Net profit up 3.4x YoY

|

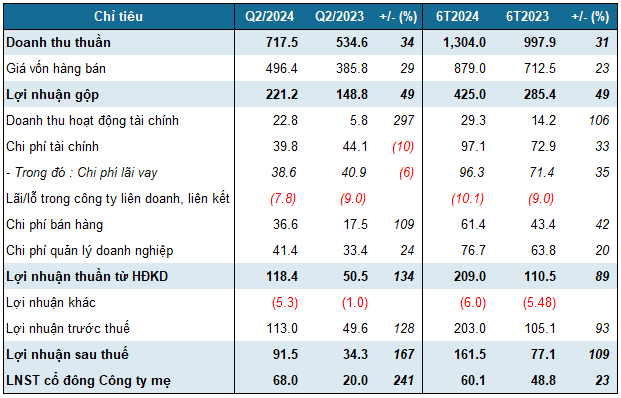

VSC’s Q2 and 6M 2024 business results

Unit: Billion VND

Source: VietstockFinance

|

According to the Q2/2024 financial statements, VSC’s net revenue was nearly VND 718 billion, up 34% YoY. Gross profit margin improved by 3 percentage points to 30.8%, resulting in a 49% increase in the company’s gross profit to over VND 221 billion.

Financial activities still incurred a loss of more than VND 17 billion, but this was a significant improvement compared to the loss of over VND 38 billion in the same period last year. VSC explained that financial revenue increased due to the optimization of short-term idle capital, while financial expenses decreased.

Selling and management expenses increased significantly, by 109% and 24% respectively, to nearly VND 37 billion and over VND 41 billion, causing the ratio of SG&A expenses to net revenue to increase from 9.5% to 10.9%, thereby creating some pressure on profits.

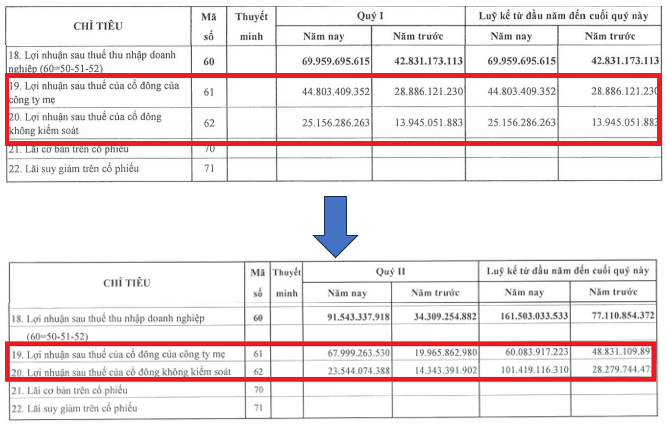

At the end of Q2, VSC recorded a net profit of VND 68 billion, 3.4 times higher than the same period last year. Notably, the cumulative net profit for the first six months was lower than the Q2 profit, possibly due to VSC’s adjustment of profit allocation between the parent company and non-controlling shareholders in Q1.

|

VSC likely changed the profit allocation structure for Q1/2024

Unit: VND

Source: VSC, author’s compilation

|

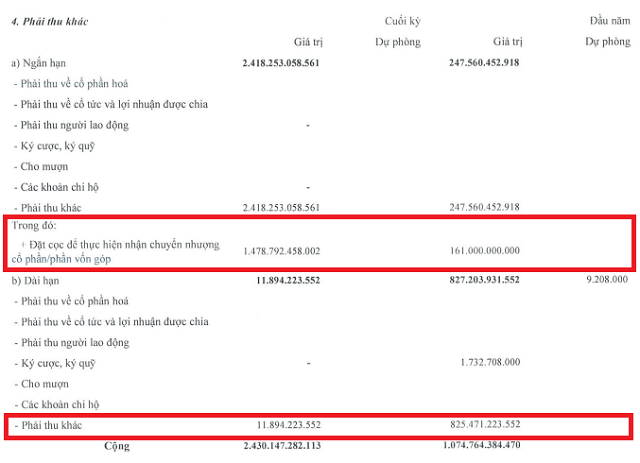

Asset structure underwent significant changes

As of Q2/2024, VSC’s total assets were nearly VND 6,489 billion, up 25% from the beginning of the year, mainly due to the increase in short-term receivables to VND 2,745 billion, almost 6 times higher than at the beginning of the year and accounting for 42% of total assets.

The increase in receivables was due to VSC recognizing an additional deposit of nearly VND 1,479 billion for the transfer of capital contributions at Dinh Vu Nam Hai Port.

On July 18, VSC announced the completion of the transaction to acquire capital contributions in Dinh Vu Nam Hai Port JSC. Therefore, the results of this transaction will be more clearly reflected in the Q3 financial statements.

According to the plan previously announced by VSC, the sellers were Commerce and Investment Joint Stock Company and Kim Khi Export Import Joint Stock Company. The maximum transfer ratio is 65% from these two companies, with a price of VND 83,800 per share, corresponding to a transaction value of nearly VND 2,179 billion.

On the other hand, long-term receivables decreased by 99%, to less than VND 12 billion. This balance was related to the contract for investment and business cooperation between T&D Group and two subsidiaries owned by VSC, Green Logistics Center and Port Services, to implement investment and business cooperation in the Hyatt Place Hai Phong hotel project.

Previously, on June 27, VSC’s Board of Directors passed a resolution on the termination of this cooperation agreement.

Source: VSC’s Q2/2024 financial statements

|

VSC completes the acquisition of Dinh Vu Nam Hai Port and plans to pay 2023 dividends

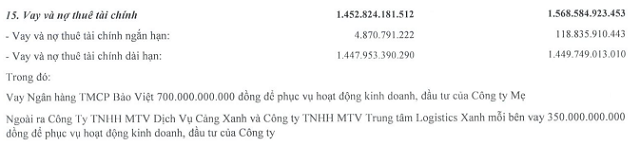

In terms of capital sources, VSC’s loan balance was VND 1,453 billion, down 7% from the beginning of the year, accounting for 22% of the structure.

Source: VSC’s Q2/2024 financial statements

|