Services

The global economy faced significant challenges in the first half of 2024, with inflation and interest rates remaining high. In this context, the Government and the State Bank of Vietnam (SBV) implemented a series of solutions to stabilize the macro-economy and curb inflation. With the flexible and timely management of the SBV, commercial banks, including Nam A Bank, continued to operate stably and maintain sustainable growth.

As the only bank in the system to list its shares on the Ho Chi Minh Stock Exchange (HOSE) in the past six months, Nam A Bank has reaffirmed its sustainable development through positive operating results. Notably, the bank’s pre-tax profit for the first half of 2024 surged to over VND 2,200 billion (completing more than 55% of the 2024 plan), with total assets reaching over VND 228,000 billion (completing 98.7% of the 2024 plan) and operational safety indices surpassing SBV regulations.

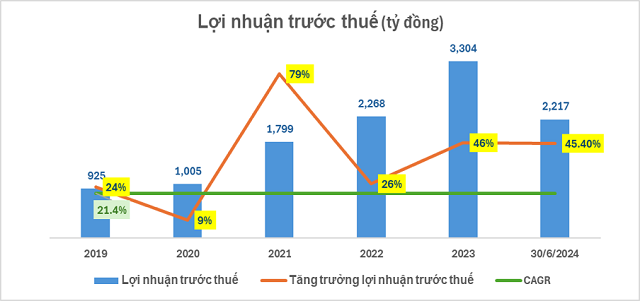

Specifically, Nam A Bank’s pre-tax profit for the first half of 2024 reached VND 2,217 billion, a 45.4% increase compared to the same period in 2023 and completing 55.4% of the 2024 plan. As of June 30, 2024, the bank’s total assets reached over VND 228,000 billion, a 14.3% increase compared to the same period in 2023 and completing 98.7% of the 2024 plan. Capital mobilization from individuals and economic organizations grew satisfactorily, reaching nearly VND 173,000 billion, a more than 9.4% increase compared to the same period in 2023 and completing 97.1% of the 2024 plan. Customer loan balance grew in line with the credit growth limit permitted by the SBV, reaching nearly VND 157,000 billion, a 21.2% increase compared to the same period in 2023.

Notably, this is the second consecutive quarter in which Nam A Bank has recorded a profit of over VND 1,000 billion. Net interest income increased by VND 834 billion, a 27% rise compared to the same period in 2023.

(Nam A Bank’s six-month profit increased by more than 45.4% compared to the same period in 2023 – Source: Nam A Bank’s Financial Statements)

|

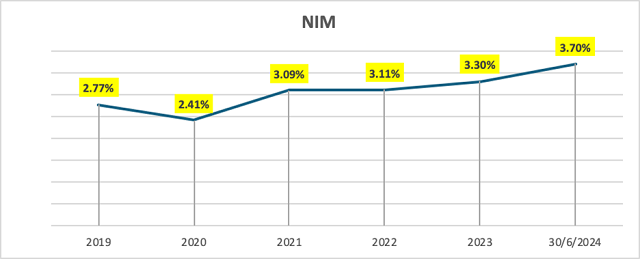

Positively, Nam A Bank’s net interest margin (NIM) grew by 3.7% despite the narrowing of the interest rate spread for deposits and customer loans. This achievement is attributed to the optimization of the bank’s interest-bearing asset and funding structure.

(Source: Nam A Bank’s Financial Statements)

|

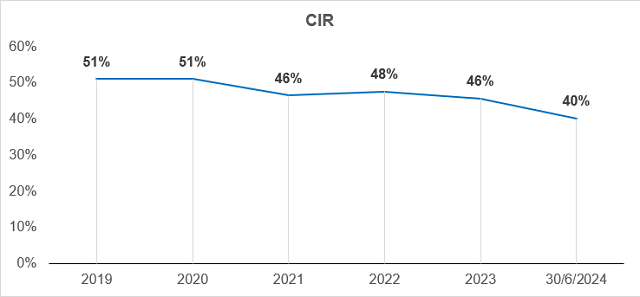

The cost-to-income ratio (CIR) at Nam A Bank improved effectively in the second quarter of 2024, with CIR for the quarter approaching 40% – the lowest level in the past five years.

(Source: Nam A Bank’s Financial Statements)

|

Over the years, Nam A Bank has undergone a robust digital transformation and expanded its operations nationwide. While operating costs have increased, the CIR has gradually improved over the years.

Furthermore, the bank’s safety indices in operations far exceeded SBV regulations. Nam A Bank has also complied with liquidity ratios and completed the implementation of risk management standards according to Basel III norms. The capital adequacy ratio (CAR) stood at over 11.38% (the minimum requirement set by the SBV is 8%), the loan-to-deposit ratio (LDR) reached 76.06% (the maximum limit set by the SBV is 85%), the liquidity coverage ratio (LCR) was 17.35% (the minimum requirement set by the SBV is 10%), the 30-day VND liquidity coverage ratio exceeded 73.41% (the minimum requirement set by the SBV is 50%), and the ratio of short-term capital for medium and long-term loans was 14.13% (the maximum limit set by the SBV is 30%). Nam A Bank maintains a stable and safe liquidity strategy, and non-performing loans are well controlled according to SBV regulations (a 0.15 percentage point decrease compared to the same period in 2023).

A representative of Nam A Bank shared: “Amid a challenging market environment, Nam A Bank has implemented the right strategies and demonstrated a high level of adaptability to create sustainable growth momentum in the first half of 2024. This also lays a solid foundation for the bank to achieve its goals for the year and soon realize its vision of becoming one of the top 15 strongest banks in Vietnam.”

VPBankS wins award for “Most Innovative Stock Trading App 2023”

VPBankS, a subsidiary of VPBank, has recently been awarded the “Most Innovative Stock Trading Application” by the International Finance Magazine. This prestigious accolade distinguishes VPBankS as the only securities company in Vietnam to receive such recognition in 2023.

VPBank strengthens its system in 2023, laying the foundation for sustainable growth

By 2023, VPBank has made significant strides in expanding its customer base and scaling up its operations. The bank has managed to make progress amidst challenging macroeconomic conditions, focusing its resources on strengthening its system and building momentum for sustainable growth in 2024 and beyond.

Eximbank revamps website interface

The website has undergone a modern and user-friendly interface transformation since 01/02/2024, ensuring an enhanced user experience.