saw net buying of VND107 billion. BID, MSN, and FPT were also net purchased in the range of VND45-71 billion.

On the other hand, DGC and MWG faced the strongest selling pressure from foreign investors, with a value of over VND80 billion. SSI, HPG, and VHM also witnessed net selling of a few tens of billions of dong.

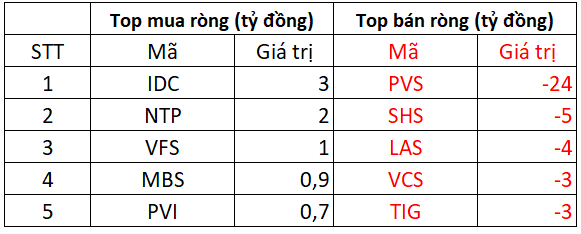

On the HNX, foreign investors net sold VND35 billion

IDC witnessed the strongest net buying on this exchange, with a value of VND3 billion. Additionally, foreign investors also net bought a few billion dong worth of NTP, VFS, and MBS shares.

On the selling side, PS faced the highest net selling pressure from foreign investors, with a value of nearly VND24 billion. This was followed by SHS, LAS, VCS, and TIG, which were net sold in the range of a few billion dong.

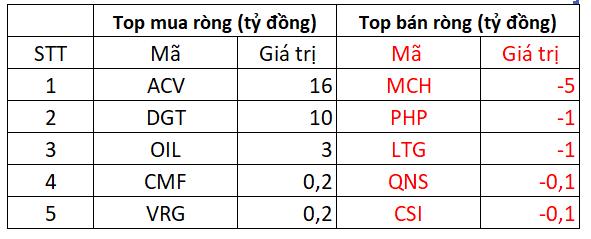

On the UPCoM, foreign investors net bought VND22 billion

Conversely, MCH faced net selling pressure of nearly VND5 billion. PHP, LTG, and other stocks were also net sold by foreign investors.

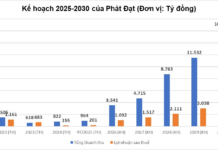

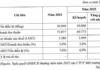

LandX Services reports a loss of 160 billion VND in 2023, cuts over 1,000 staff

In 2023, Dat Xanh Services incurred a net loss of 160 billion VND primarily due to a shortfall in real estate service revenue. Additionally, the company downsized its workforce by over 1,000 employees in the past year.