Market liquidity increased compared to the previous trading session, with the VN-Index’s matched trading volume reaching over 834 million shares, equivalent to a value of more than 19.1 trillion VND. The HNX-Index reached over 80 million shares, equivalent to a value of more than 1.6 trillion VND.

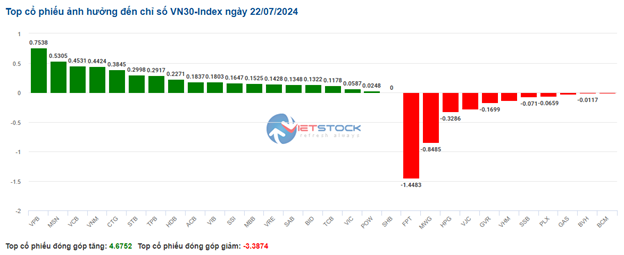

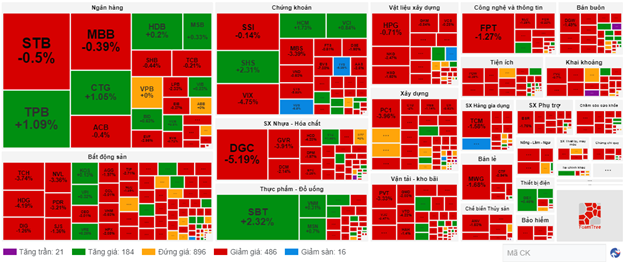

The VN-Index opened the afternoon session with buying force reappearing, supporting the index, but selling pressure remained dominant, causing the index to remain in the red until the end of the session. In terms of impact, GVR, HVN, FPT, and DGC were the codes with the most negative impact, taking away more than 3.8 points from the index. On the other hand, TCB, MSN, CTG, and VCB were the codes with the most positive impact on the VN-Index, with an increase of more than 1.4 points.

| Top 10 stocks with the strongest impact on the VN-Index on July 22 |

The HNX-Index also followed a similar trend, with the index negatively impacted by the codes MBS (-6.78%), PVS (-3.07%), VIF (-8.38%), and PVI (-2.32%),…

|

Source: VietstockFinance

|

The plastic and chemical manufacturing industry recorded the sharpest decline in the market at -4.06%, mainly due to the GVR (-5.07%), DGC (-6.02%), DCM (-3.49%), and DPM (-1.97%) codes. This was followed by the consulting and support services sector and the transportation and warehousing sector, with decreases of 3.48% and 2.6%, respectively. On the contrary, the rubber products industry witnessed a strong recovery of 0.55%, mainly driven by the CSM (+6.69%) and SRC (+6.91%) codes.

In terms of foreign trading, this group returned to net buying on the HOSE exchange, focusing on the SBT (375.12 billion), FPT (43.64 billion), POW (33.14 billion), and TCH (25.78 billion) codes. On the HNX exchange, foreigners net sold more than 2 billion VND, focusing on the MBS (9.56 billion), TNG (5.59 billion), QTC (5.07 billion), and TIG (4.05 billion) codes.

| Foreigners’ net buying and selling activities |

Morning session: VN-Index plunged sharply

The stock market started the week on a pessimistic note as red dominated from the beginning of the session. As the morning session drew to a close, selling pressure intensified, causing the VN-Index to drop by 15.69 points, reaching 1,249.09, while the HNX-Index fell by 3.75 points, settling at 236.77 points. The market breadth inclined towards sellers, with 565 declining stocks versus 147 advancing stocks. The VN30 basket followed a similar trend, with 21 declining stocks and only 7 advancing stocks.

The trading volume of the VN-Index in the morning session surged compared to the previous session, reaching over 530 million units, with a value of more than 11.7 trillion VND. The HNX-Index recorded a trading volume of nearly 52 million units, with a value of nearly 536 billion VND.

Most sectors were engulfed in red. Notably, consulting and support services, and plastic and chemical manufacturing were the two sectors that declined the most, with decreases of around 4%. Strong selling pressure was observed in stocks such as TV2 (-5.11%), GVR (-4.49%), DGC (-6.1%), DCM (-3.75%), and DPM (-2.25%)…

The banking group failed to maintain its slight gains towards the end of the session as pressure from the broader market intensified. By the end of the morning session, the banking sector index fell by 0.49%. Only 4 out of 21 stocks posted slight increases, namely VCB (+0.46), CTG (+0.6), TPB (+0.27), and SSB (+0.48%). Conversely, LPB was the most negative performer, falling by 3.88%. This was followed by NAB (-2.30%) and NVB (-2.08%). The remaining stocks, including MBB, ACB, and SHB, recorded declines of over 1%.

