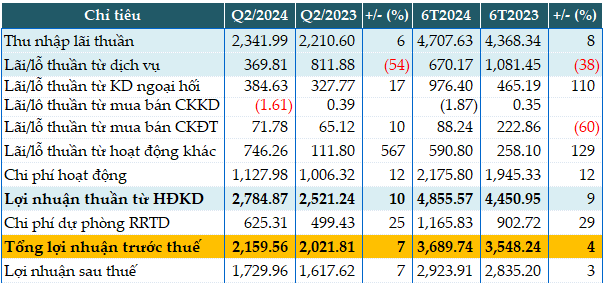

For Q2 alone, MSB’s net interest income reached VND 2,342 billion, up 6% year-on-year.

Non-interest income also grew, with profits from foreign exchange trading (+17%), investment securities trading (+10%), and other activities (6.7 times) all increasing.

As a result, the bank recorded a 10% increase in pre-tax profit, reaching nearly VND 2,160 billion. Despite setting aside VND 625 billion for credit risk provisions (+25%), MSB’s pre-tax profit for the quarter rose by 7% year-on-year.

For the first six months of the year, the bank’s pre-tax profit was nearly VND 3,690 billion, up 4% year-on-year. Thus, MSB has achieved 54% of its full-year target of VND 6,800 billion in pre-tax profits after the second quarter.

The cost-to-income ratio (CIR) improved to 30.9% from 33.6% in Q1, while the net interest margin (NIM) for the half-year reached 3.7%.

|

MSB’s Q2/2024 Business Results. Unit: VND billion

Source: VietstockFinance

|

As of the end of Q2, the bank’s total assets stood at VND 295,537 billion, an increase of 11% from the beginning of the year. In addition to a 12% growth in customer lending (VND 166,389 billion), the rise in total assets was significantly supported by a more than 40% increase in investment securities (VND 53,100 billion), with approximately 66% coming from government bond investments.

MSB’s customer deposits (VND 151,742 billion) and marketable securities (VND 14,741 billion) also increased by 15% and 64%, respectively, compared to the beginning of the year. Moreover, the balance of non-term deposits exceeded VND 40,500 billion, a 15% increase. The CASA ratio in the total funding structure stood at 26.71%, slightly down from the previous quarter, mainly due to the rebound in term deposits. “CASA remains a focus for MSB as a competitive advantage to minimize funding costs,” said an MSB representative.

The bank’s loan-to-deposit ratio (LDR) reached 72.57%, while the ratio of short-term capital used for medium and long-term loans (MTLT) was maintained at 26.1%. The consolidated capital adequacy ratio (CAR) stood at 12.13%.

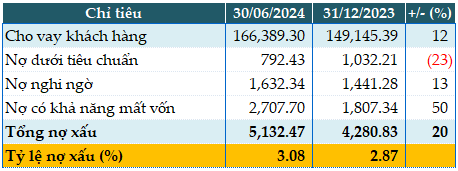

As of June 30, 2024, total non-performing loans (NPLs) amounted to VND 5,132 billion, a 20% increase from the beginning of the year. The NPL ratio, as per Circular 11, was managed at 2.13%.

|

MSB’s Loan Quality as of June 30, 2024. Unit: VND billion

Source: VietstockFinance

|

Furthermore, during the past quarter, MSB received approval from the State Bank of Vietnam for its plan to increase its charter capital through a 30% stock dividend payment. On July 25, 2024, the SSC also issued a document allowing MSB to pay dividends in stocks. The bank is expected to complete the issuance in Q3. After the capital increase, the total number of outstanding shares is projected to be 2.6 billion, corresponding to a new charter capital of VND 26,000 billion.

Han Dong

Declining USD Prices: Banks and Free Market Suffer Declines

Approaching Tet holidays, the USD price in banks and the free market dropped significantly, despite the international USD index maintaining a high level.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.