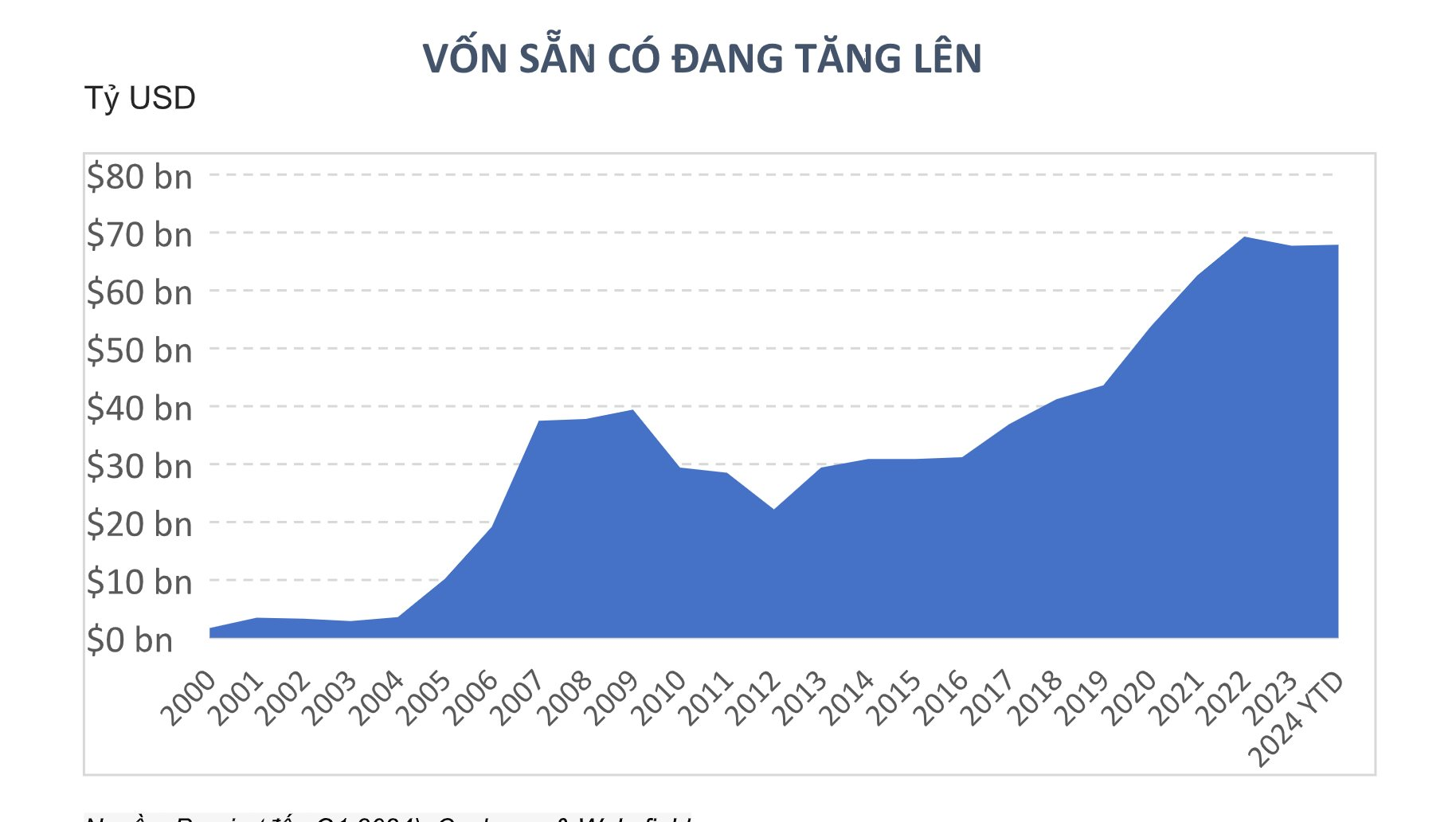

This report analyzes the current economic cycle, investment market conditions in the Asia-Pacific region in the first half of 2024, future forecasts, and key investment strategies in the region. There is an expected investment of $70 billion in debt instruments and assets with potential for value appreciation.

Gordon Marsden, Head of Capital Markets, Asia-Pacific at Cushman & Wakefield, stated that while there has been some investment activity in the past year, investors have not yet shown their full strength globally. Investors have remained cautious and observant over the past 18-24 months. However, there are now signs indicating a potential recovery in the investment market by 2025.

According to Cushman & Wakefield, finding suitable and transactable assets for investors remains a key challenge, despite the availability of deployable capital. As a result, investors are predicted to target opportunistic and value-add investments, including bonds. Assets and sectors with potential for high yields, especially through recovering income streams, are likely to be the most favored.

Source: Preqin (as of Q1 2024); Cushman & Wakefield

Dr. Dominic Brown, Head of Research for Asia-Pacific at Cushman & Wakefield, noted that the Asia-Pacific region continues to demonstrate resilience despite rapid interest rate hikes over the past two years slowing economic growth. Although growth has decelerated, the region’s fundamentals remain strong.

“Looking ahead, we foresee a gradual easing of interest rates across the region, with varying degrees and speeds. The underlying growth drivers in the region remain robust, reinforcing the position of Asia-Pacific. Regional growth is projected to stabilize at around 4% in the second half of 2024 and throughout 2025-26. This reflects a normalization of growth in emerging markets such as India and a recovery in major economies like Australia and Japan,” added Dr. Brown.

Cushman & Wakefield also highlighted potential disruptors that could significantly impact the market, including geopolitical fragmentation, debt levels, macroeconomic trends, and the rise of AI and technology.