The Ho Chi Minh City Stock Exchange (HoSE) has recently announced the mandatory delisting of shares of Hoa Binh Construction Group Joint Stock Company (code: HBC) after receiving the company’s audited separate and consolidated financial statements for 2023.

According to the 2023 audited consolidated financial statements, the company’s undistributed post-tax profits as of December 31, 2023, amounted to a loss of 3,240 billion VND, exceeding its actual paid-up capital of 2,741 billion VND. As per regulations, HBC shares are subject to mandatory delisting, and HoSE will proceed with the delisting of these shares.

Following the delisting from HoSE, HBC plans to transfer nearly 347.2 million shares to the UpCOM trading platform of the Hanoi Stock Exchange (HNX). The transfer to the new exchange is expected to be completed in August 2024.

In its latest announcement, HBC has committed to continue fulfilling its information disclosure obligations in accordance with regulations, ensuring transparency and protecting the interests of shareholders and investors. “We recognize the importance of maintaining a continuous and reliable channel of communication with the investment community, especially during this transition phase,” the company stated.

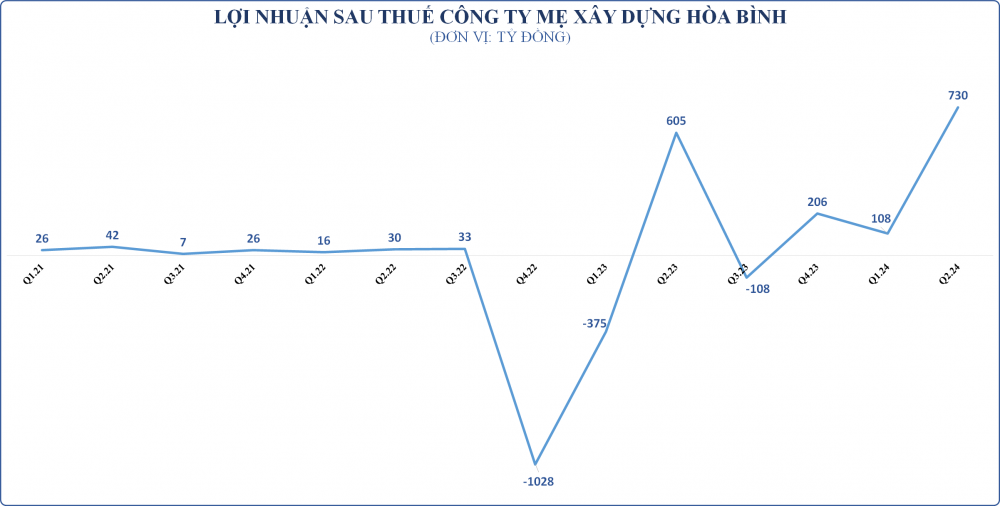

HBC also reported that, for the first six months of 2024, the company has made efforts to improve its financial indicators, with revenue reaching 3,810.82 billion VND, a 10.1% increase compared to the same period in 2023. Additionally, the company’s post-tax profit amounted to 740.91 billion VND, a significant improvement from the loss of 713.21 billion VND in the previous year.

The company further stated, “We will continue to implement the plan to increase owner’s equity as reported at the 2024 Annual General Meeting of Shareholders.”

HBC also mentioned the successful completion of a debt-to-equity swap, converting 730.8 billion VND of debt into 73.08 million shares for 99 suppliers and subcontractors on June 29, 2024, resulting in a 21.05% increase in its charter capital. In addition, the company is actively undergoing a comprehensive restructuring, including optimizing its management structure, streamlining personnel, and enhancing labor productivity and operational efficiency.

Mr. Le Viet Hai, Chairman of HBC, shared with the media that the 15% fluctuation band on UPCoM will provide shareholders with more flexibility in trading with a wider price range. Moreover, with the company’s commitment to fulfilling its obligations unchanged, Mr. Hai assured that the share price would not be affected.

“After a challenging period, Hoa Binh Construction is gradually improving its financial indicators, and we expect the company’s shares to perform well in the next two years. We are determined to relist on the HoSE as soon as possible,” Mr. Hai added.

HBC’s post-tax profit has shown significant improvement compared to the loss in the same period last year.

HBC was the first construction contractor to list its shares on HoSE in late 2006, with an initial charter capital of approximately 54 billion VND.

Mr. Hai’s decision to take the company public was considered a strategic move to enhance its financial resources and facilitate its expansion. However, the share price faced challenges over the years. In 2011, HBC shares dropped from 31,000 VND to 18,700 VND, prompting Mr. Hai to write an open letter to employees, encouraging them to use their idle money to buy HBC shares to prevent a potential takeover.

Despite the setbacks, Hoa Binh Construction gradually stabilized and achieved impressive growth, with its post-tax profit soaring to 567 billion VND in 2016, a significant increase from the previous year’s figure of 83 billion VND. This upward trajectory continued in 2017, with a record profit of 859 billion VND and revenue of 16,034 billion VND.

By November 2021, after years of trailing behind its rival Coteccons, Hoa Binh Construction had become Vietnam’s largest contractor, with a market capitalization of over 5,700 billion VND. The company had already surpassed Coteccons in both revenue and profit.

However, HBC’s post-tax profit began to decline after 2017, and in the last two years, the losses amounted to thousands of billions of VND, with a loss of 2,570 billion VND in 2022 and 1,115 billion VND in 2023.