Vietnamese manufacturers have seen a rebound at the beginning of 2024 as initial signs show improvements in demand, leading to an increase in new orders and production. However, employment and purchasing activity have slowed down, and business confidence has also decreased.

Reports indicate that transportation delays have prolonged delivery times for suppliers, resulting in increased cost pressures. Despite rising input prices, companies have lowered their output prices to stimulate demand.

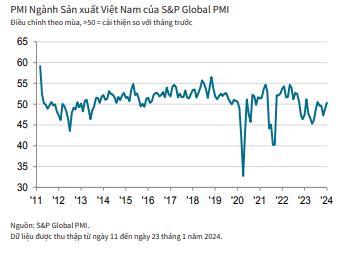

The Vietnam Manufacturing Purchasing Managers’ Index (PMI) by S&P Global has returned above the 50-point threshold in the first month of the year, reaching 50.3 points compared to 48.9 points in December. The index result indicates a modest improvement in the manufacturing sector’s health for the first time in months, albeit a small one.

The improvement in general business conditions has focused on the rebound in new orders and production levels.

This is the first increase in three months for the total number of new orders, as there are signs of recovery in both the domestic and export markets (new export orders also increased for the first time since October). As a result, companies have increased production, ending a four-month period of contraction. The increase in production is modest but the most significant since September 2022. The overall increase in production is concentrated in intermediate goods manufacturers.

With slight increases in both production and new orders, companies have maintained their workforce and purchasing activities almost unchanged in the first month of 2024. The near-stability of operational capacity in the context of a rebound in new orders has led to an increase in backlogs for the second consecutive month in January. Though mild, the pace of backlog growth is the most significant since March 2022.

Some companies have opted to fulfill orders with finished goods from stock to cater to customers. As a result, post-production inventory has decreased after remaining unchanged in the last month of 2023. Purchased inventory also decreased as production needs increased while purchasing activities remained nearly unchanged. The decrease in pre-production inventory is substantial and the strongest since June last year.

Transportation delays and logistical issues have contributed to extended supplier delivery times in January, marking the first decline in vendor performance in over a year. However, the extent of delivery time extension is slight.

The transportation-related issues causing delivery delays have also led to increased transportation costs at the beginning of the year, resulting in continued significant increases in input prices. Companies have also reported increases in fuel and road-related expenses.

Despite continuing significant increases in input costs, demand optimism has prompted Vietnamese manufacturers to reduce selling prices. The reduction in output prices has ended a prolonged period of price increases. Confidence in future production prospects has decreased to a seven-month low and below the historical average of the PMI index as companies have concerns about economic conditions. However, manufacturers, on the whole, remain cautiously optimistic, hoping for improved demand and customer numbers, and through plans to launch new products.

Commenting on Vietnam’s January 2024 PMI, Andrew Harker, Economics Director at S&P Global Market Intelligence, said:

“This is an encouraging start to 2024 for Vietnam’s manufacturing sector as it witnesses positive strides in new orders and production. Nevertheless, the corresponding increases are only modest and insufficient to convince companies to hire more employees or expand purchasing activities. Backlogs keep increasing as industry capacity remains the same. There have been reports of transportation and delivery issues in January, leading to delayed delivery times and higher costs. However, companies have lowered selling prices, reflecting relatively weak demand.”