The low liquidity in the previous session indicated a cooling-off period for selling pressure. As large-cap stocks made a comeback today, the VN-Index signaled a recovery.

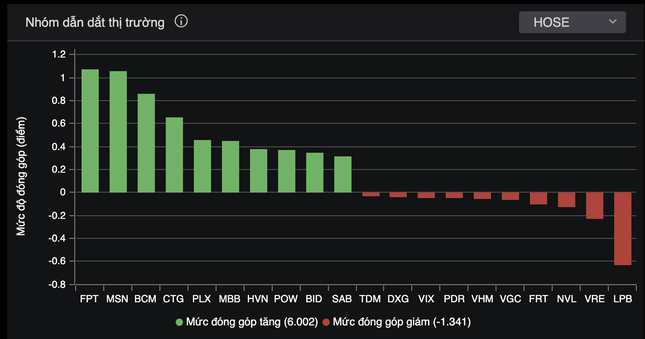

The VN-Index’s recovery gained momentum in the afternoon session, especially in the last 30 minutes of trading, as large-cap stocks exerted their influence. 22 out of 30 VN30 stocks rose, with FPT, a technology stock, leading the market. MSN, BCM, CTG, PLX, and MBB also contributed to the upward trend.

Large-cap stocks resume their market leadership.

Although the impact on the overall market was modest, the largest sector by market capitalization – banking – saw a return to a predominantly green performance. On the HoSE, LPB was the sole decliner.

Most sectors also supported the VN-Index’s recovery. Stocks in the oil and gas, real estate, securities, insurance, and chemicals sectors moved higher. While liquidity remained low, many stocks witnessed strong price gains.

Small and medium-cap stocks also traded positively, with notable performances from CMG, VRC, DBC, TV2, POW, and HVN. Notably, HVN, the stock of Vietnam Airlines, rebounded into the green after a series of adjustments. At the close, the airline stock climbed 3.47% to 20,900 VND per share. Liquidity also increased, with nearly 9.7 million shares changing hands.

Meanwhile, some penny stocks continued to face selling pressure. QCG of Quoc Cuong Gia Lai fell for the sixth consecutive session, hitting the floor price with no buyers. Since the arrest of Nguyen Thi Nhu Loan, QCG has lost 35% of its market value, currently trading at 6,330 VND per share. The company’s market capitalization has shrunk by over 940 billion VND. Given the sharp decline, the Ho Chi Minh City Stock Exchange has requested QCG to provide an explanation.

LDG, facing a similar situation with low liquidity, continued its downward trend after the initiation of bankruptcy proceedings. Shareholders rushed to sell their shares at the floor price, but the matched volume was minimal. By the end of the session, LDG had over 23.7 million shares remaining in sell orders at the floor price. In a recent development, LDG has requested the court to reconsider its decision to initiate bankruptcy proceedings, arguing that the company has not lost its solvency.

At the close, the VN-Index rose 8.92 points (0.72%) to 1,242.11 points. The HNX-Index gained 1.41 points (0.6%) to 236.66 points. The UPCoM-Index climbed 0.67 points (0.71%) to 95.18 points. Liquidity slightly improved from the previous session, with matched orders on the HoSE exceeding 10,100 billion VND in value.