DIC Corp (DIG) has released its second-quarter 2024 financial report, revealing impressive growth. The company’s revenue surged to 821 billion VND, marking a remarkable 410% increase compared to the same period last year. This substantial growth is primarily attributed to their real estate business, particularly the transfer of CSJ project apartments and the transfer of rough construction works in the Dai Phuoc and Hau Giang projects.

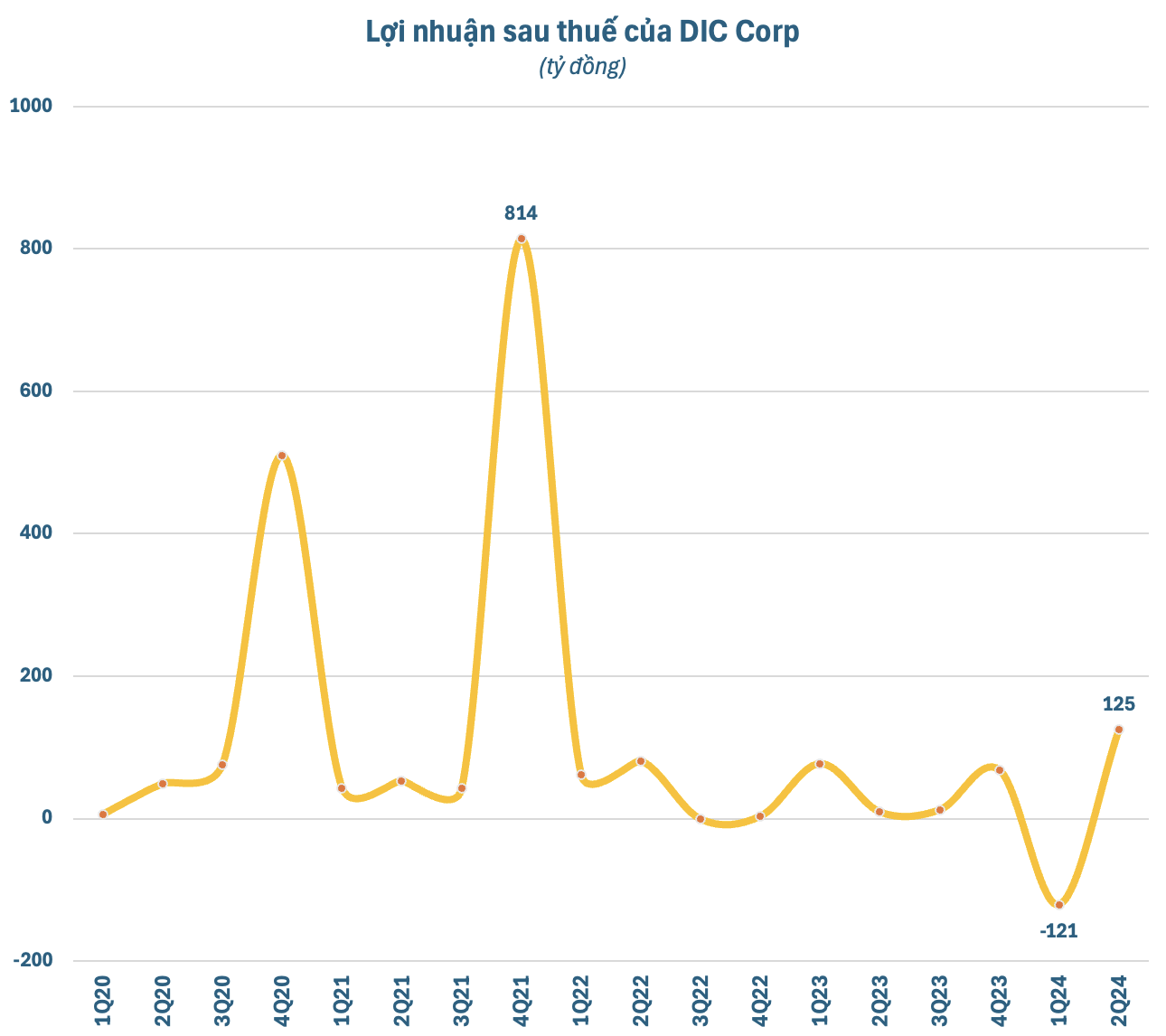

After deducting the cost of goods sold and expenses, DIC Corp’s pre-tax profit for the second quarter stood at 168.8 billion VND, a significant 9.8 times higher than the previous year. The company’s net profit reached over 123 billion VND, almost 14 times higher than the second quarter of 2023, and the highest in the past 10 quarters since the beginning of 2022.

Despite the profitability, DIC Corp experienced a significant negative cash flow from operating activities, amounting to over 1,200 billion VND in the second quarter, a notable change from the 108 billion VND deficit in the same period last year.

For the first six months of the year, DIC Corp recorded a consolidated revenue of 822 billion VND, a 130% increase compared to the same period in 2023. However, the company’s pre-tax profit decreased by nearly 60% compared to the first half of last year, amounting to 48 billion VND, mainly due to significant losses incurred in the first quarter of this year. With these results, DIC Corp has achieved 26% of its revenue plan and 5% of its profit target for the full year.

For 2024, DIC Corp has set ambitious goals, aiming for a revenue of 2,300 billion VND and a pre-tax profit of 1,010 billion VND, representing increases of 72% and 509%, respectively, compared to the previous year. Last year, the company also set high business targets but ultimately fell short of their plans.

The management of DIC Corp shared that they have been diligently working on resolving legal procedures in the second quarter of 2024 to lay the groundwork for accounting for the indicators in the last six months of the year. They are confident in achieving the targeted consolidated pre-tax profit of 1,010 billion VND.

DIC Corp’s 2024 profit is based on their business plan and expected revenue from the transfer of products in various projects: Dai Phuoc Eco-Tourism Urban Area (Dong Nai); Lam Ha Center Point Residential Area (Ha Nam); DIC Nam Vinh Yen City Urban Area (Vinh Phuc); DIC Victory City Hau Giang Urban Area; Hiep Phuoc Residential Area Project; Vung Tau Gateway Apartment Project; and CSJ Project Phase 1.

As of June 30, DIC Corp’s total assets amounted to 18,444 billion VND, a 9.6% increase from the beginning of the year, including 2,975 billion VND in cash and cash equivalents. Short-term receivables (5,874 billion VND) and inventory (7,654 billion VND) make up a significant portion of the company’s total assets.

As of the end of the second quarter, DIC Corp has advanced 3,824 billion VND in compensation for a series of real estate projects, including the Long Tan project (2,401 billion VND), Bac Vung Tau project (851 billion VND), and Chi Linh project (140 billion VND). Additionally, the company has invested 2,414 billion VND in the Dai Phuoc Eco-Tourism Urban Area project, an 83% increase compared to the beginning of the year.

In the market, DIG shares are currently trading at 24,300 VND per share, a 9% decrease compared to the beginning of the year. The corresponding market capitalization stands at 14,800 billion VND.

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.