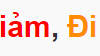

The Manufacturing Purchasing Managers’ Index™ (PMI®) for Vietnam remained unchanged at 54.7 in July, signaling continued substantial improvement in business conditions in the sector. In fact, the last time growth was recorded to be faster was back in November 2018.

“The fact that Vietnam’s manufacturing sector could carry the strong growth momentum from June into July adds to the optimism that we are entering a phase of robust growth that will propel the economy forward,” said Andrew Harker, Economics Director at S&P Global Market Intelligence.

The report found that all sectors, including consumer, intermediate, and investment goods, experienced a rebound. Specifically, new orders grew for the fourth consecutive month in July, albeit at a slightly slower pace compared to June’s near-record level.

Where there was an increase in new orders, survey group members attributed it to stronger market demand and a higher number of customers. Additionally, new export orders also rose, although at a weaker rate compared to total new orders. Some companies mentioned that export demand had been impacted by high shipping costs.

With a significant rise in new orders, manufacturers substantially increased production in July, at a faster rate than in June.

Despite the increase in production, companies had to rely on their current inventory to fulfill new orders, according to S&P Global. In fact, stocks of finished goods fell to the second-lowest level on record, only surpassed by the level seen in February 2014.

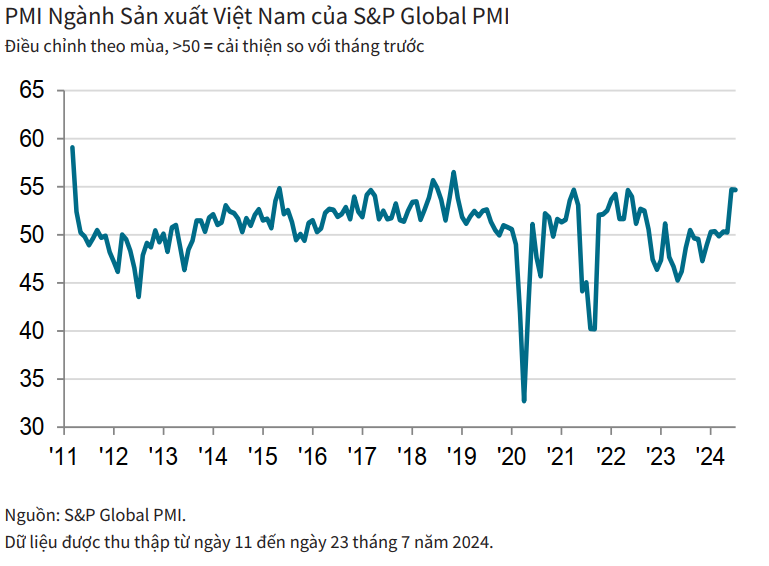

To boost output, companies increased both purchasing activity and employment at the start of the third quarter. Consequently, the purchase of input goods rose considerably, with the fastest growth rate since May 2022. On the other hand, the number of employees rose only marginally compared to June, while backlogs of work increased for the second month in a row.

The report suggests that manufacturers found it easier to procure raw materials as suppliers’ delivery times shortened for the second month in a row, although the improvement in vendor performance remained modest.

Inventories of purchases decreased for the 11th consecutive month, with the rate of decline being strong and the fastest since April.

Additionally, input costs continued to rise sharply in July, with the rate of inflation only slightly weaker than June’s two-year high. Suppliers were reported to have increased their selling prices, while higher transportation costs also played a factor.

As a result of rising material and transportation costs, manufacturers raised their selling prices for the third month in a row in July. The rate of inflation was strong, although slower than in the previous survey period.

Expectations of further new order growth in the coming year bolstered business confidence regarding future output. According to S&P Global, around 40% of respondents expressed optimism, but business sentiment fell to the lowest level since January.

According to the Economics Director at S&P Global Market Intelligence, the main challenge for companies now is keeping up with demand. While production has been ramped up, companies are still having to utilize their inventories to meet new orders, leading to a substantial decrease in stock levels.

“Manufacturers will need to increase their workforce at a faster rate and continue to secure additional inputs if the current trend of new orders is to be maintained in the coming months,” the expert added.

PMI January 2024: Increase in Production and New Order Volume

Vietnam’s Manufacturing Purchasing Managers’ Index (PMI), a key indicator for the industry, has returned to above the 50-point threshold in the first month of the year, rising to 50.3 from December’s 48.9. The PMI result suggests an improvement in the health of the manufacturing sector for the first time in months, although the improvement is only modest.

Labor Market to Recover by 2024

According to the Ministry of Labor, Invalids and Social Affairs, in the coming time, there needs to be a high focus on perfecting the institutional framework, building and organizing the enforcement of labor laws…

Health industry improves after 5 months

According to a market research report by S&P Global – a multinational corporation engaged in providing financial information and data, Vietnam’s Manufacturing Purchasing Managers’ Index (PMI) has witnessed a rebound in early 2024, driven by an improved economic situation leading to a resurgence in new order volumes.