On August 2, the State Bank of Vietnam set the daily reference exchange rate at 24,242 VND/USD, a slight decrease compared to the previous day. However, over the past week, the reference exchange rate has dropped by more than 20 VND, which is considered a significant decline.

Commercial banks such as Vietcombank and Eximbank have also adjusted their USD rates. Vietcombank is buying USD at 24,060 VND and selling at 25,400 VND, a decrease of 10 VND from the previous day. Eximbank is buying USD at 25,050 VND and selling at 25,390 VND.

Compared to a week ago, USD rates at commercial banks have dropped by 50-70 VND. If we look at the peak in June, USD rates at these banks have cooled down by more than 1.5%.

In the free market, some foreign exchange trading points are offering rates of around 25,600 VND for buying USD and 25,682 VND for selling. These rates have remained stable over the past few days, and the free market USD rates have also retreated from the previous peak of over 26,000 VND.

USD rates at banks have dropped significantly in recent days

|

The exchange rate easing comes as the US Dollar Index (DXY) weakens in the international market. Currently, the DXY stands at 104.135 points, a nearly 2% drop from its April peak.

In their July currency market report, MBS Securities Company attributed the cooling of the US dollar in the international market to a series of positive inflation data releases from the US.

The market is anticipating a 90% likelihood that the Federal Reserve (Fed) will cut interest rates by 0.25 percentage points to 5.00-5.25% in September. This expectation has contributed to the weakening of the US dollar globally.

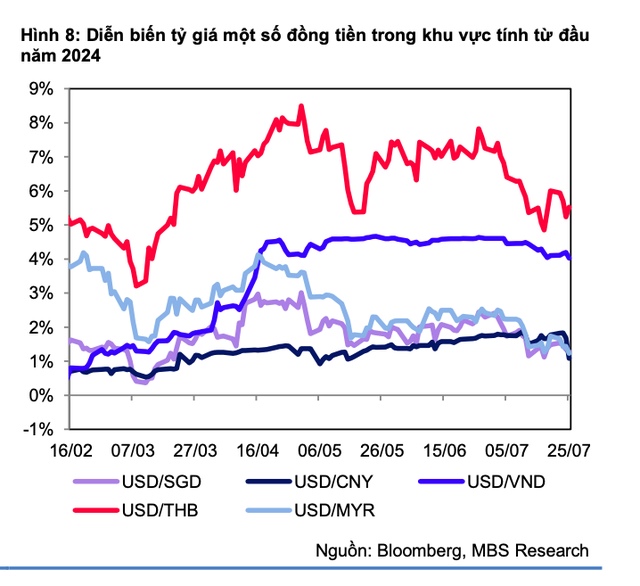

In the domestic market, the decline in the DXY, coupled with effective interventions by the State Bank of Vietnam through foreign exchange sales, has eased pressure on the USD/VND exchange rate in July 2024.

MBS experts also noted that the State Bank’s maintenance of high interbank interest rates has helped narrow the interest rate gap between the USD and VND, thereby supporting the depreciation of the Vietnamese dong.

“Exchange rate pressure is expected to ease, and the exchange rate is likely to fluctuate within the range of 25,100 – 25,300 VND/USD in the fourth quarter,” said Tran Khanh Hien, Director of MBS Analysis. “This forecast is based on positive trade surplus, increasing FDI inflows, and a strong recovery in the tourism sector.”

VND depreciation in line with regional peers in the first half of 2024 |

Looking ahead, UOB Group maintains its view that the Fed will cut interest rates twice, by 0.25 percentage points each in September and December. This will provide a favorable basis for other economies to consider cutting rates or refraining from raising them, thereby reducing pressure on exchange rates for emerging market currencies.

Regarding the VND/USD exchange rate outlook, Mr. Suan Teck Kin, Head of Research at UOB Group, predicted that a Fed rate cut would lead to a weaker USD. He anticipated a recovery for the VND in the second half of the year, in line with the Chinese yuan (CNY). Mr. Kin forecast the exchange rate to reach 25,000 in the fourth quarter of 2024.

By Thai Phuong

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.

New currency exchange service: Rare small denominations

The demand for exchanging small denominations of money increases during the Lunar New Year, but the availability of small bills is limited. The familiar “money exchange kiosks” are also gradually disappearing from this service.