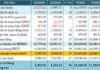

Agribank’s Latest Savings Interest Rates

On the first day of August, Agribank officially increased its savings interest rates. According to the bank’s recently published deposit interest rate table for individual customers, the interest rate for 1-2 month terms has been adjusted, increasing by 0.1% per year to 1.7% per year. The interest rate for 3-5 month terms has also seen a 0.1% annual increase, now sitting at 2.0% per year.

Meanwhile, interest rates for 6-11 month terms remain unchanged at 3.0% per year. Agribank has also maintained the interest rate for 12-18 month terms at 4.7% per year, but the rate for 24-month terms and above has been increased by 0.1% to 4.8% per year.

Sacombank’s Latest Savings Interest Rates

At the beginning of August, Sacombank also made adjustments, increasing interest rates for all terms. As a result, the interest rate for 1-month terms has increased by 0.3% to 3.3% per year, the rate for 2-month terms has gone up by 0.4% to 3.5% per year, and the rate for 3-month terms has risen by 0.3% to 3.6% per year.

Sacombank has also increased the interest rates for 4 and 5-month terms by 0.2% and 0.1% respectively, with both now sitting at 3.6% per year. Additionally, the interest rate for 6-month terms has seen a significant increase of 0.8% to 4.9% per year.

After adjustments, the interest rates for 7-11 month terms at Sacombank have increased to 4.9%, with a rise of 0.6-0.7%. The interest rate for 12-13 month terms is now at 5.4% per year, reflecting a 0.5% increase. Sacombank has also significantly increased interest rates for longer terms. Specifically, the rate for 15-month terms has gone up from 5.0% to 5.5% per year, the rate for 18-month terms has increased from 5.1% to 5.6% per year, the rate for 24-month terms has risen from 5.2% to 5.7% per year, and the rate for 36-month terms has climbed from 5.4% to 5.7% per year.

HDBank’s Latest Savings Interest Rates

HDBank has also adjusted its savings interest rates this week. From 1-month to 5-month terms, the bank’s advertised savings interest rates have increased to 3.05% per year, reflecting a 0.3% rise compared to the previous adjustment. The interest rate for 6-month terms has also been raised to 5.0% per year, a 0.2% increase from the previous month.

For 7-11 month terms, the savings interest rate remains at 4.6% per year. For 12-month terms, there will be two types of interest rates: 7.7% per year for amounts above 500 billion VND and 5.4% per year for amounts below 500 billion VND.

For 13-month terms, savings accounts with amounts above 500 billion VND will be offered an interest rate of 8.1% per year, while those with amounts below 500 billion VND will receive an interest rate of 5.6% per year.

The interest rates for 15-month and 18-month terms are 5.9% and 6.0% per year, respectively. For 24-month and 36-month terms, the savings interest rate remains at 5.4% per year.

5 banks that increased interest rates in the last week of July and the first week of August 2024

ACB’s Latest Savings Interest Rates

ACB officially adjusted its savings interest rates on July 31st. According to the bank’s online savings product with interest payable at maturity for individual customers – the product with the highest interest rate, ACB offers different rates based on the amount deposited: below 200 million VND, from 200 million VND to below 1 billion VND, from 1 billion VND to below 5 billion VND, and 5 billion VND or above.

The interest rate for 1-month terms has increased by 0.2% per year and now ranges from 3.0% to 3.2% per year, depending on the amount deposited. The interest rate for 2-month terms has also increased by 0.2% per year and now ranges from 3.1% to 3.3% per year. The 3-month term interest rate has gone up by 0.3% per year and now ranges from 3.4% to 3.6% per year. The 6-month term interest rate has increased by 0.25% per year and is now approximately 4.5% to 4.35% per year. The 9-month term interest rates have also been adjusted upward to the range of 4.2% to 4.4% per year.

For 12-month terms, ACB has increased the interest rate by 0.1% compared to the previous period, and it now ranges from 4.8% to 5.0% per year. As a result, the highest savings interest rate currently offered by ACB is 5.0% per year, applicable to deposits of 5 billion VND or more for 12-month terms. For smaller amounts, the highest interest rate customers can receive ranges from 4.8% to 4.95%.

SHB’s Latest Savings Interest Rates

This week, SHB also made adjustments to its savings interest rates. The new deposit interest rates took effect on July 30th. SHB increased the interest rates for short-term deposits of 1-5 months by 0.2% per year.

For online deposits – SHB’s product with the highest interest rate, the interest rate for 1-2 month terms is now 3.5% per year, while the rate for 3-5 month terms has increased to 3.6% per year.

SHB has maintained the interest rates for other terms. The interest rate for 6-8 month terms is 4.7% per year, the rate for 9-11 month terms is 4.8% per year, and the rate for 12-month terms has increased to 5.2% per year. For 13-15 month terms, the interest rate is 5.3% per year, for 18-month terms, it is 5.5% per year, for 24-month terms, it is 5.8% per year, and for 36-month terms and above, the current highest interest rate is 6.1% per year.