In the latest update, the Dragon Capital group has reported selling nearly 2 million shares of MWG of Mobile World Investment Joint Stock Company.

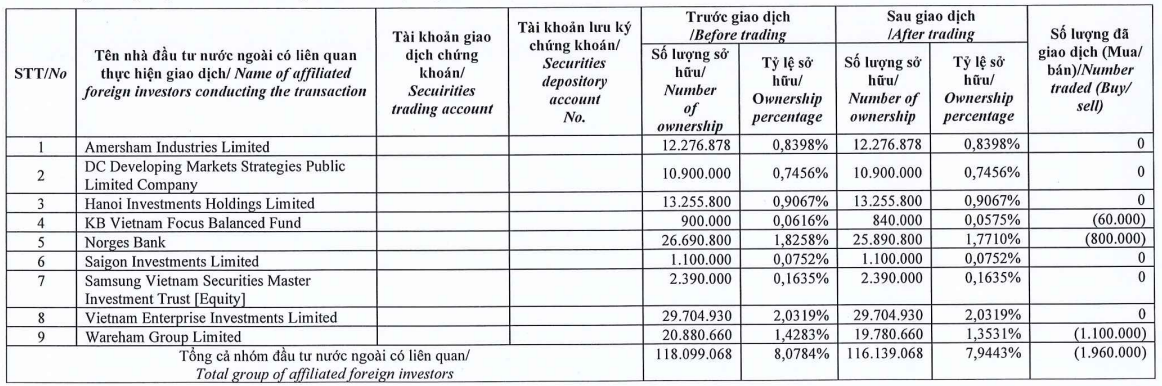

Specifically, member fund Wareham Group Limited sold 1.1 million shares, Norges Bank fund sold 800,000 shares, and KB Vietnam Focus Balanced Fund sold 60,000 shares.

The transaction was made during the July 30 session, and the group temporarily calculated the closing reference price, collecting approximately VND 123 billion.

After the transaction, the Dragon Capital group still holds more than 116 million MWG shares, equivalent to a ratio of 7.94%. Vietnam Enterprise Investments Limited (VEIL) holds the largest number of shares with more than 29.7 million MWG shares (a ratio of 2.03%), followed by Norges Bank (25.9 million shares, or 1.77%) and Wareham Group Limited (19.8 million shares, or 1.35%).

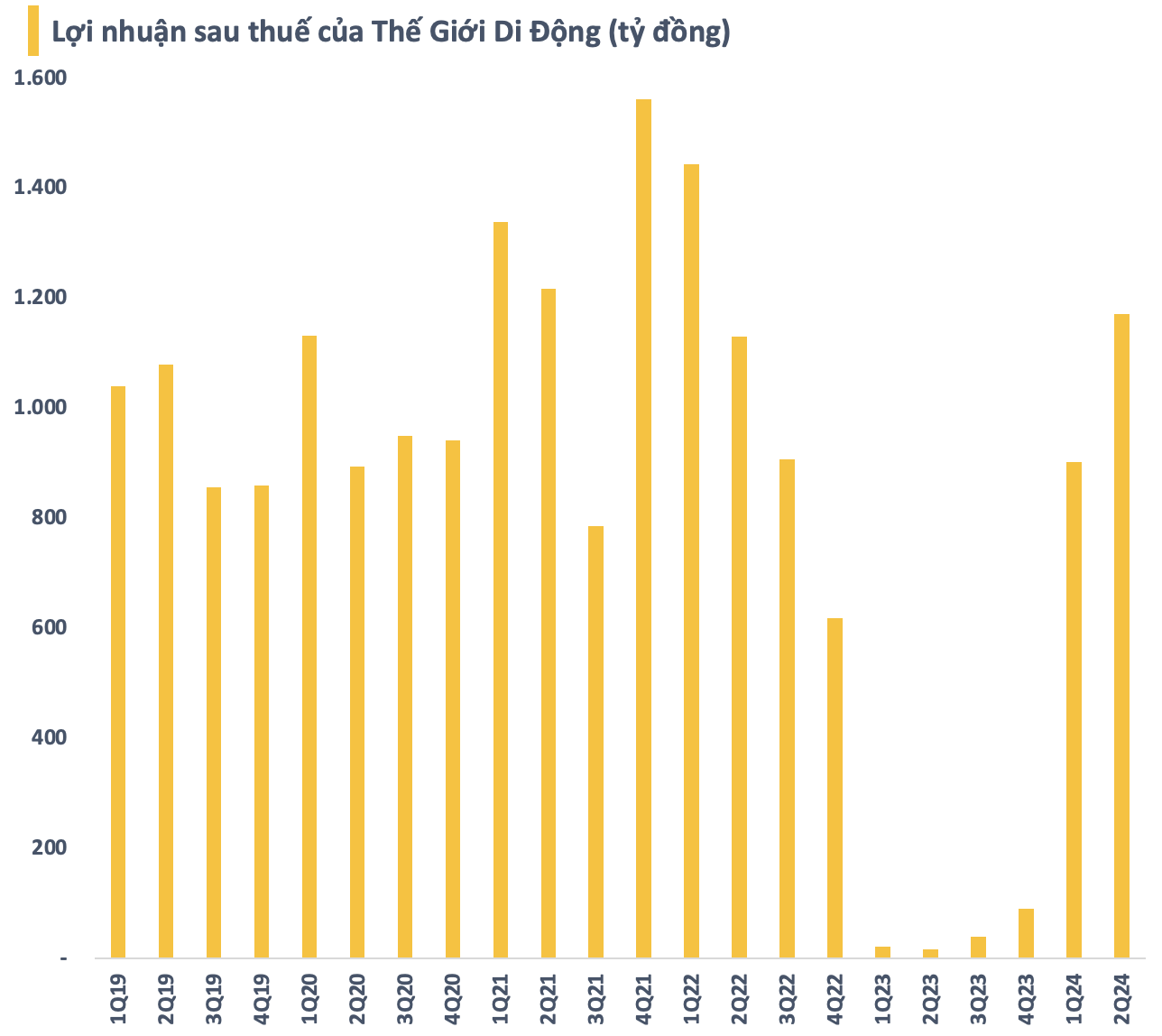

Regarding MWG, the enterprise has just announced its Q2/2024 business results, which are very positive. Revenue reached VND 34,234 billion, up nearly 16% over the same period last year. Gross profit margin improved significantly from 18.5% in Q2/2023 to 21.4%. After deducting expenses, MWG’s after-tax profit in Q2 was VND 1,172 billion, 69 times higher (equivalent to an increase of 6,800%) compared to the same period in 2023. This is the fourth consecutive quarter that this retail enterprise has grown positively compared to the previous quarter, and it is also the highest profit in the last nine quarters.

For the first six months of the year, MWG recorded VND 65,621 billion in revenue and VND 2,075 billion in after-tax profit, completing 86.5% of the full-year profit target.