Coteccons Construction JSC (CTD: HoSE) has released its consolidated financial statements for the fourth quarter of the 2023-2024 fiscal year (April 1, 2024 – June 30, 2024), reporting a remarkable 82% year-on-year surge in net revenue to over VND 6,595 billion.

Gross profit for the quarter stood at VND 222 billion, more than doubling the figure from the same period last year, which was VND 101 billion.

During this period, CTD’s financial income decreased by 27% to VND 69.5 billion. Financial expenses amounted to VND 30.4 billion, a 14% decline year-on-year, while administrative expenses rose significantly by 61% to VND 194 billion.

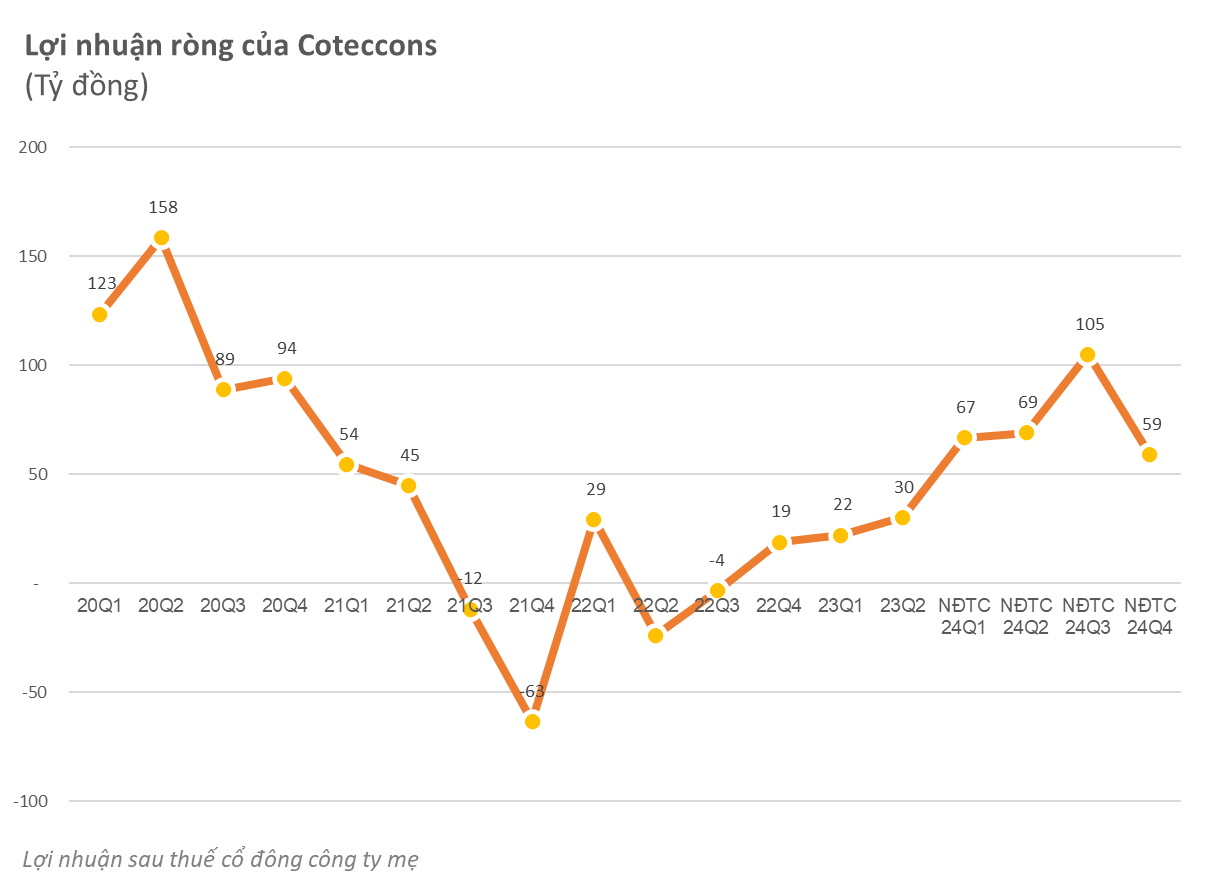

Consequently, Coteccons posted an after-tax profit of nearly VND 60 billion for the quarter, marking a substantial 95% increase compared to the previous year.

For the full fiscal year, CTD recorded a net revenue of VND 21,045 billion, representing a 31% increase year-on-year. The company’s after-tax profit reached over VND 299 billion, an impressive four-fold rise compared to the previous fiscal year.

As of June 30, 2024, CTD’s total assets were valued at VND 22,829 billion, reflecting an increase of VND 1,454 billion from the beginning of the fiscal year. This included cash and bank deposits totaling more than VND 3,825 billion.

The company has allocated VND 255 billion for investment in securities and set aside VND 2.7 billion for securities devaluation. Specifically, CTD invested nearly VND 40 billion in KIM GROWTH VN30 ETF certificates and approximately VND 34 billion in MCH shares. Based on MCH’s market price as of June 30, CTD held roughly 177,000 MCH shares.

Previously, in the third-quarter financial report for the 2023-2024 fiscal year, CTD disclosed that it had invested over VND 28 billion in FPT shares. Estimating from FPT’s market price as of March 31, CTD owned approximately 412,600 FPT shares.

Total liabilities amounted to VND 14,248 billion, including loan debts of VND 1,540 billion. As of the end of June, the company’s equity stood at over VND 8,581 billion.

In 2024, Coteccons secured contracts worth VND 22,000 billion, laying a solid foundation for the fulfillment of its business plan for the following year. Notably, 41 projects out of the newly acquired ones stemmed from the successful implementation of the “repeat sales” strategy, targeting previous clients.

Additionally, Coteccons has expanded its client base by securing projects from new investors, including the Pandora Factory, Suntory PepsiCo Factory, Westlake Residential, Legend City Urban Area, Logos Yen Phong BN 2 Factory, Eaton Park Residential Area, Sembcorp Logistics Park Thuy Nguyen, and the apartment complex in eastern Da Nang.

On July 19, Coteccons (CTD: HoSE) announced that it had received Decision No. 82/2024/QD-PQTT from the Ho Chi Minh City People’s Court regarding the request for annulment of Arbitral Award No. 49/23/HCM dated January 2, 2024, in the dispute between Coteccons and Boho Decor Co., Ltd. (Boho). As per the decision, Coteccons is required to pay nearly VND 22 billion to Boho Decor as per the arbitral award.

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.

Viglacera Reports First-Ever Loss

Viglacera, the construction equipment giant, reported a net loss of 48 billion VND in Q4/2023, due to declining revenues and high maintenance costs. This marks the first time the company has reported a loss since its inception.