According to Mr. Nguyen Van Chinh – Member of the Board of Management and General Director of Cadovimex Joint Stock Company (UPCoM: CAD), the company is currently in a serious decline in all aspects. Despite going through many leadership changes, they have been unable to revive their business operations due to the accumulation of difficulties from previous years.

The company’s leadership has been seeking investments from various sources to improve the current situation, but to no avail. Mr. Chinh attributes this to investors’ lack of confidence in the safety of investing in the company. Currently, CAD is unable to recover its receivables but is under tremendous pressure to repay debts to banks, government agencies, and other customers.

Mr. Chinh also mentioned that CAD has completed the necessary legal procedures to initiate bankruptcy proceedings, in accordance with legal regulations. It is understood that the company had previously approved the bankruptcy plan at previous meetings, but there are still obstacles due to an ongoing criminal investigation, and the court has not yet accepted the application.

Production facilities and equipment have deteriorated into scrap

The management of Cadovimex stated that the production workshop structure, which has been in operation for 20 years, has not been properly maintained and is now in a severe state of disrepair. The machinery, equipment, and technology are also nearly 20 years old, breaking down frequently, and lacking spare parts for repairs. This leads to low labor productivity, high energy consumption, and unprofitable processing fees for the company. All of the company’s infrastructure and equipment are mortgaged to the bank for working capital loans from 2009 to the present. Currently, the machinery and infrastructure are severely degraded, with only the outer shell remaining or a pile of scrap that cannot be used.

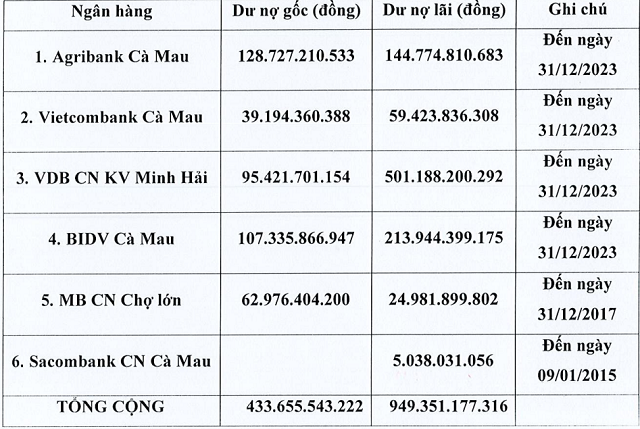

In the past year, CAD generated revenue of less than VND 21 billion, while expenses amounted to nearly VND 166 billion, mainly consisting of interest expenses of nearly VND 139 billion. As a result, the company incurred a loss of more than VND 144 billion, bringing the accumulated loss to over VND 1,621 billion. Tangible asset value stands at nearly VND 7 billion, while the book value is recorded at nearly VND 14 billion. Total liabilities amount to VND 1,383 billion, including principal and interest. Among the six major creditors are banks, with Agribank Ca Mau being the largest, with VND 129 billion in principal debt and VND 145 billion in interest debt as of the end of 2023.

|

CAD’s bank debts as of the end of 2023.

Source: CAD

|

CAD also has social insurance, health insurance, unemployment insurance, occupational accident insurance, and trade union fund debts totaling more than VND 26 billion. In addition, the company has uncollectible receivables of over VND 172 billion, with nearly VND 172 billion owed by domestic and foreign customers from before 2017.

Moving forward, the company will continue its cold storage rental business, process seafood products for existing customers, and seek new clients. They will also collaborate with partner companies on product processing and mobilize finances to upgrade workshops and machinery…

The company will prioritize salary payments to employees, settle debts with social insurance and other state agencies, and maintain machinery and assets to prevent further deterioration.

Cadovimex’s rise and fall

During its peak, Cadovimex was once among the top ten enterprises with the largest export turnover in Vietnam. In Ca Mau province, it was one of the top three enterprises in terms of processing volume and export turnover. The company had three large enterprises and thousands of employees, serving major export markets such as the US, EU, Japan, Hong Kong (China), and the Middle East…

At its height, CAD‘s total assets exceeded VND 1,000 billion (during the period of 2008-2010), peaking at nearly VND 1,200 billion in 2009. However, things took a turn for the worse in 2011 when the company operated below cost, resulting in a record loss, and CAD began its downward spiral. The company’s equity has been negative ever since, with assets dwindling to just VND 14 billion, and negative equity of VND 1,426 billion. The stock price is now cheaper than “an ice tea.”

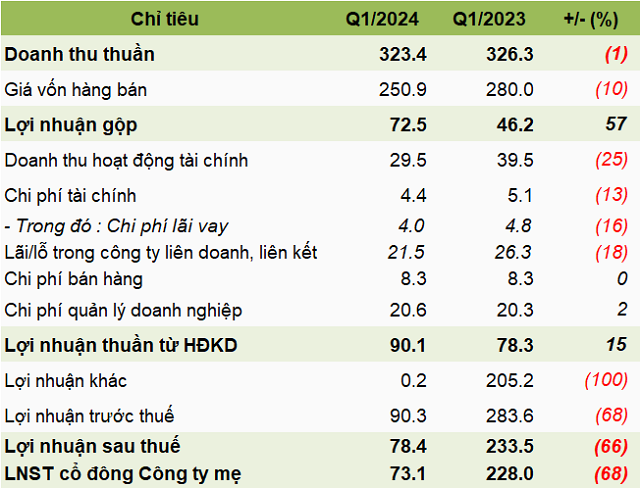

| Total assets, liabilities, and equity of CAD |

| Net revenue, gross profit, and net income of CAD for the first 6 months from 2017 to present |

|

CAD stock price has been cheaper than “an ice tea” for over 10 years

Source: VietstockFinance

|

|

Regarding the fraud case at Cadovimex, on July 27, the Ministry of Defense’s Criminal Investigation Agency announced that it had issued a decision to prosecute and arrest Mr. Vo Thanh Tien (born in 1962, former Chairman and General Director of Cadovimex) for his involvement.

|

The Body Shop Vietnam’s response to the global parent company’s bankruptcy wave

Despite The Body Shop brand filing for bankruptcy, laying off employees, and experiencing a series of collapses from the US to the UK, The Body Shop Vietnam declares that it is unaffected by these developments and still has plans to expand in bustling areas in Ho Chi Minh City and Hanoi.