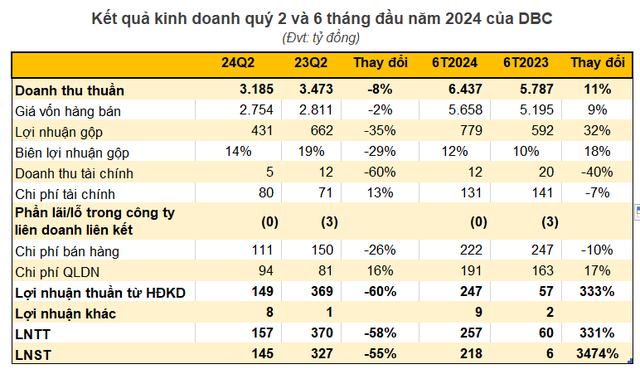

Vietnam Dabaco Group JSC (code DBC) has released its Q2 2024 financial report, revealing a 3.185 trillion VND revenue, an 8% decrease from the previous year. As the reduction in cost of revenue was lower than the decrease in revenue, gross profit narrowed by 35% to 431 billion VND. The gross profit margin also decreased to 14% in Q2 2024.

Additionally, financial revenue plummeted by 60%, yielding approximately 5 billion VND. Conversely, financial expenses rose by 13% to 80 billion VND.

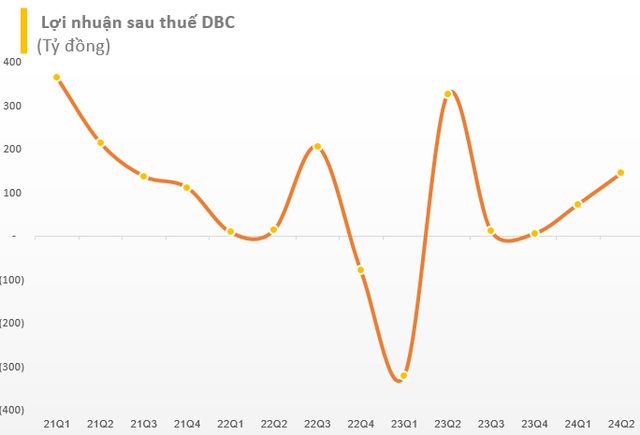

After deducting various expenses, Dabaco’s post-tax profit declined by 55% to 145 billion VND. For the first half of the year, Dabaco recorded a total revenue of 6.437 trillion VND, an 11% increase compared to the same period last year. The company’s post-tax profit exceeded 218 billion VND, 36 times higher than the figure in the first half of 2023.

According to Dabaco, in Q2 2024, there were continued fluctuations in the prices of raw materials for animal feed production, both domestically and for imports. Additionally, diseases among livestock and poultry, particularly the African Swine Fever, remained complex and widespread, resulting in a significant decrease in the country’s total pig herd, which also impacted the company.

“Despite the increase in domestic pig prices, the production and business results of the Group’s livestock units have not improved significantly. Meanwhile, in the same period last year, the parent company recorded profits from real estate business activities,” the explanatory note stated.

For the year 2024, Dabaco’s Board of Directors approved an ambitious business plan with a revenue target of 25,380 billion VND, a 14% increase from the previous year, and a post-tax profit goal of 729.8 billion VND, 29 times higher than the result achieved in 2023. With the performance in the first half of the year, the company has accomplished only 25% of its revenue target and 30% of its profit goal.

As of the end of Q2 2024, Dabaco’s total assets were recorded at over 13,326 billion VND, an increase of more than 300 billion VND from the beginning of the year. Cash, cash equivalents, and deposits amounted to 1,045 billion VND, accounting for nearly 8% of total assets, while inventory surged by 335 billion VND to nearly 5,829 billion VND.

On the capital side, equity reached over 4,885 billion VND, an increase of more than 200 billion VND from the beginning of the year, with post-tax profit not distributed at nearly 221 billion VND, eight times higher than at the start of the year. The company’s short-term and long-term borrowings were recorded at 5,749 billion VND and 918 billion VND, respectively.

In the stock market, DBC shares traded sluggishly after unexpectedly announcing a sharp drop in profits, with DBC even falling to the floor towards the end of the July 30 session. The current market price is at 26,050 VND/share.

Vinamilk: Impressive nearly 20% growth in Q4/2023 export revenue

Vinamilk has announced its financial report for Q4 2023, recording a consolidated total revenue and after-tax profit of VND 15,630 billion and VND 2,351 billion, respectively. This represents an increase of 3.6% and 25.8% compared to the same period last year. For the full year, the consolidated total revenue and after-tax profit reached VND 60,479 billion and VND 9,019 billion, completing 95% of the revenue target and 105% of the profit target.