On the other hand, the food and beverage group traded positively, with an increase of 0.33%. The industry leaders all donned green: SAB (+1.45%), VNM (+0.46%), MSN (+0.42%), and SBT (+1.54%).

The rubber group also went against the market trend, rising by 0.17% thanks to the strong performance of CSM and SRC. However, DRC and BRC of the same group exhibited contrasting trends, falling by 3.53% and 2.02%, respectively.

Foreigners resumed net buying after net selling in the previous session, with a value of approximately 213 billion VND on the HOSE exchange. SBT was the stock that was net bought the most, with a value of over 375 billion VND. On the HNX exchange, foreigners net sold more than 29 billion VND, focusing on selling the PVS stock, with a value of over 10 billion VND.

10:45 am: Selling pressure persists, banks continue to support the market

Red continued to dominate despite the emergence of buying force supporting the indices. However, selling pressure remained significant, leading to a tug-of-war between the bulls and bears below the reference level. The VN-Index remained in negative territory despite the strong support from the banking and food and beverage groups.

The breadth in the VN30 basket was relatively balanced, with 15 advancing stocks and 15 declining stocks. VPB, MSN, VCB, and CTG contributed the most to the overall index, adding 0.75 points, 0.53 points, 0.45 points, and 0.44 points, respectively. Conversely, FPT, MWG, HPG, and VJC had a less favorable performance, dragging down the VN30-Index by more than 2.8 points.

Source: VietstockFinance

|

The banking group continued to be the market’s “savior,” maintaining a solid recovery trend. Although there was still some divergence within the sector, green prevailed. Notably, large-cap stocks such as VCB (+0.91%), BID (+1.15%), CTG (+1.35%), and TCB (+0.21%) led the charge, along with several other codes, in supporting the broader market. Only three codes, LPB, HDB, and SSB, faced mild selling pressure. As of 10:30 am, the value of matched orders reached more than 1,521 billion VND, with a volume of over 69 million units.

The food and beverage group also maintained its strong performance from the beginning of the session, driven mainly by the industry leaders: VNM (+0.77%), MSN (+0.56%), and SAB (+1.45%) … However, red continued to dominate in this group, with codes such as VHC (-0.27%), KDC (-0.35%), and BAF (-0.26%) weighing down the indices.

In contrast, the plastic and chemical manufacturing group was mired in red for most codes, with a sharp decline of 3.15%. Strong selling pressure was evident in codes such as DGC (-5.19%), DCM (-2.68%), DPM (-1.97%), and BMP (-0.26%) … Notably, GVR continued its downward adjustment after a prolonged uptrend previously.

One contributing factor to this correction could be the recent news of the prosecution of the company’s leaders. Although GVR had announced the resignation of Mr. Trần Ngọc Thuận from the position of Member of the Board of Management on June 20, 2024, and reassigned tasks to the remaining members to ensure the continuity of the corporation’s management, the stock price has yet to show any positive recovery.

Compared to the beginning of the session, sellers remained dominant. There were 486 declining stocks and 184 advancing stocks. As of 10:30 am, the VN-Index fell by 6.96 points, hovering around 1,258 points, while the HNX-Index dropped by 1.43 points, trading around 239 points.

Source: VietstockFinance

|

Opening: Broad-based decline, VN-Index drowned in red

The market opened the morning session on a negative note, with red dominating most industry groups. The VN30 index had the most negative impact, with most of the stocks in this group trading in the red.

Large-cap stocks weighed heavily on the market. GVR, FPT, and DGC led the decline. On the other hand, BID, PGB, and MBB were the main contributors to the market’s gains this morning.

The plastic and chemical manufacturing industry experienced the most significant negative impact, falling by 2.23%. Specifically, stocks such as GVR, DGC, DPM, DCM, BFC, LAS, PHR, and BMP all traded in negative territory.

The information and technology sector followed a similar fate, dragged down mainly by leading stocks. FPT fell by 1.11%, CTR dropped by 2.29%, CMG declined by 2.68%, and ELC slipped by 1.28%…