Foreign selling pressure eases, but the market is yet to pick up momentum

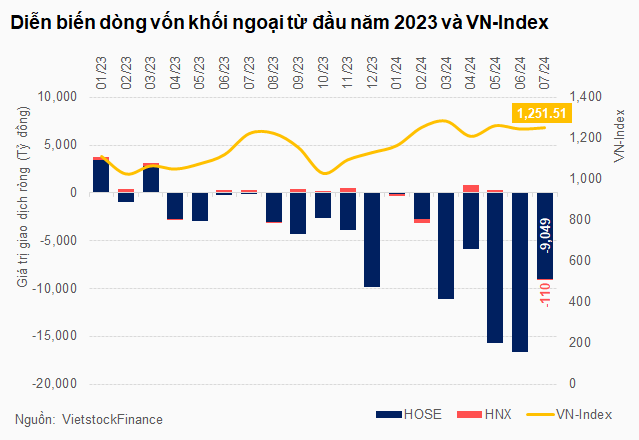

VN-Index started July with a rise from the 1,240 region to almost 1,294, but then entered a continuous downward phase, hovering around 1,232, and only truly recovered in the final phase to close July at 1,251.51, a slight 0.5% increase compared to the end of June.

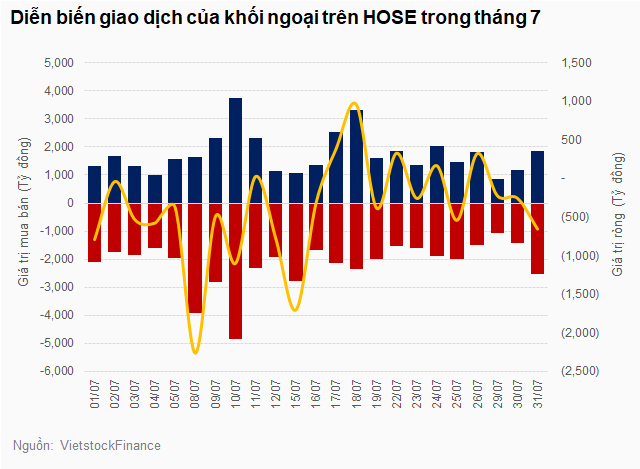

The index made multiple reversals, and foreign investors also recorded unpredictable moves, but there was a noticeable difference between the first and second halves of the month.

Specifically, foreign investors continued the selling spree from previous months, replicating the old scenario in the early days of July. There was even a session of net selling of nearly VND 2,265 billion on July 08, with broad-based selling pressure, led by HDB shares, which saw net selling of over VND 498 billion. In this session, HDB shares also attracted attention with a near VND 450 billion negotiated trading volume.

However, in the latter half of July, foreign investors’ actions changed with a mix of net buying and selling sessions. The strongest net buying session was recorded on July 18, with a value of nearly VND 963 billion, led again by HDB with a net buy value of nearly VND 494 billion. HDB shares also stood out with a negotiated trading volume of nearly VND 700 billion in this session.

Overall, the dominant trend was net selling, with 17 out of 23 sessions in the month recording net selling of nearly VND 9,049 billion, a significant decrease compared to June.

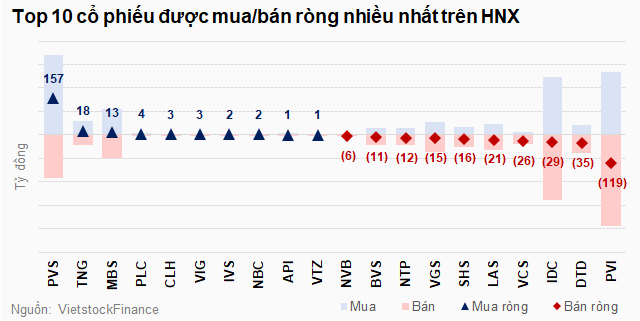

The Hanoi Stock Exchange (HNX) also recorded net selling, for the first time in four months. In July, foreign investors net sold more than VND 110 billion on the HNX exchange. Combined across all exchanges, foreign investors net sold more than VND 9,159 billion.

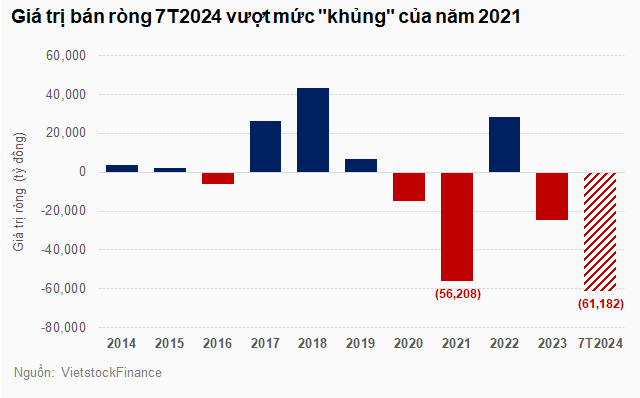

Cumulatively, in the first seven months of 2024, foreign investors net sold more than VND 62,182 billion on the HOSE exchange, surpassing the “huge” figure of over VND 56,208 billion in 2021.

