Since the banking restructuring in 2014, credit policies have been oriented towards more sustainable capital allocation and optimizing credit leverage for the economy. This shift in approach and credit management by banks and the State Bank of Vietnam (SBV) channels capital into areas with strong growth potential and better suitability.

Moreover, directed credit growth helps capital absorption into the economy and achieves annual credit growth targets. Based on recent credit growth by industry, there is a correlation between credit flows and economic developments.

In 2023, if economic growth was driven by public investment, private investment and FDI became the main drivers in 2024. An analysis of GDP growth by industry shows that the strong performance of the industrial sector contributed to the overall economic growth in the first half of 2024. Correspondingly, credit growth witnessed a significant shift in the past two years, with corporate credit growth becoming the primary driver, replacing household and consumer credit growth, which had been sustained for almost a decade.

With its directional function, credit flow also serves as an important indicator in determining the main drivers of economic growth in each phase.

The Role of Credit Flow Allocation

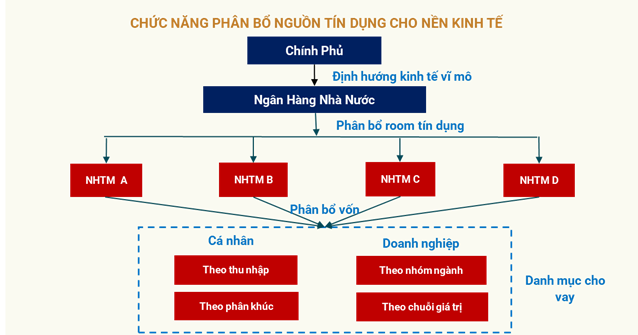

“Credit flow allocation” is a term specific to Asian countries, including Vietnam, where the capital market is underdeveloped, and bank lending is the dominant source of short, medium, and long-term capital for the economy. Rational credit allocation enables industries to access capital quickly, thereby boosting growth.

Credit has its efficiency and depends on the absorbing industry. Thus, in each phase, credit flow will be based on the driving forces and development orientation of the industries to direct credit flow accordingly. Based on the government’s orientations towards potential economic sectors, credit flow will be directed towards industries with high growth potential, strong spillover effects on other sectors, or better recovery capabilities during economic downturns.

Figure 1: Illustration of Credit Allocation Function for the Economy

In the last three years, as the economy began to recover from the pandemic and faced macroeconomic fluctuations, credit orientation played a crucial role. In 2022, when economic growth was driven by the services sector and domestic consumption, credit was prioritized for this sector, with an average credit growth of nearly 20% for service activities. This helped the services sector achieve a 10% growth rate compared to the previous year, and total retail sales of goods and services grew by approximately 20%.

Looking back at 2023, economic growth was still mainly driven by public investment. Meanwhile, promoting trade credit resulted in high GDP growth for the construction and services sectors, at 7.06% and 6.8%, respectively. This highlights the importance of directing credit flow towards sectors with growth potential and contributing to economic growth.

Micro-level analysis of industry growth drivers is essential for determining credit flow orientation, not only for the management system of the SBV but also for the business management of banks and their branches. This ensures that capital is allocated efficiently and meets the development needs of specific industries. Every quarter, the SBV conducts surveys on inflation, credit, and business trends among credit institutions, adjusting credit policies accordingly. Through detailed micro-environment analyses, the SBV can identify industries with high growth potential and low risk based on banks’ expectations and prioritize lending to these sectors.

The advancement of big data analytics assists the SBV and commercial banks in assessing the financial health of industry groups in different geographical areas.

Assessing Industry Health Using Financial Data of Enterprises

Directed credit growth emphasizes the importance of data monitoring to evaluate the financial health of enterprises in the economy. By utilizing financial indicators such as profitability, revenue, and debt-to-equity leverage, banks can accurately assess the relative financial health of industry groups and their prospects by tracking investment activities and credit absorption. This not only serves as a regulatory compliance measure but also helps mitigate bad debt risks and ensures rational capital allocation.

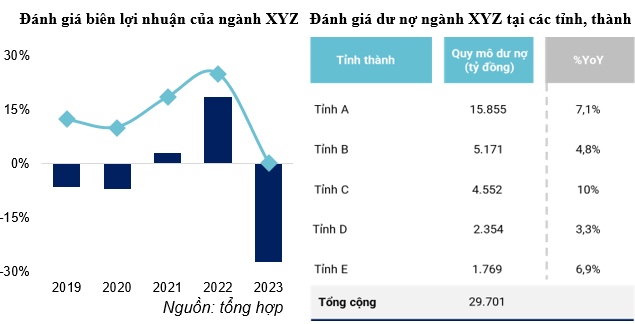

A comprehensive and accurate financial health measurement system is the foundation for effective credit flow management. This system should be designed to continuously update and analyze data from enterprises, providing managers with a clear picture of the financial health of each industry. The illustration below depicts credit distribution based on financial health indicators of enterprises in a hypothetical industry XYZ and assesses the industry’s loan balance in different provinces and cities in 2023. The loan balance varies across regions, with Province A having the largest balance of VND 15,855 billion and a growth rate of 7.1%, while Regions D, C, and E have smaller balances but positive growth rates. Credit distribution is adjusted based on the scale of cultivation in each region, reflecting the credit institutions’ focus on thoroughly evaluating financial indicators and micro and industry-level prospects to make appropriate decisions.

From 2019 to 2022, the industry’s profit margin significantly increased, peaking in 2022. However, 2023 witnessed a sharp decline in profit margins as the industry faced challenges in the export market. Detailed and focused assessments of the industry’s prospects will help concretize the SBV’s and commercial banks’ credit flow focal points, distinguishing between growth support packages and financial recovery support packages, thereby contributing to resolving enterprises’ difficulties and promoting industry recovery.

Figure 2: Credit Allocation Based on Financial Health Indicators of Enterprises

These quantitative analyses are crucial for formulating credit support policies during phases of promoting credit growth while ensuring the effectiveness of the current credit flow. Lending orientations based on in-depth assessments of industries’ financial health and enterprise groups within each industry can help allocate capital to the right recipients, enhancing the economy’s capital absorption capacity and ensuring that credit is directed towards value-creating production activities.

Managing credit flow is essential for the banking system in this phase of rapid credit growth and increasing challenges in controlling non-performing loans. Building orientations based on in-depth data on enterprises’ financial health and growth potential will assist the SBV and commercial banks in optimizing credit allocation and directing credit flow.

Le Hoai An, CFA – Nguyen Thi Ngoc An, HUB

Territory-based credit policy in Ho Chi Minh City shows nearly 39% growth

Credit programs, not only support and assist the poor and vulnerable, who are the main subjects of policies in Ho Chi Minh City, with capital for production and business to create livelihoods and employment opportunities, but also play a significant role in the direction of sustainable economic development, economic growth, and social security ensured by the Government.

VPBank strengthens its system in 2023, laying the foundation for sustainable growth

By 2023, VPBank has made significant strides in expanding its customer base and scaling up its operations. The bank has managed to make progress amidst challenging macroeconomic conditions, focusing its resources on strengthening its system and building momentum for sustainable growth in 2024 and beyond.

TPHCM’s economy may grow by 6-7.12% in Q1/2024.

With a favorable scenario in the first quarter of 2024, Ho Chi Minh City is expected to experience a growth rate of 6-7.12%.