The VN-Index continued its recovery trend at the start of this week’s trading session. Despite the main index closing slightly below the intra-day high, the market remained in positive territory.

Large-cap stocks made a strong effort to climb, but ran out of steam towards the end of the day. Several heavyweights trimmed their gains, causing the VN-Index to narrow its advance. At the close, 14 out of 30 stocks in the basket posted gains. The VN30-Index, representing the large-cap group, rose more modestly than the broader VN-Index.

BID took the lead in driving the market, with HVN coming in second, surging to the daily maximum upward limit of 22,350 dong per share. VNM, HPG, GVR, MWG, and FPT were among the most actively traded stocks and closed in positive territory. HPG saw a strong rebound following news related to anti-dumping duties on steel.

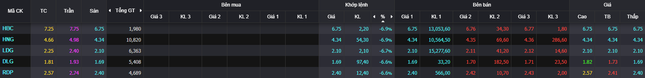

Today’s session also witnessed notable movements in small-cap stocks, such as HBC, HNG, and QCG, which traded in opposite directions. While QCG was rescued from its downward spiral, HBC and HNG plummeted after being notified of their forced delisting from the HoSE.

After a week of consecutive losses, QCG regained liquidity, matching orders for the entire volume of shares previously dumped. More than 7.5 million QCG shares changed hands, pushing the share price up to 6,770 dong per unit.

A number of penny stocks hit the daily downward limit.

On the other hand, HBC and HNG took a nosedive as investors rushed to offload their holdings following the announcement of their mandatory delisting from the HoSE.

HBC announced that it will transfer its listing to the UPCoM exchange in August, assuring that the move is not expected to impact the fundamental rights and interests of shareholders. Nonetheless, investors reacted with panic selling after the unfavorable news of the HoSE delisting.

HNG, having incurred losses for three consecutive years from 2021 to 2023, faces the same fate of delisting. By the end of the session, more than 10.5 million HNG shares were left unmatched on the selling side, with no buyers.

Additionally, LDG and DLG remained at the downward limit following the initiation of bankruptcy proceedings against the companies.

At the closing bell, the VN-Index climbed 4.49 points (0.36%) to 1,246. The HNX-Index advanced 0.86 points (0.36%) to 237.52, while the UPCoM-Index rose 0.28 points (0.29%) to 95.46.

Turnover inched slightly higher to nearly VND10.5 trillion. Foreign investors resumed net selling, offloading nearly VND315 billion worth of shares, focusing on PDR, DCM, PVS, and MWG.