Looking back at June, investors were excited when the VN-Index surpassed the 1,300 threshold, but then confidence waned as the index not only failed to hold this level but also continued to fall deeper.

Looking at a broader perspective, the index has made three attempts in the last four months to conquer the 1,300 threshold but has failed each time. Numerous reasons have been put forth, including strong net selling pressure from foreign investors, which peaked at VND 15,695 billion and VND 16,605 billion in May and June, respectively.

During that period, many investors expected the market to turn positive if foreign selling pressure eased. However, the reality shows that even though net selling has decreased significantly to just under VND 9,049 billion in July, the market has not shown any truly positive signals.

Many large-cap stocks faced strong net selling

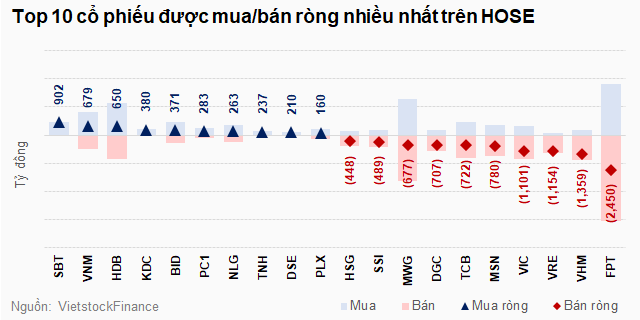

Returning to the HOSE exchange, shares of many large-cap companies on the exchange experienced strong net selling, with FPT facing the most significant net selling of nearly VND 2,450 billion. In addition to FPT, there were three other stocks that were net sold in the trillions: the trio of “Vin” stocks, including VHM, VRE, and VIC.

On the opposite side, net buying value remained modest compared to net selling, with SBT leading the net buying, but only at a little over VND 902 billion.

On the HNX exchange, two companies closely related to the Vietnam Oil and Gas Group, PVI and PVS, stood at opposite ends. PVI faced the most substantial net selling of over VND 119 billion, while PVS saw the highest net buying of nearly VND 157 billion.

When will net selling stop?

In the C2C program for July, held on the afternoon of July 31 by HSC Securities Co., Mr. Nguyen Manh Dung – Director of Strategy Research (HSC) shared his insights on the net selling trend of foreign investors.

According to Mr. Dung, through discussions and research on foreign investment funds, they identified four reasons why Vietnam was not attractive to foreign investors in the recent period.

First, foreign investors can actively disburse into more attractive markets. The Vietnamese market is currently lagging compared to other markets such as Indonesia, Malaysia, and even India.

A typical example is the technology, semiconductor, renewable energy, and artificial intelligence industries, which have been mentioned a lot, but the actual implementation and legal framework to support these industries are still lacking. In addition, legal reforms for the oil and gas, real estate, and securities industries have not materialized, especially regarding the stock market’s upgrade and the deployment of a new trading system.

Second, the Vietnamese market does not offer many new stock options for investors, mainly focusing on the old basket of stocks.

Third, the second-quarter business results showed a recovery but not strong enough. While the VN-Index grew by 15-18%, which is quite good, a breakdown reveals that small and medium-sized enterprises did not perform well, and they account for 98% of the total number of enterprises in Vietnam.

Fourth, it is related to notable events in the market, typically the bond and Van Thinh Phat cases…

However, Mr. Dung also assessed that foreign investors have shown signs of wanting to return to Vietnam due to five factors: positive macroeconomic conditions, reasonable valuations for small and medium-sized enterprises, the Fed’s expected interest rate cuts, more stable political situation, and the Ministry of Finance’s effort to abolish the 100% deposit rule before trading.

Similarly, in a Livestream Radar Investment session held on the afternoon of July 31, Mr. Cao Minh Hoang – Director of Premium Clients in Hanoi (DNSE Securities) answered a question regarding when foreign investors would start net buying. He stated that when foreign direct investment (FDI) continues to grow, foreign indirect investment (FII) will return. This could happen in 12-18 months when the Fed’s interest rate cuts take effect. At that time, indirect investment will find its way into markets with appropriate valuations.

He added that, from 2014 to the present, there have been years when valuations were very high, such as in 2017, when the VN-Index‘s P/E ratio reached 23 times. Conversely, there have been pessimistic periods, like during the COVID pandemic and the Van Thinh Phat case, when valuations were low. Currently, valuations are quite reasonable.