Illustrative image

Joint Stock Commercial Bank for Foreign Trade of Vietnam (VIB – Code: VIB) has just announced that the

record date for bonus share issuance is August 23, 2024.

Accordingly, VIB will issue nearly 431.3 million bonus shares to shareholders from its owner’s equity,

equivalent to a ratio of 17% (shareholders owning 100 shares will receive 17 new shares). The total issuance

value at par value is VND 4,312.6 billion, with the issuance source being the supplementary capital reserve

and undistributed post-tax profits as of the end of 2023. After this issuance, VIB’s charter capital is expected

to increase by nearly VND 4,313 billion.

Earlier, the 2024 Annual General Meeting of Shareholders of VIB approved the dividend plan with a ratio

of 29.5% of charter capital. Of which, the maximum cash dividend rate is 12.5%, and the dividend rate in

shares is 17%.

VIB has completed two cash dividend payments to shareholders with a total rate of 12.5%, with a total value

of VND 3,171 billion.

Regarding VIB’s business results, pre-tax profit in the first half of the year reached more than VND 4,600

billion, down compared to the same period. The return on equity (ROE) remained at 21%

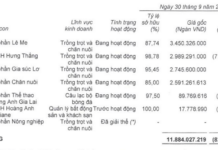

As of June 30, 2024, VIB’s total assets reached more than VND 431,000 billion, up 5% from the beginning

of the year. Capital mobilization increased by 5%, higher than the industry average of 1.5%. As of the end of

the second quarter, credit outstanding was nearly VND 280,000 billion, up 5% from the beginning of the

year.